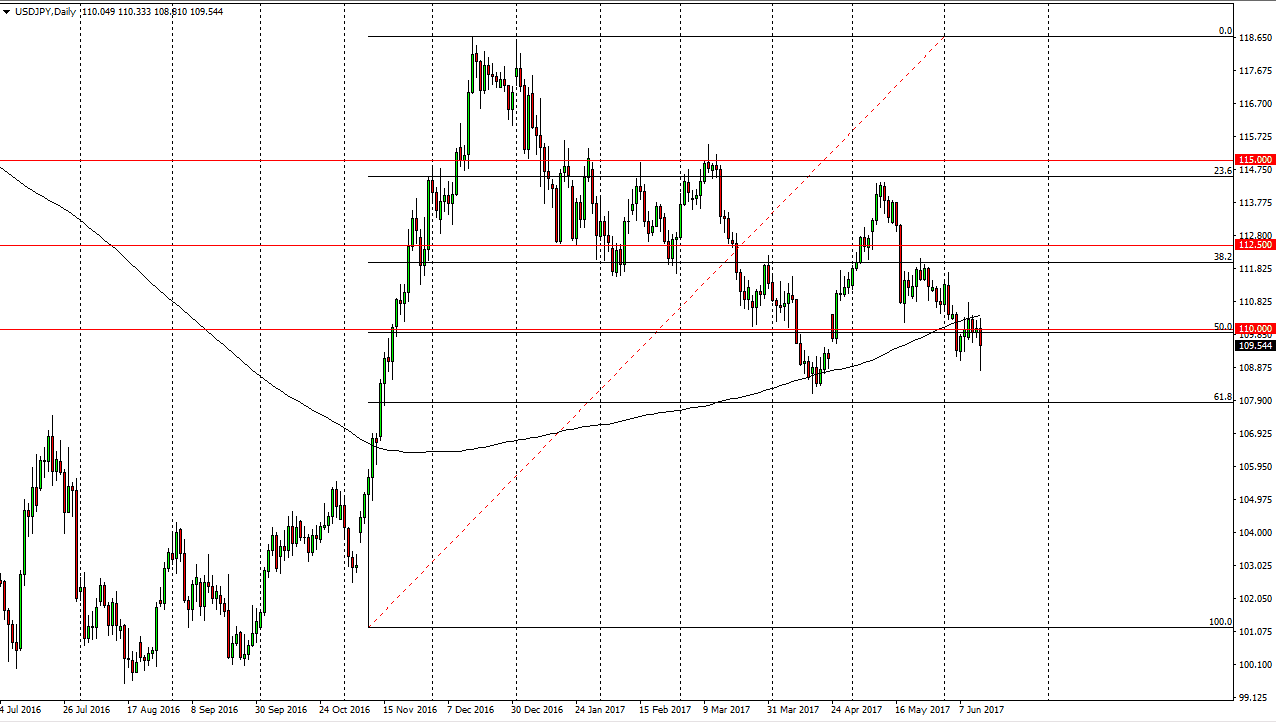

USD/JPY

The USD/JPY pair initially fell during the day on Wednesday, but found enough pressure underneath to turn around and form a bit of a hammer. The market is currently sitting at the 50% Fibonacci retracement level, and just below the 200-day exponential moving average. The market seems a bit stuck in this area, so I’m waiting for some type of impulsive move. The fact that the Federal Reserve cannot cause that to happen was a bit surprising, but if we can break above the top of the range for the day on Wednesday, I think that the buyers will jump into this market, reaching towards the 112 level, if not the 112.50 level after that. Ultimately, if we breakdown below the bottom of the candle, I believe the market then goes down to the 108 level, which is the 61.8% Fibonacci retracement level.

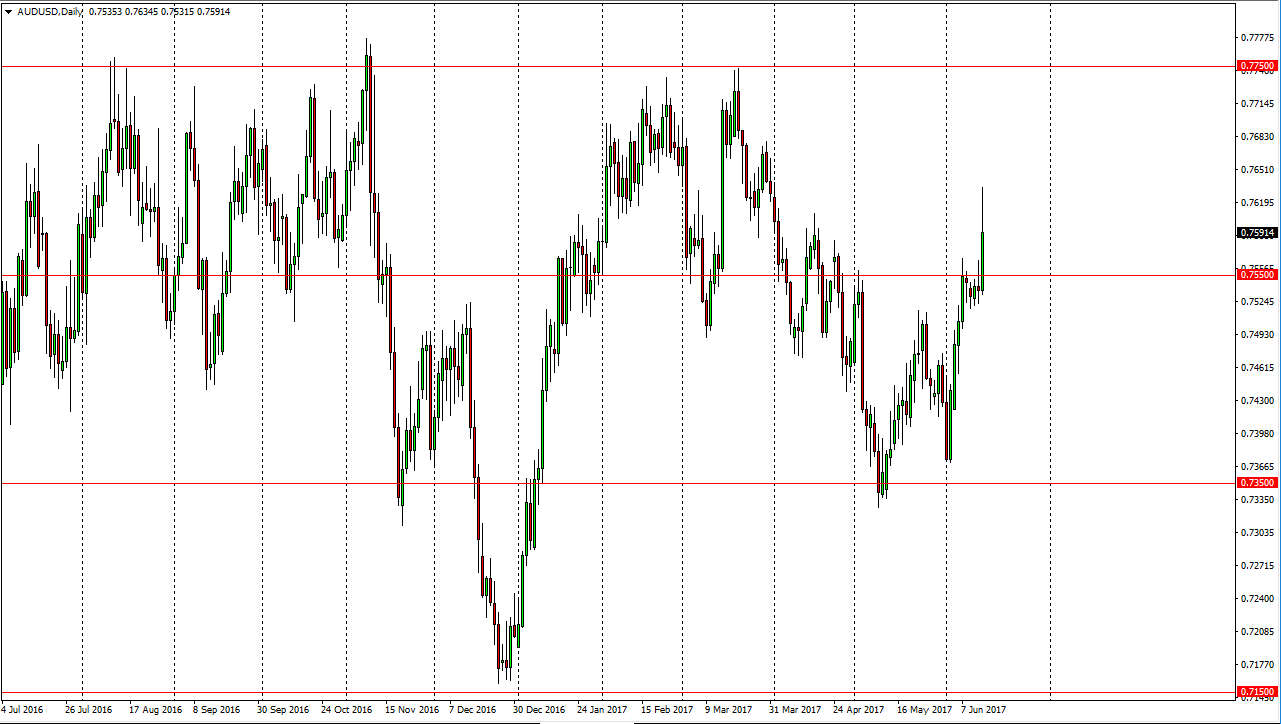

AUD/USD

The Australian dollar broke out to the upside, slicing through the 0.7550 level. The market sliced through the 0.6 level at one point, but pulled back slightly. I believe that the market will continue to go higher, but you may have to look to short-term charts to take advantage of this move. The goal markets will have a large effect obviously, and I think that now that the Federal Reserve is done, it’s more than likely going to be a continuation of what we had seen previously. Because of this, I think continuation is in the air, and I’m seen that on several fronts, and this market is just one of them. I think the market can then go to the 0.7750 level, which is my longer-term target ultimately. The 0.75 level underneath needs to be broken in order to start selling, which doesn’t look very likely currently. If we do that though, I think the market should then go down to the 0.7350 level.