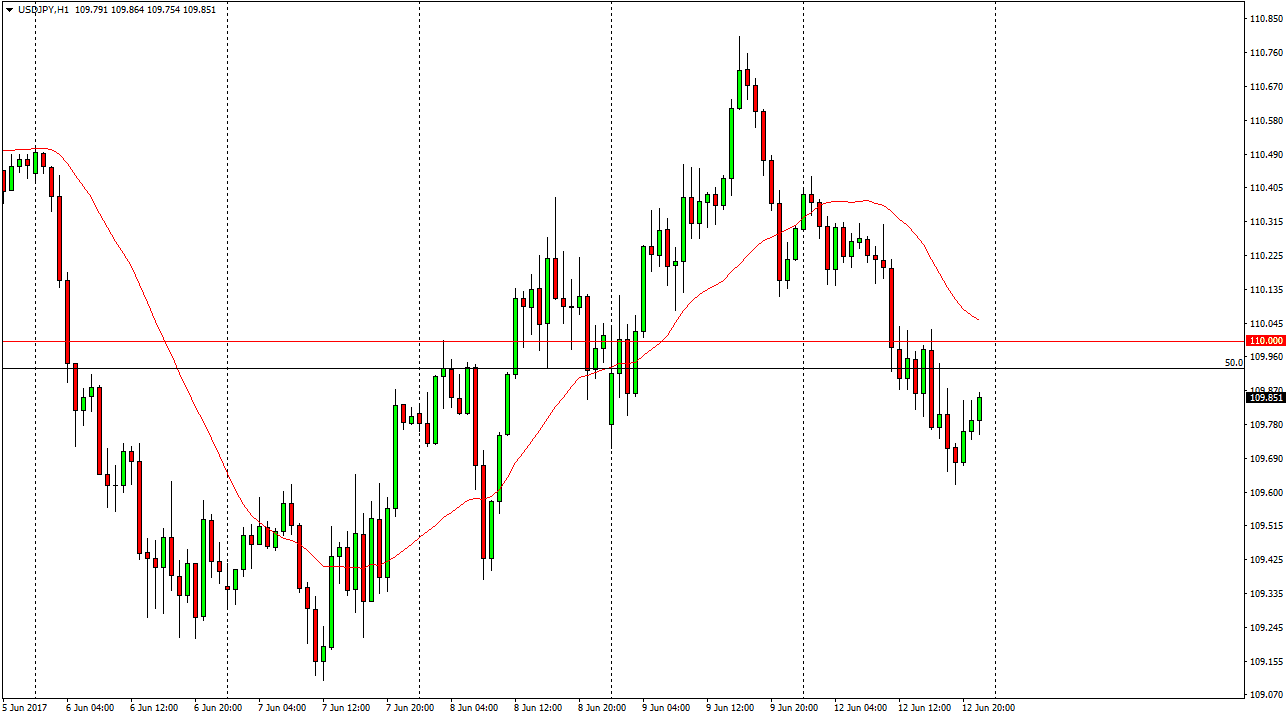

USD/JPY

The USD/JPY pair fell significantly during the session on Monday, breaking well below the 110 level. By doing so, it shows a significant amount of bearish pressure, and as long as we stay below the 110 level, it’s likely that the market will continue to struggle and eventually find sellers. We are bouncing towards that level again, but I think the real fight begins once we reach the 110 handle. If we can break above that level, it’s likely that there could be sellers involved that would be trying to cover their position, thereby adding even more bullish pressure to the market. Alternately, if we roll over and breakdown below the lows for the session on Monday, the market will only extend the losses, perhaps reaching towards the 109 handle at that point. Either way, expect a lot of choppiness.

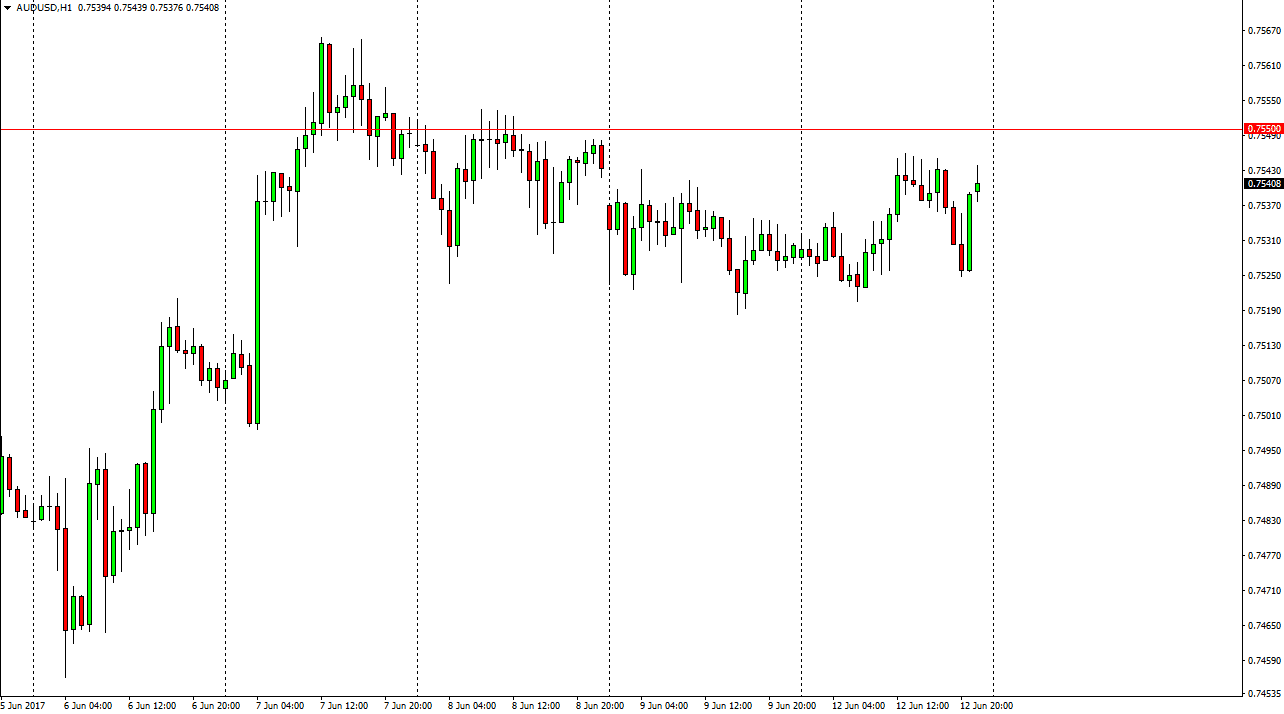

AUD/USD

The Australian dollar had a back and forth type of session during the day on Monday, as we continue to go sideways overall. The 0.7550 level above is resistance, and if we can somehow break above there I feel that the market could go much higher. However, there is a certain amount of bearish pressure in that area, so it’s likely that the market will have to continue to grind until we can get enough momentum to break out. Pullbacks should continue to find support at the 0.7525 handle, as the market has seen the buyers jump back in more than once in that particular area.

Gold markets are trying to stabilize, and if they do, it’s likely that this market will continue to rally as well as the Australian dollar is highly sensitive to gold. With enough time, it’s likely that the markets will reached a fresh, new highs, and then perhaps all the way to the 0.77 handle after that.