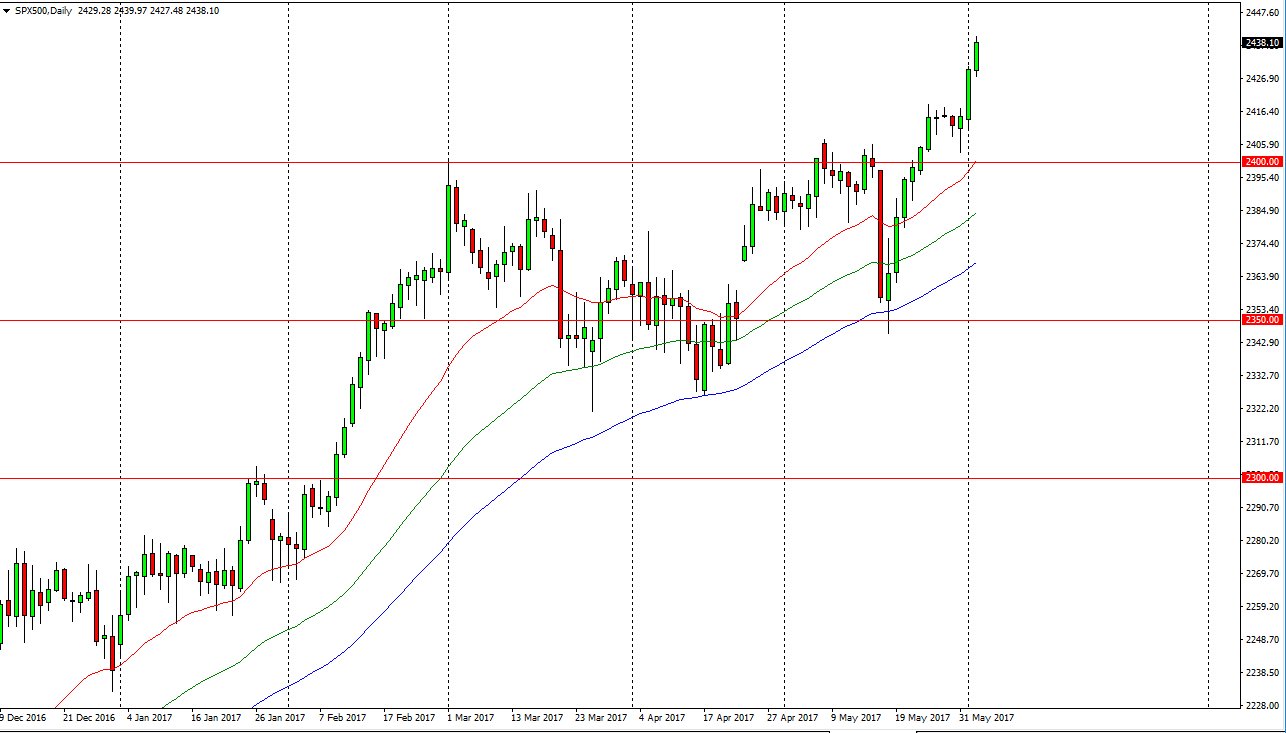

S&P 500

The S&P 500 had a very interesting session on Friday, as we initially sold off, but then exploded to the upside after a very poor jobs report. I find this interesting, and believe that it shows just how bullish the market truly is. The 2450 level above is the first target, and going forward I believe that it’s only a matter of time before the buyers get involved on dips. This 2400 level underneath should continue to offer a bit of a “floor” in this market, and I believe that the markets do continue to reach much higher, perhaps trying to get all the way to the 2500 level. Ultimately, I believe we break above there as well, but in the meantime, I think we will see some volatility from time to time, and I look at pullbacks as an opportunity to buy this very strong market “on the cheap.”

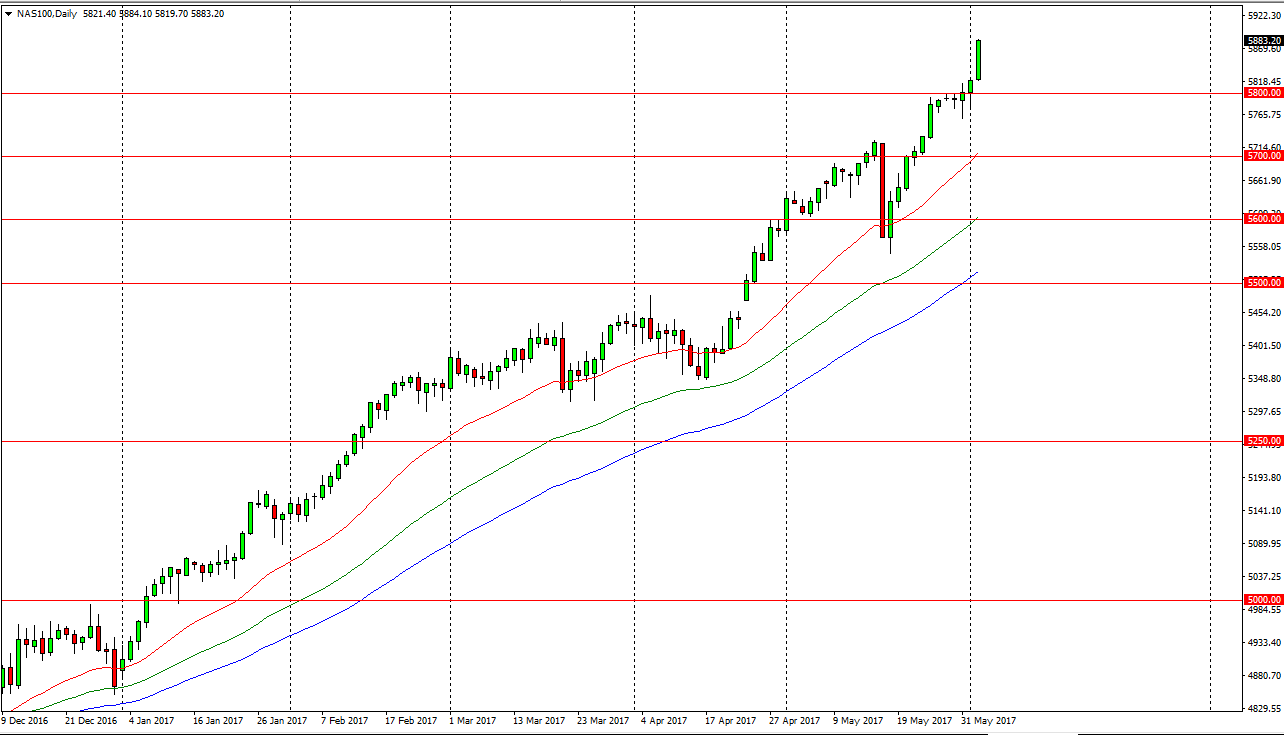

NASDAQ 100

The NASDAQ 100 also exploded to the upside, breaking the top of the hammer from the Thursday and the hammer from the Wednesday sessions. The 5800 level looks to be very supportive, and we close to the very top of the range. Because of this, I’m very confident in the bullish uptrend, and believe that we are going to go looking for the 5900 level, followed by the 6000 level longer term. The 6000 level will course be very psychologically important, so I would expect to see a bit of selling in that area. Nonetheless, I am very bullish of the longer term as well, and believe the dips offer value in this market just as they do in the S&P 500. If we can break above the 6000 level, that would be extraordinarily strong, but I highly doubt is going to happen at the first attempt.