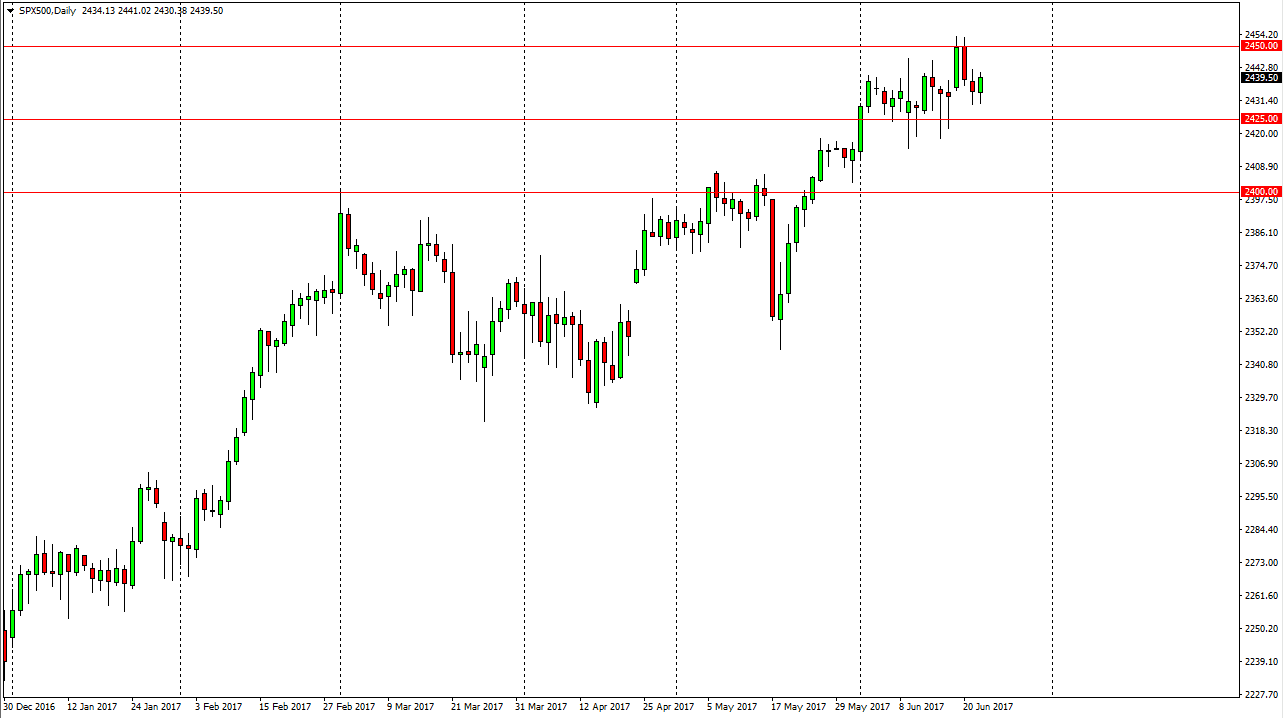

S&P 500

The S&P 500 initially tried to fall, but turned around to form a green candle. Ultimately, the market looks as if it is trying to reach towards the 2450 handle, and given enough time I don’t think that we will be able to stay underneath it for any real length of time. Ultimately, I think we go to the 2500 level. I think that pullbacks offer value, and that the 2425 level should offer plenty of support. I believe that the uptrend is still in effect if we can stay above the 2400 handle. A break above the 2500 level is more of a longer-term “buy-and-hold” situation, and eventually will be able to do that. I like building a large position, and profiting on the way up to the upside.

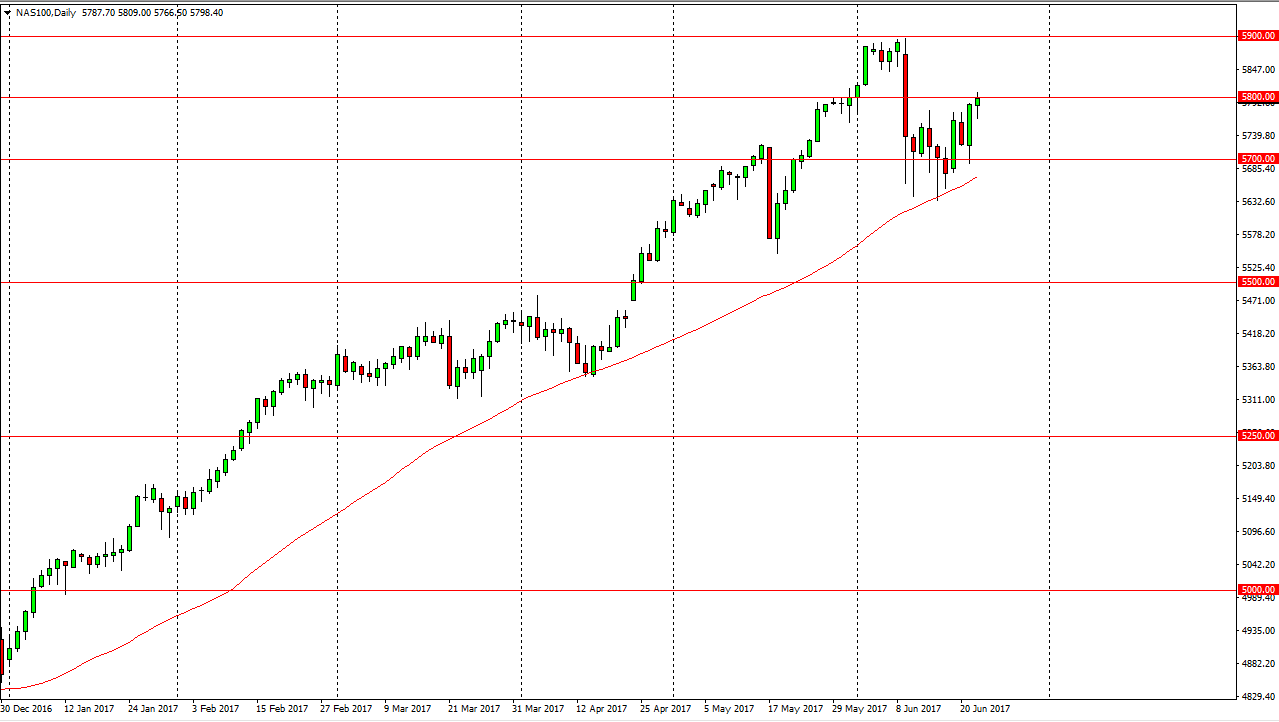

NASDAQ 100

The NASDAQ 100 initially fell during the day on Thursday, but turned around and formed a hammer, testing the 5800 level. If we can break above the top of the range for the day, the market should then go to the 5900 level. The 5900 level above is massively resistive, and more than likely going to be the target. If we can break above there, the market should then go to the 6000 level. I think pullbacks continue to offer value in a very strong uptrend, and recently we have seen the 50-day exponential moving average offer a significant amount of support. The 5700-level underneath is also massively supportive, so having said that, I like pullbacks to offer value that people will take advantage of. Recently, biotech stocks have rallied, and that of course has been pushing the NASDAQ 100 higher. Most of the selloff that we had seen recently was due to just a handful of stocks, so I think it’s been overdone, and people are starting to look at this as a value play yet again.