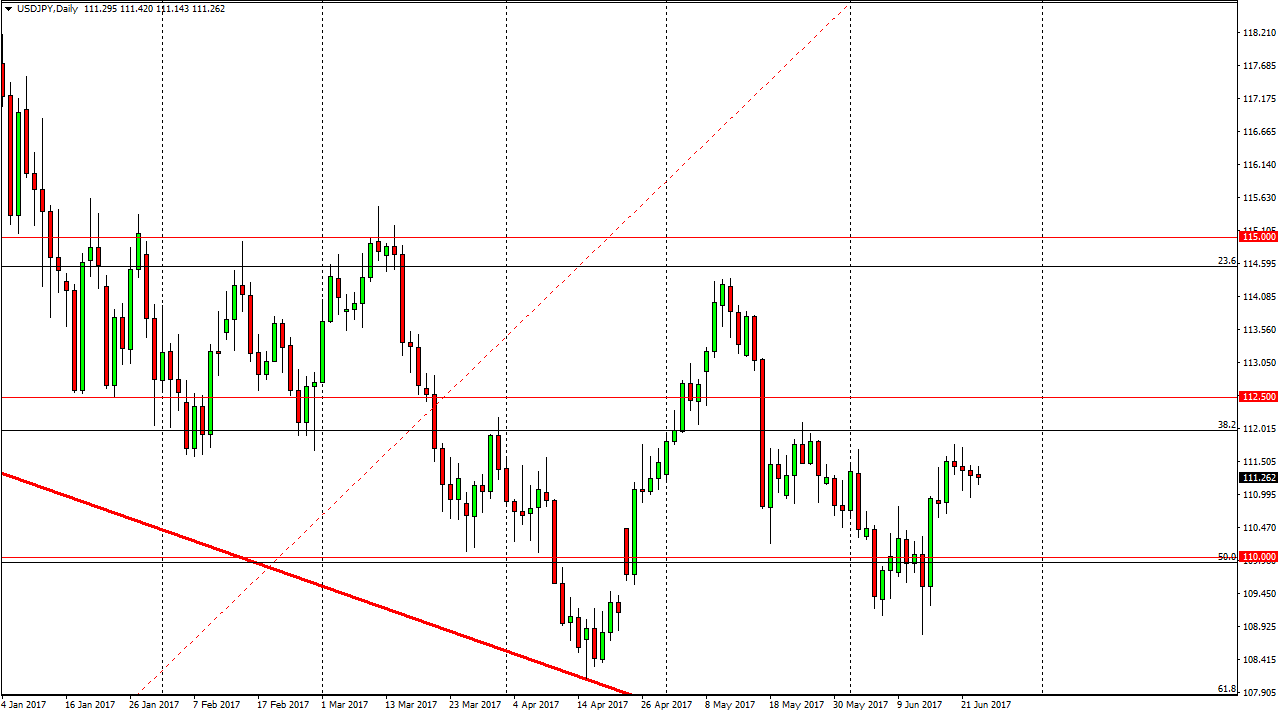

USD/JPY

The US dollar went sideways during the day on Friday, as we continue to grind back and forth. I believe that the 111 level continues to offer significant support. If we can break down below the 111 level however, I think the market could probably go looking towards the 110 level. That’s an area that will be even more supportive as it is the 50% Fibonacci retracement level. I think that buying on dips will continue to be the way to go going forward. If we can break to the upside, the 112.50 level is the next target. A break above there should send the market towards the 114 handle. Ultimately, this is a market that is very sensitive, so if stock markets rally, that should put a little bit of a charge in this market as well.

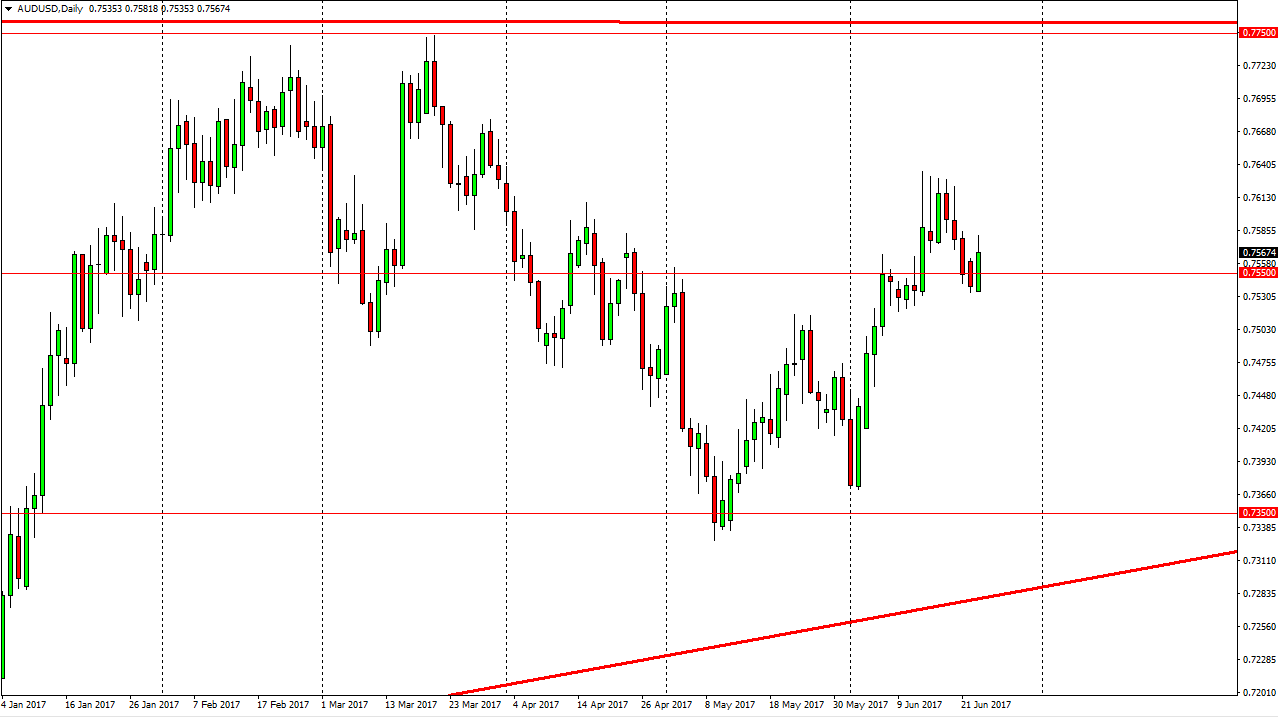

AUD/USD

The Australian dollar rallied a bit during the day on Friday, forming a positive candle. It looks as if the market is going to find the 0.7550 level as support. A break above the top of the range should send the market towards the 0.7640 level, and then break higher towards the 0.7750 level. Ultimately, this is a market that I think will eventually go higher, and of course of gold rallies that should help this market as well. I think that pullbacks continue to offer value as long as we stay above the 0.75 level. If we can stay above there, there is more than enough reason to think that the buyers will take control. I don’t have any interest in shorting until we break below the 0.75 level, and then at that point I would expect the market to go down to the 0.7350 level. However, I believe that the longer-term outlook for the market is to the upside, not down.