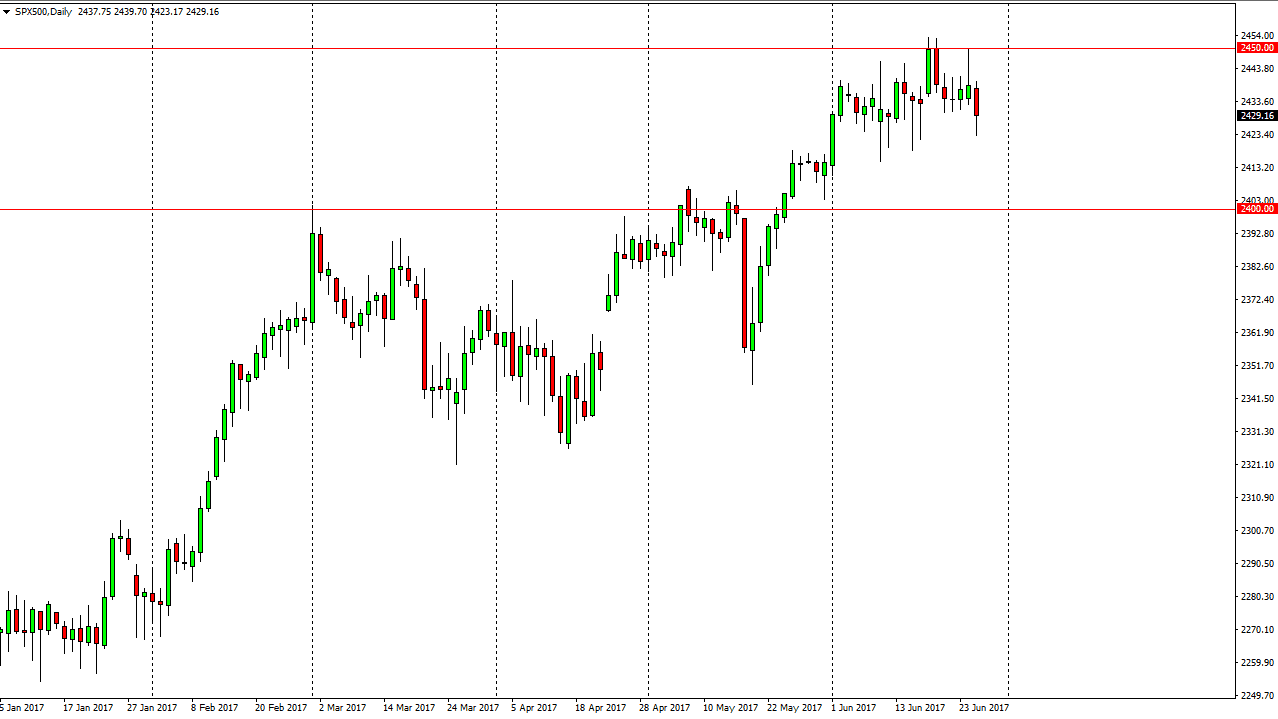

S&P 500

The S&P 500 fell a bit during the day on Tuesday, as we continue to grind sideways. This being the case, looks like we could pull back a little bit and go looking for the 2400 level. The 2400 level underneath should offer plenty of support, thereby an opportunity to pick up a little bit of value. This being the case, I’m looking for a supportive candle underneath to start going long again, and therefore I am going to be very patient as we will need to build up momentum to finally break above the 2450 handle. However, I think that one of the biggest concerns in the stock markets now can be found in the NASDAQ 100.

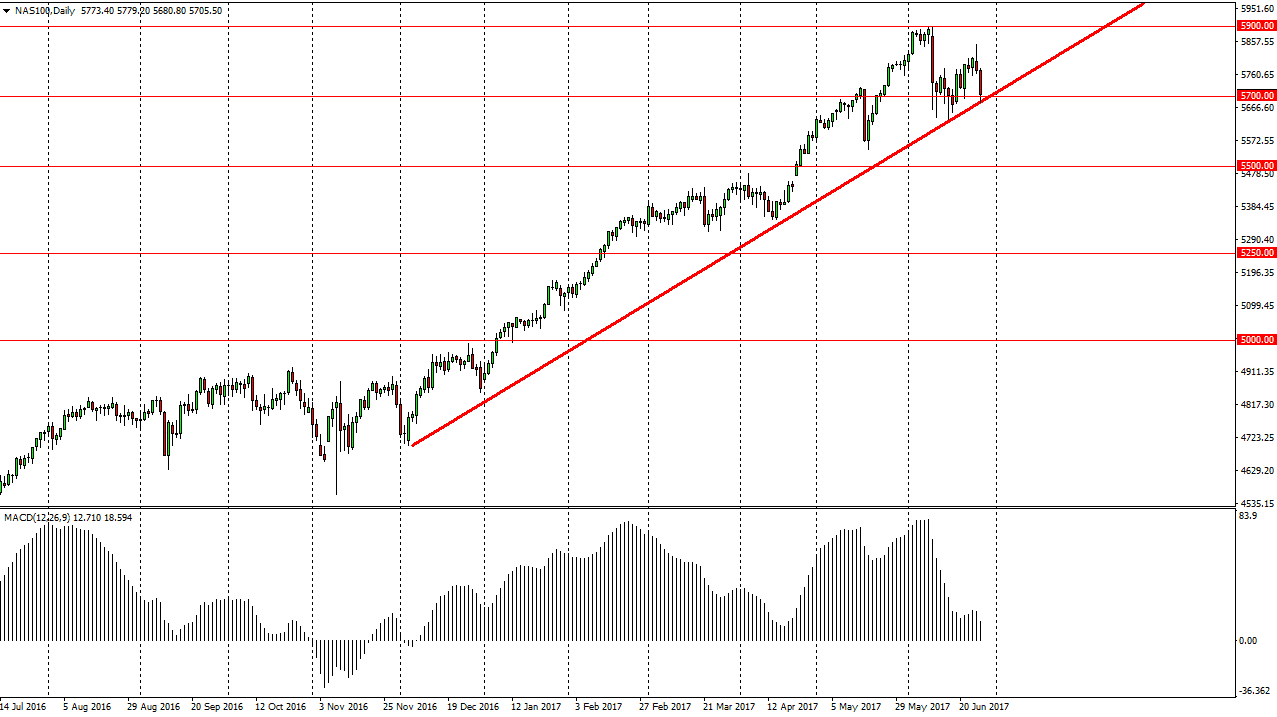

NASDAQ 100

The NASDAQ 100 fell during the day on Tuesday, testing the massive uptrend line that we have seen since November of last year. Because of this, we are at a significant inflection point. I think that if we can break down below the uptrend line, the market will more than likely go looking for the 5500-level underneath, and then possibly even lower than that. Alternately, if we do rally from here, the market should go looking for the 5800 level. This is a market that has lead the way for other US indices, and there are several signs now that are starting to point towards potential trouble. I think the next several sessions will be very important, so pay attention to what’s going on is going to be paramount. I will keep you informed as to what I’m doing, the right now I think we are about to see this market try to break down. One of the most negative signs is that we had formed a lower high than the previous one, and of course the MACD is starting to roll over as well.