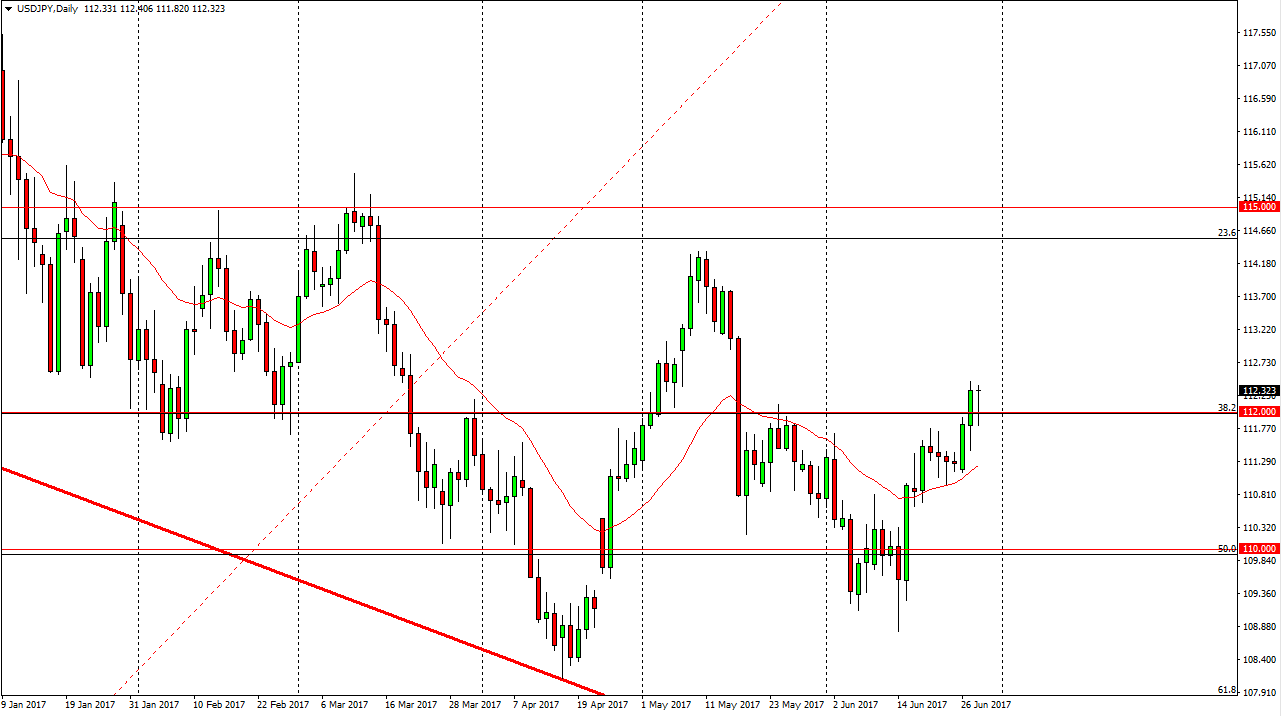

USD/JPY

The US dollar initially fell against the Japanese yen, testing the 112 level for support. We did find it there though, and rallied enough to form a hammer. This is a very bullish sign if we can break above the 112.50 level, the market should continue to reach the higher levels, essentially the 114 level would then be my target. I believe that we will not only reach that level, but then possibly even go as high as the 115 level which is the longer-term resistance. A break above there would be very bullish, but I think it will take a significant amount of volume to do so. If we did breakdown below the bottom of the range for the session on Wednesday, then I would be concerned. In the meantime, looks as if this market is going to continue to find buyers.

AUD/USD

The Australian dollar had a very bullish showing during the day on Wednesday, breaking above the top of the shooting star from the previous session, and of course the highs from earlier this month. Now that we have broken above there, I think that is certainly a market that can be bought on pullbacks, and perhaps reach towards the 0.7750 level above. That is a massive amount of resistance just waiting to be tested, and it makes sense that the market will continue to be choppy, but I do think that there is more of an upward bias. I believe that the 0.7550 level is essentially the floor in the market, and if gold starts to pick up again, that will only supercharge the moved to the upside. If we do breakout above the 0.7750 level, then I believe that the market goes looking for the 0.80 level which has been massively supportive and resistive on longer-term charts.