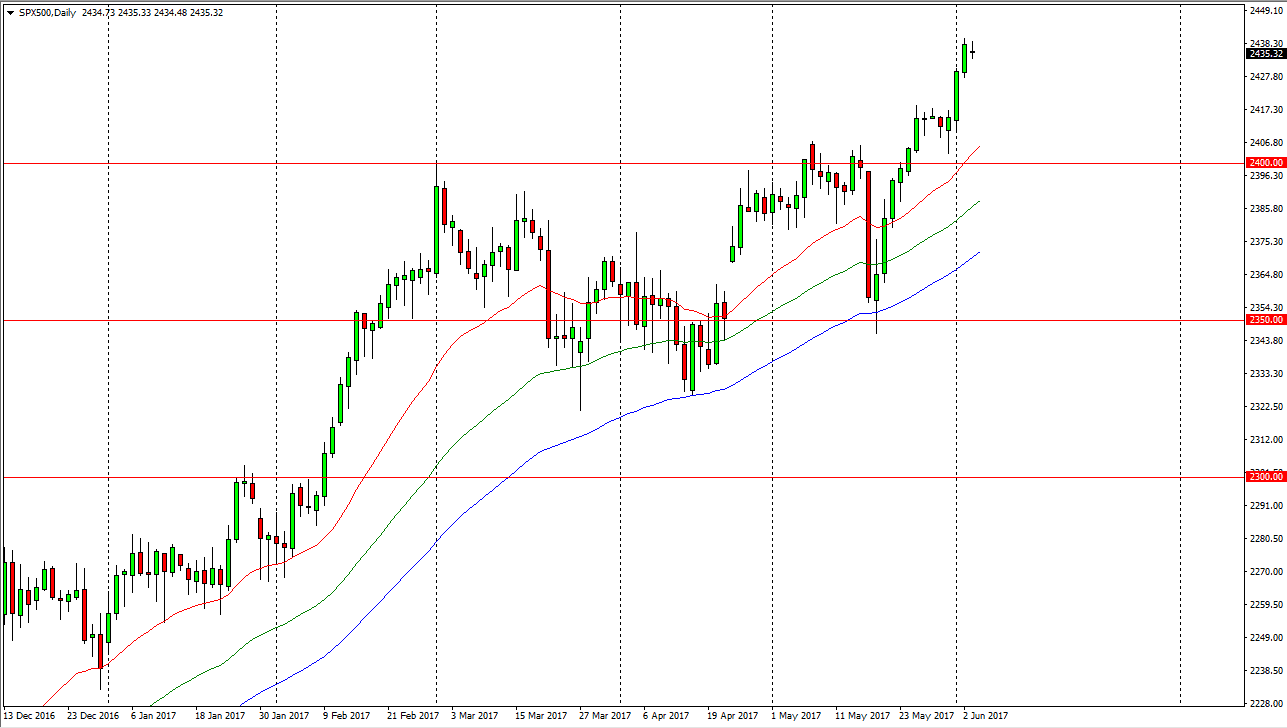

S&P 500

The S&P 500 was very quiet during the Monday trading session, as we continue to see bullish pressure, only this time in the form of the market being comfortable at high levels. I think the pullback is probably coming, but that pullback should be a buying opportunity as I expect to see a lot of support underneath, especially at the 2400 level. I think that most people look at this market as a bullish market, and therefore any pullback at this point probably has somewhat of a limited range. I would be very surprised to see the 2400 level broken, and therefore I look at it as a “hard floor” in the market. Eventually, I anticipate that this market will go to the 2500 level, but it will of course take some time to get there as there are a lot of moving pieces economically speaking.

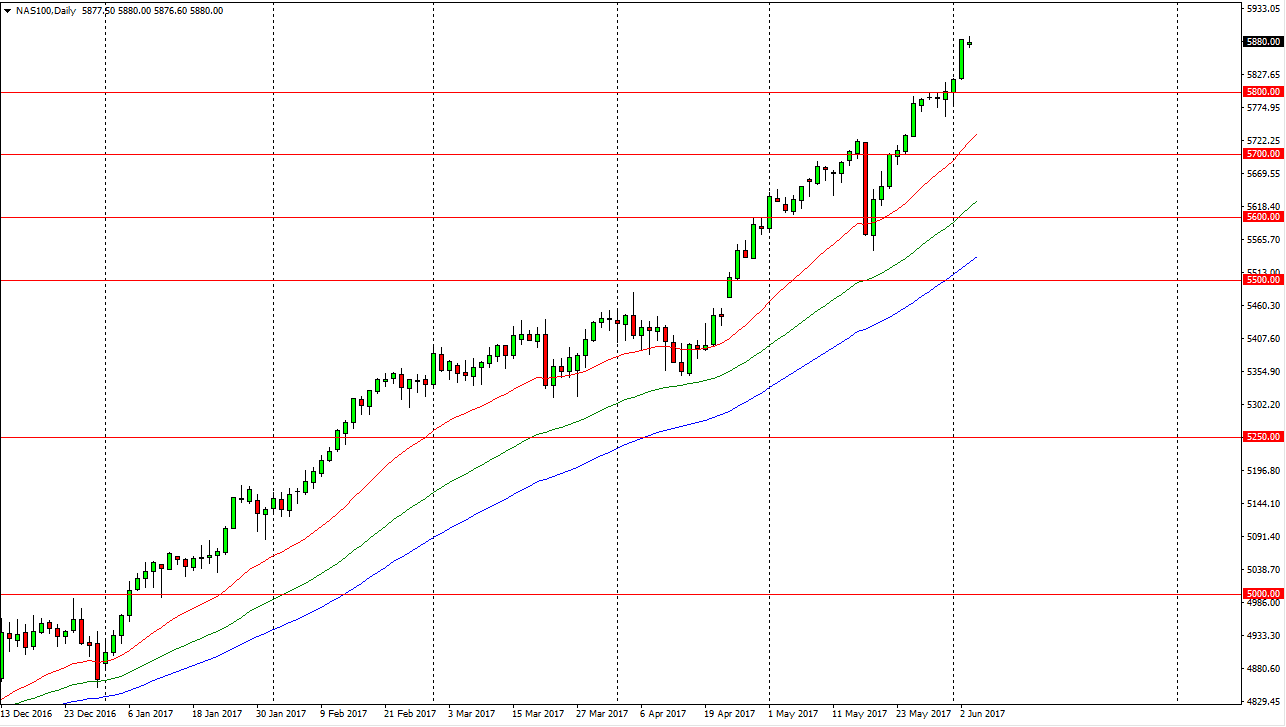

NASDAQ 100

The NASDAQ 100 was very quiet during the session as well, as the market continues to hover just below the 5900 level. That is an area that of course will have a certain amount of psychological resistance built into it due to the large, round, psychologically significant number, but given enough time I think that a pullback will only find buyers at lower levels, especially the 5800-level underneath. That level for me is the “floor” in this market, and therefore I think that the buyers will jump in and push this market much higher if we do reach down to that level. Quite friendly, I think a pullback is only going to do favors for the market that has been so bullish for some time. Because of this, I am looking for pullbacks as value and therefore have no interest in selling. I believe that the market will remain a “buy on the dips” situation.