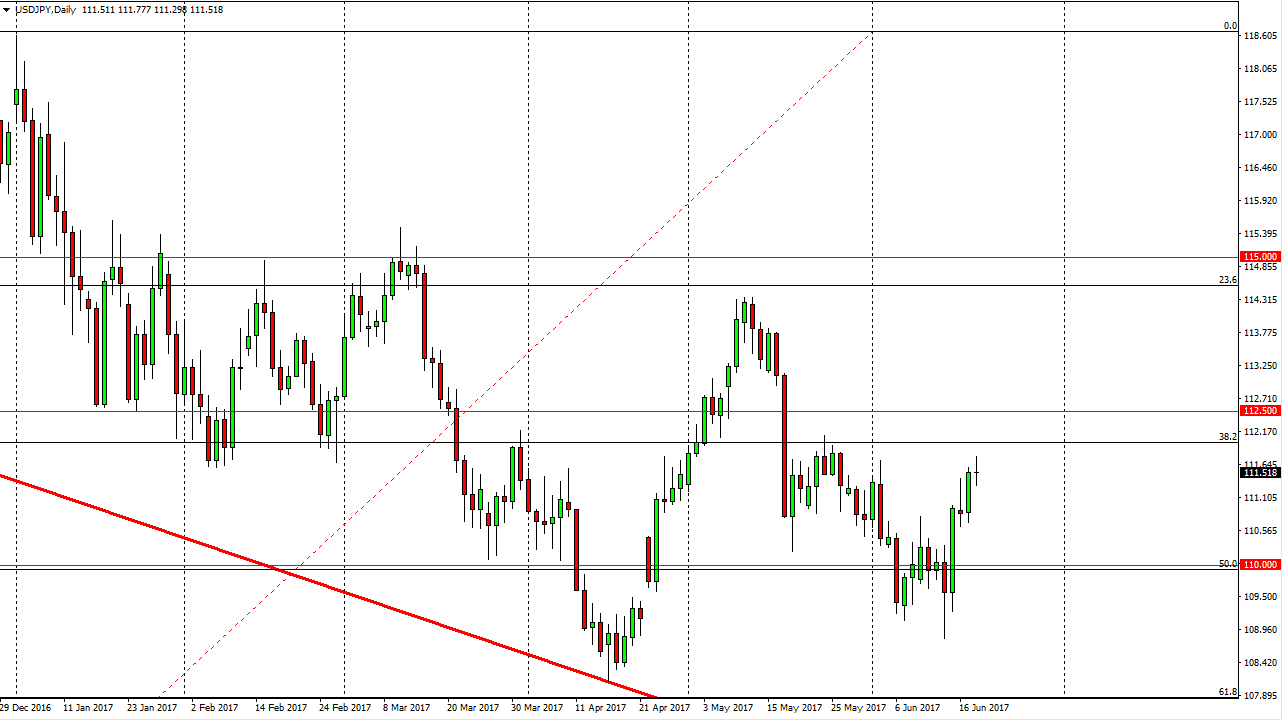

USD/JPY

The US dollar tried to rally during the day on Tuesday but found enough resistance above to turn around to form a shooting star. This is a negative sign, and I think we are going to drop from here, more than likely looking for buyers underneath. Alternately, if we break above the top the candle the market could go looking for the 112 level, and then the 112.50 level after that. To break above there should send this market even higher, perhaps reaching towards the 114 handle. I believe longer term we are to continue to see buyers, as the Federal Reserve is looking very likely to raise interest rates over the next year or so.

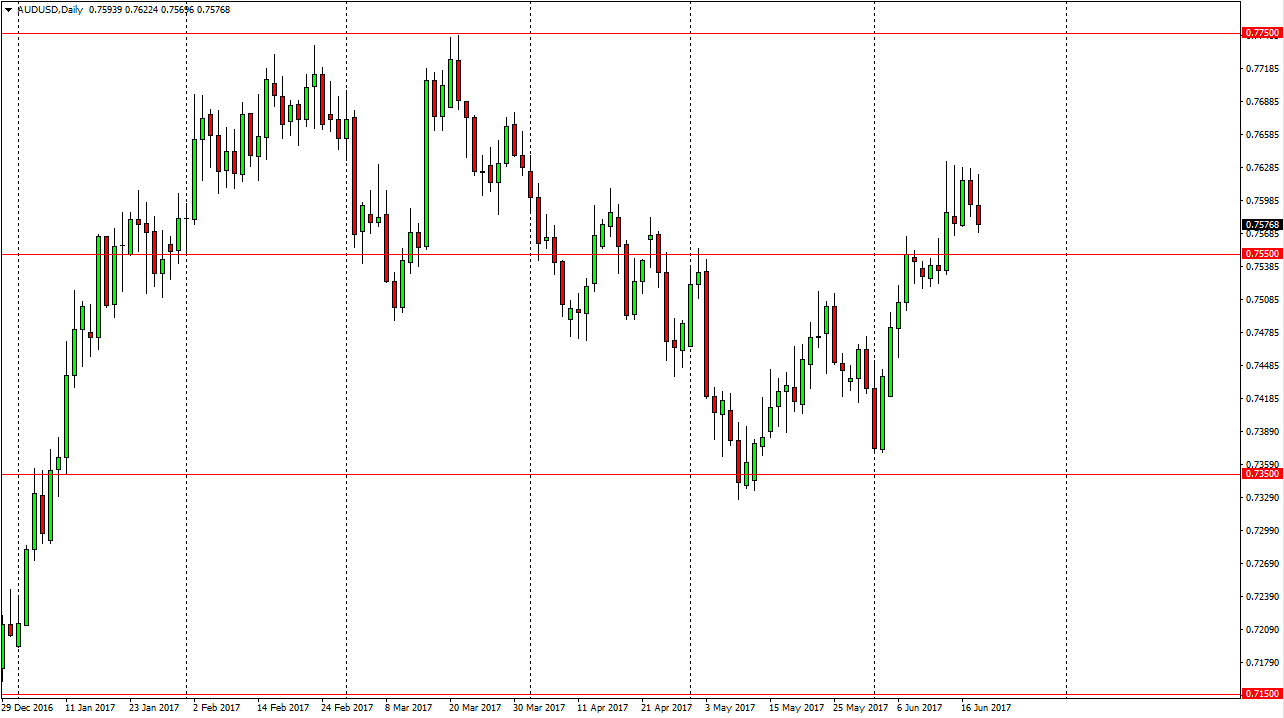

AUD/USD

The Australian dollar initially tried to rally during the day on Tuesday but found enough resistance at the 0.7625 level again to turn around to form a negative candle. The 0.7550 level underneath should be supportive, and I think that extends all the way down to the 0.75 handle. Because of this, I think that sooner or later we will find buyers underneath that support this market, so I’m waiting to see a supportive candle that I can take advantage of. If we do breakdown below the 0.75 handle, the market should then drop to the 0.74 level next. Alternately, we break above the 0.7625 handle, the market should then feel free to go to the 0.7750 level after that.

Pay attention to gold, it will have its influence on this market as per usual, and with this being the case the market should pay attention to the commodity in order to get an idea as to whether or not something could be about to happen in this market. Ultimately, the market should be volatile, but the next impulsive move should be rather important.