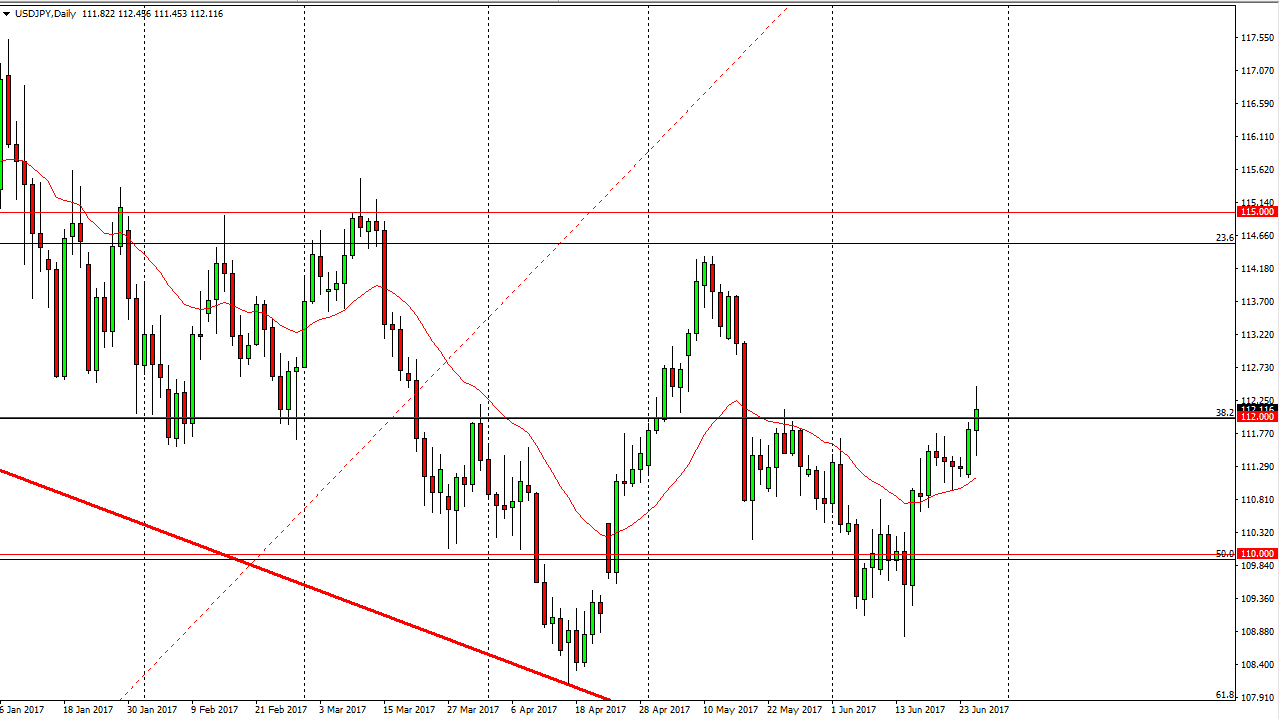

USD/JPY

The US dollar had a positive session during the day on Tuesday, breaking above the 112 level. This is a very bullish sign and I think if we can break above the top of the range for the day on Tuesday, the market should go higher, perhaps reaching the 114 handle. This market should continue to have plenty of volatility, as the pair tends to mirror what we see in stock markets. We have seen quite a bit of choppiness in the stock markets, so with that being the case it’s likely that we will continue to see choppiness here, but I do like the idea of buying this pair on the break out as clearing the 112 level was a significant victory for the buyers.

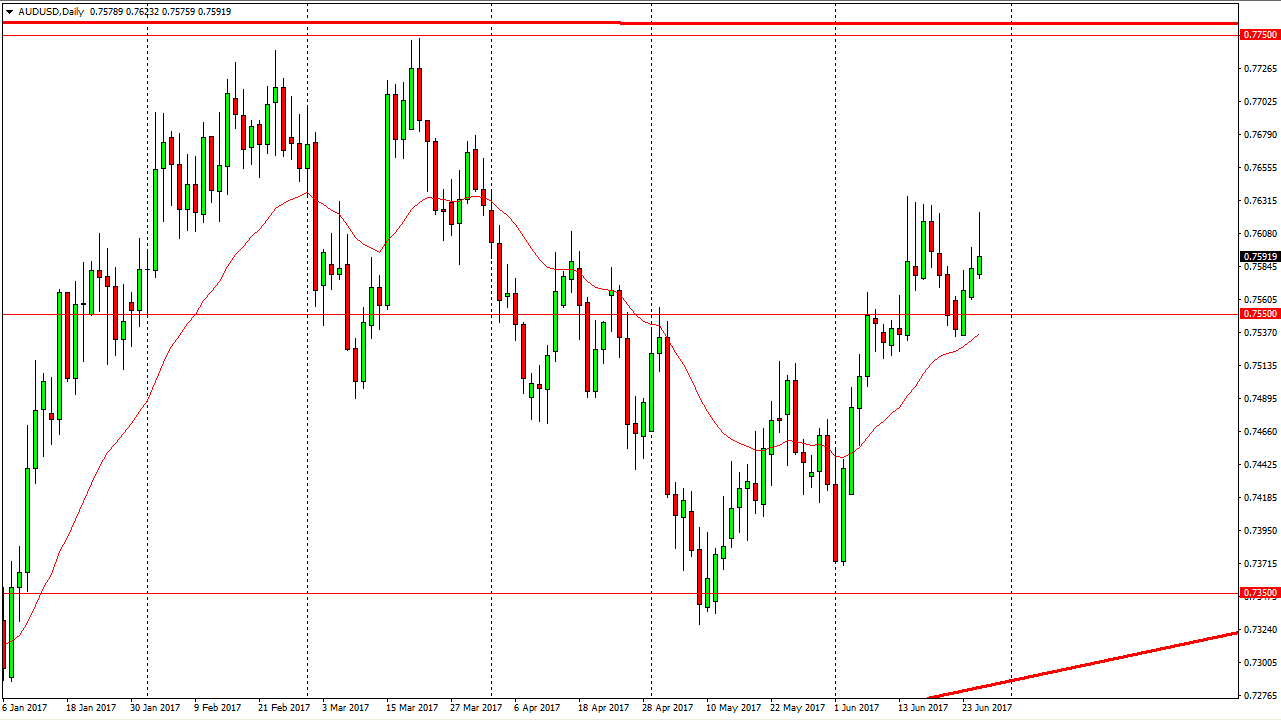

AUD/USD

The Australian dollar broke higher during the day, but turned right back around to form a bit of a shooting star. The market looks likely to pull back to the 0.7540 level, which is a support level. I believe that the market will continue to grind sideways overall and try to find some type of clarity. A break above the 0.7640 level is a very bullish sign and has meaning for the 0.7750 level. If we did breakdown, especially below the 50-day exponential moving average on the chart, then I think the market will probably go looking for the 0.7375 handle underneath. This is a very volatile market, and pay attention to gold as it certainly has quite a bit of influence.

I believe that ultimately the Australian dollar will find buyers, but we have a lot of choppiness that can continue to cause market to be difficult, but I do believe that the upward buying pressure should continue over the longer term. If we can finally break above the 0.7750 level, we will go to the longer-term psychologically important 0.0 level.