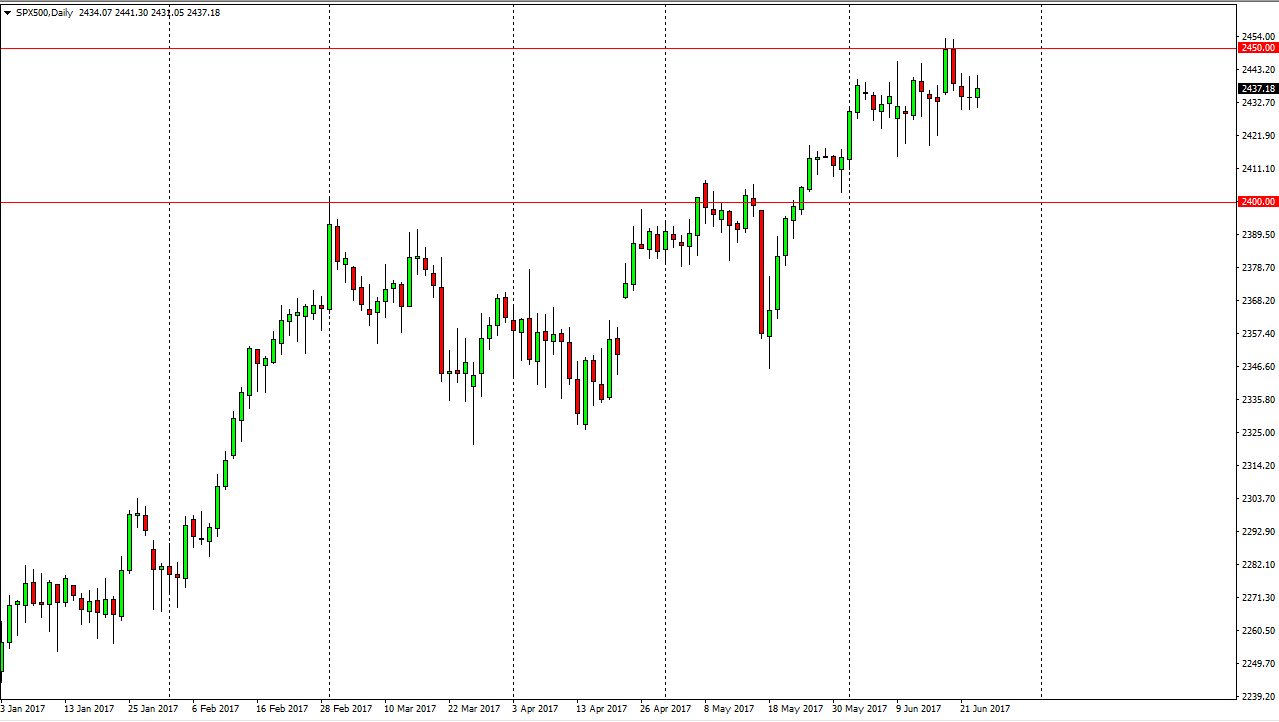

S&P 500

The S&P 500 went sideways during the week, and Friday was no different. It looks as if we are trying to build up enough momentum to finally go higher, but the weekly chart has formed a bit of a shooting star. Because of this, I would not be surprised at all to see this market pull back to the 2400 level. That is an area that should be massively supportive though, so I’m looking for any bounce or supportive candle to start buying again. A break above the 2450 level is obviously bullish as well, and I think that the buyers will then try to push this market towards the 2500 level. That is an area that should be very resistive, but once we get above there it should be a longer-term “buy-and-hold” type of situation.

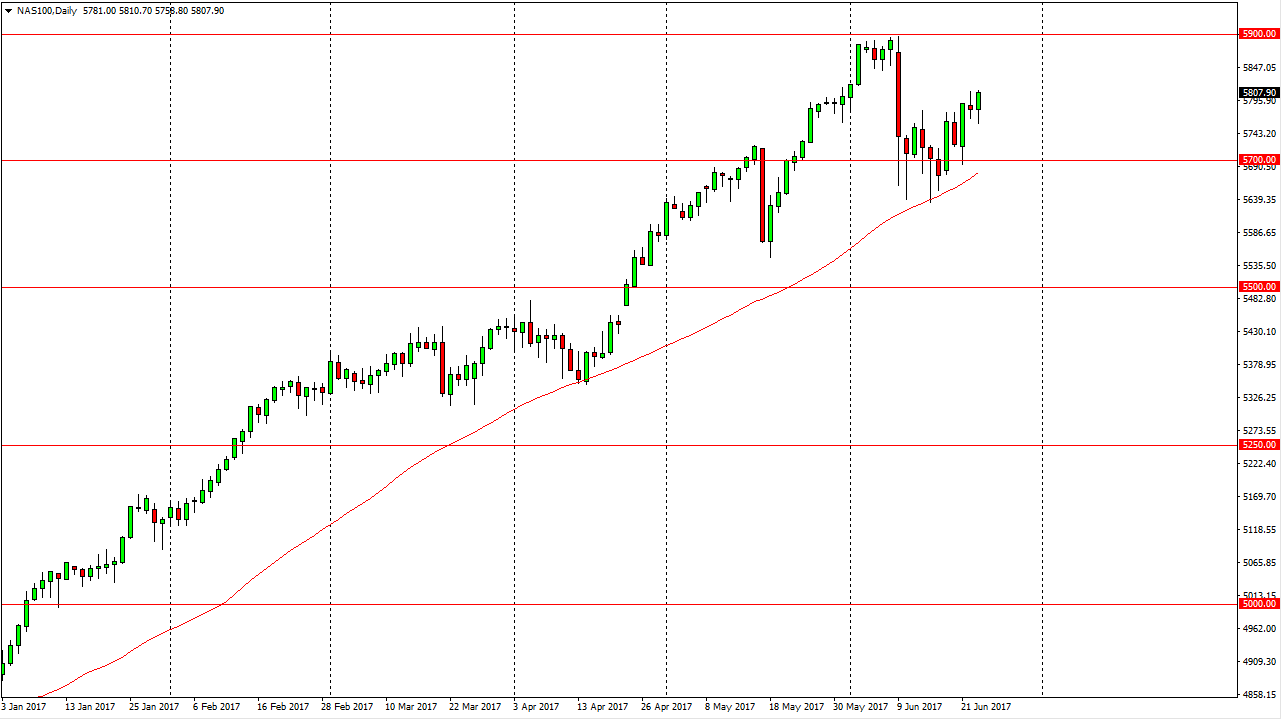

NASDAQ 100

The NASDAQ 100 initially fell on Friday, but turned around to form a bullish candle. I think that the NASDAQ 100 is going to try to reach towards the 5900 level, and perhaps pull other US indices to the upside. The NASDAQ 100 has lead the way for most other indices, so don’t be surprised at all if it does this again. I am very bullish of the NASDAQ 100, and I believe that the market should then go to the 5900 level above. Once we get above there, the market should then reach towards the 6000 handle. I believe that the 5700-level underneath continues to be supportive, and that support should be longer term in nature. The 50-day exponential moving average underneath should continue to support this market, and that will continue to be a reason to go forward. I believe that this market is starting to see a lot of strength due to biotech, and that biotech sector will propel us higher.