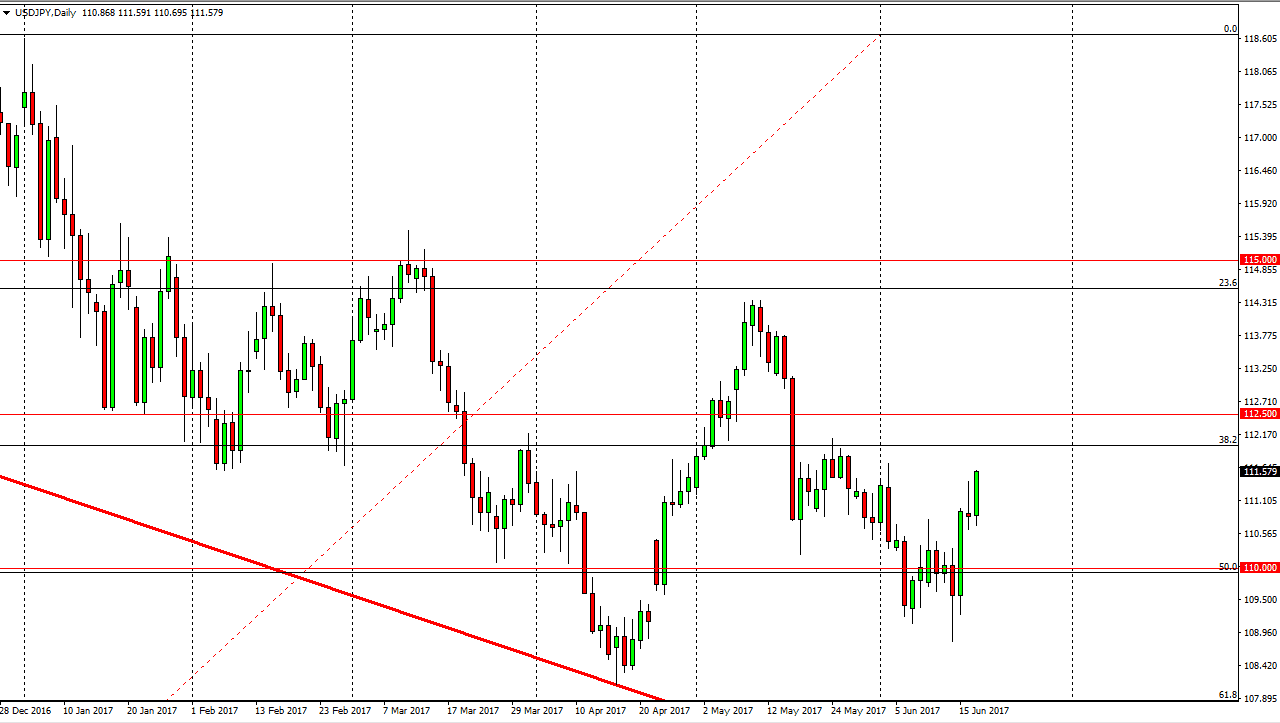

USD/JPY

The USD/JPY pair initially dipped on Monday, but broke above the top of the shooting star from the Friday session, and that of course is a very bullish sign. Not only that, we broke above the top of the hammer during the previous week, so I believe that the market should send to the upside, perhaps reaching towards the 112 level, then the 112.50 level. To break above there should send this market reaching towards the 114.50 level next. Ultimately, I believe that the trend is changing in general, so I am very bullish of this pair and believe that short-term pullbacks are buying opportunities, and the higher low suggests that we are starting to see a little bit of a momentum change. Given enough time, I do like the idea of going long, and it makes quite a bit of sense as the Federal Reserve is likely to raise interest rates at least one more time this year.

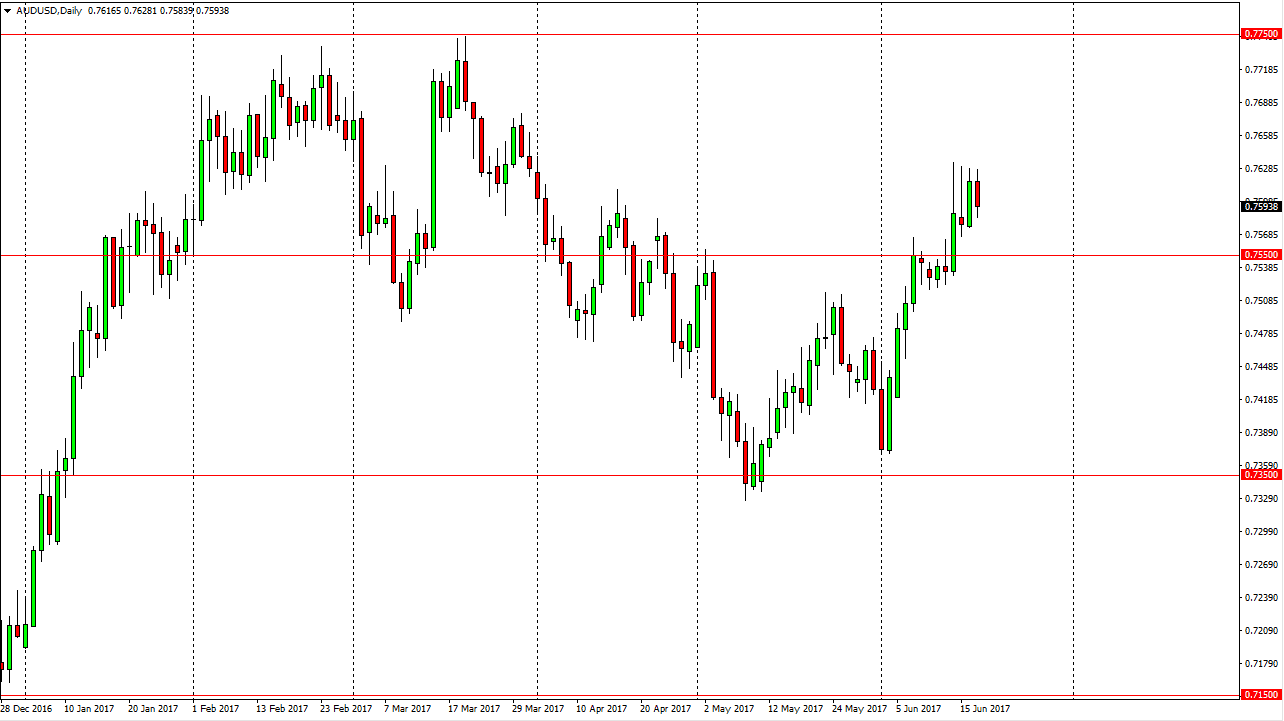

AUD/USD

The Australian dollar fell during the day on Monday, looking as if it is trying to find support below, especially near the 0.7550 level underneath. Some type of supportive candle underneath is a reason to go long, and I will take advantage of that opportunity when it occurs. I think that the market will then go towards the 0.7750 level, but it could be very choppy between here and there. Ultimately, I think that we will break above that level as well and go looking for the 0.80 level but the goal markets are not cooperating, so we could move relatively slow in the meantime. I don’t have any interest in selling, at least not until we get below the 0.75 level underneath, which doesn’t look likely as the short-term charts look very bullish.