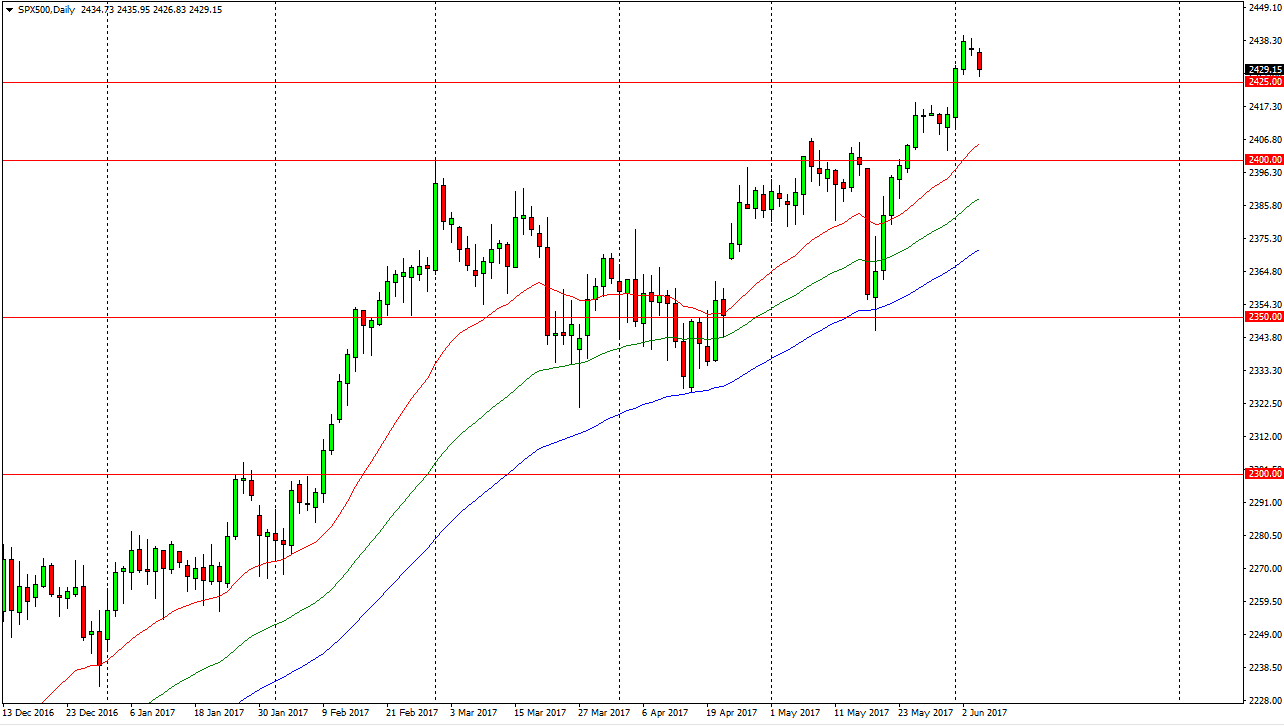

S&P 500

The S&P 500 fell during the day on Tuesday, testing the 2425 level underneath. The area should be somewhat supportive, but I feel there is even more support below. The market has been very bullish over the last several weeks, so a pullback from here makes quite a bit of sense, and should offer value given enough time. I’m looking for some type a supportive candle to go long, and I believe that the 2400 level is a perfect spot. Ultimately, we should continue to go higher, but we may have gotten a little bit ahead of ourselves in the meantime. I look at these pullbacks as opportunities to take advantage of a strong market and do not have any interest whatsoever in selling this market.

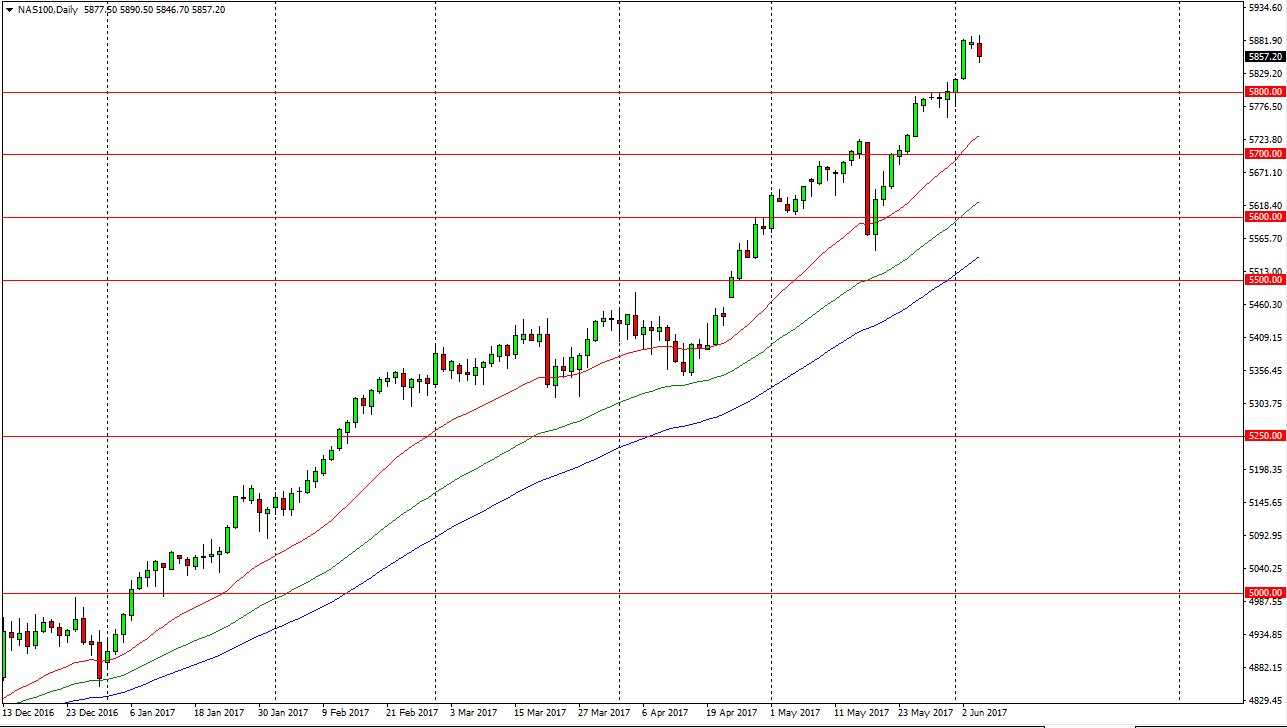

NASDAQ 100

The NASDAQ 100 initially tried to rally during the day on Tuesday but then turned around and fell finally. This is the first red candle in the last couple of weeks, and I believe we should continue to see a little bit of a pull back here now that we are stretched out. I think the 5800 level will be supportive, and the 5700-level underneath that. I have no interest in shorting though, I think this simply offers a bit of value that we can take advantage of if you are patient enough to wait for a supportive candle. I think that eventually we will then reach towards the 5900 level, and then eventually the 6000 level after that. The 6000 level is my longer-term target, and I believe that the market will try everything it can to get there.

Going forward, I believe in buying dips in small quantities to take advantage of the longer-term trend, and of course protect the account by getting involved in various smaller pieces as it may take a while to find the buying pressure to go higher.