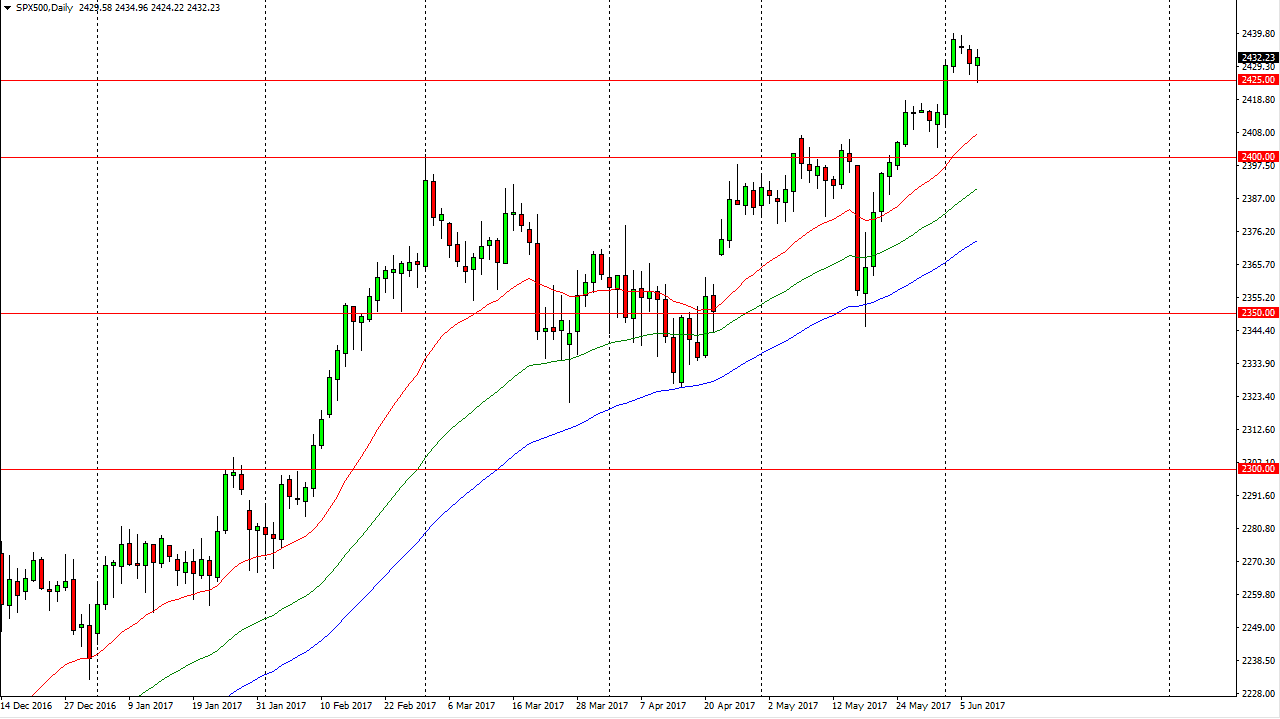

S&P 500

The S&P 500 had a volatile session on Wednesday, reaching down to the 2425 handle. The market bounced enough to form a bit of a hammer though, so looks as if the buyers are ready to get involved again. With that in mind, I believe that there will be a significant amount of buying pressure underneath, and I believe that the markets will continue to find plenty of people willing to get in. I believe that the 2400 level underneath is also massively supportive, and that the market will eventually reach towards the 2500 level above. Longer-term, I have no interest in selling and believe that the US stock indices overall will continue to show signs of buying. I believe that the continuation of buying on the dips and the longer-term buy-and-hold mentality continues.

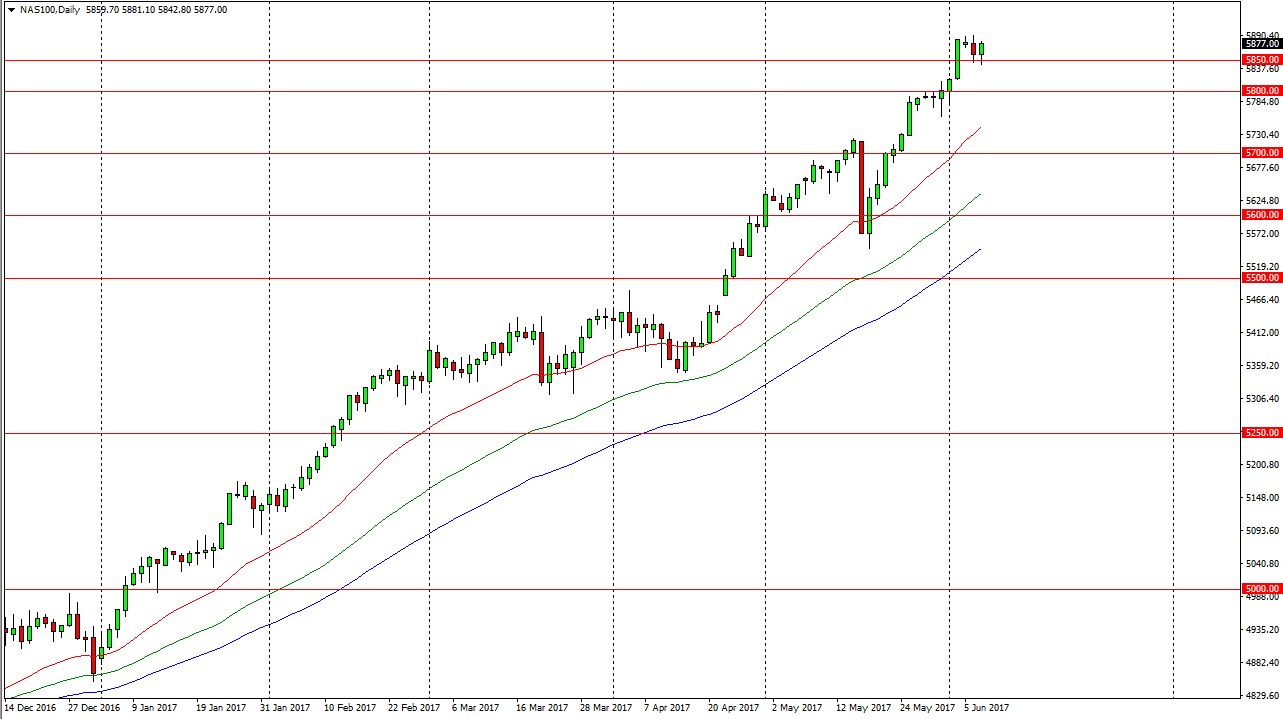

NASDAQ 100

The NASDAQ 100 also fell during the day initially, but found enough support at the 5850 level. By bouncing from there, the market ended up forming a bullish candle and it looks as if the NASDAQ 100 is looking to lead the way for the other indices as well. I believe that buying on the dips continues to be the best way to trade this market, and I believe that the 5800 level should offer massive support as well. Because of this, I’m a buyer and not a seller. I believe the given enough time the market will continue to attract buyers and that we should see the NASDAQ 100 look very healthy over the longer term. I also believe that the 6000 level should be a massive target for the overall market as it is a large, round, psychologically significant number. I believe that we will eventually break above there, but it’s going to be very difficult to do so and I do not think it will happen at the first attempt.