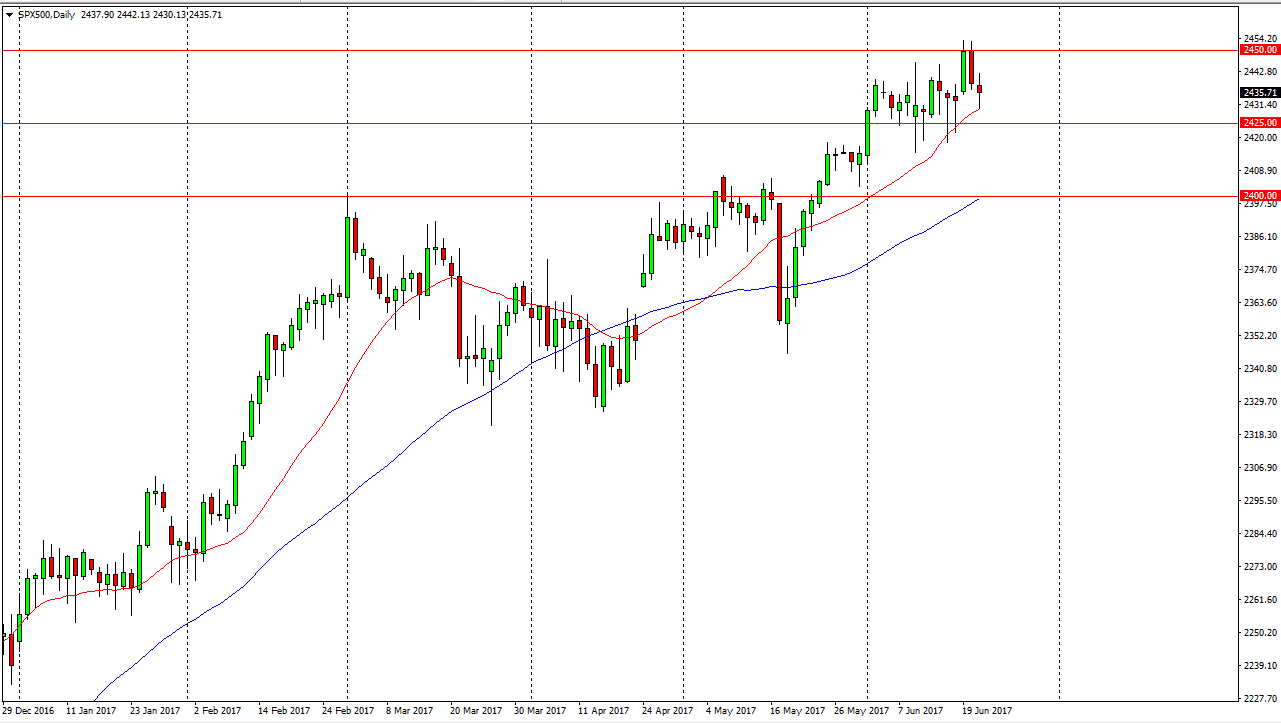

S&P 500

The S&P 500 initially fell during the day but found enough support at the 20-day exponential moving average to turn around to form a hammer. I believe that the stock indices in America look bullish in general, and it appears that towards the end of the day we started to see more buyers enter. We may have had a bit of the selloff, but quite frankly it’s only matter of time before the buyers push this market towards the highs at 2450, and above there to the 2500 level. I believe that buying dips continue to be the way going forward, and I have no interest in shorting. I believe that the market is one that will continue to find buyers, based upon value and overall strength in stock markets worldwide.

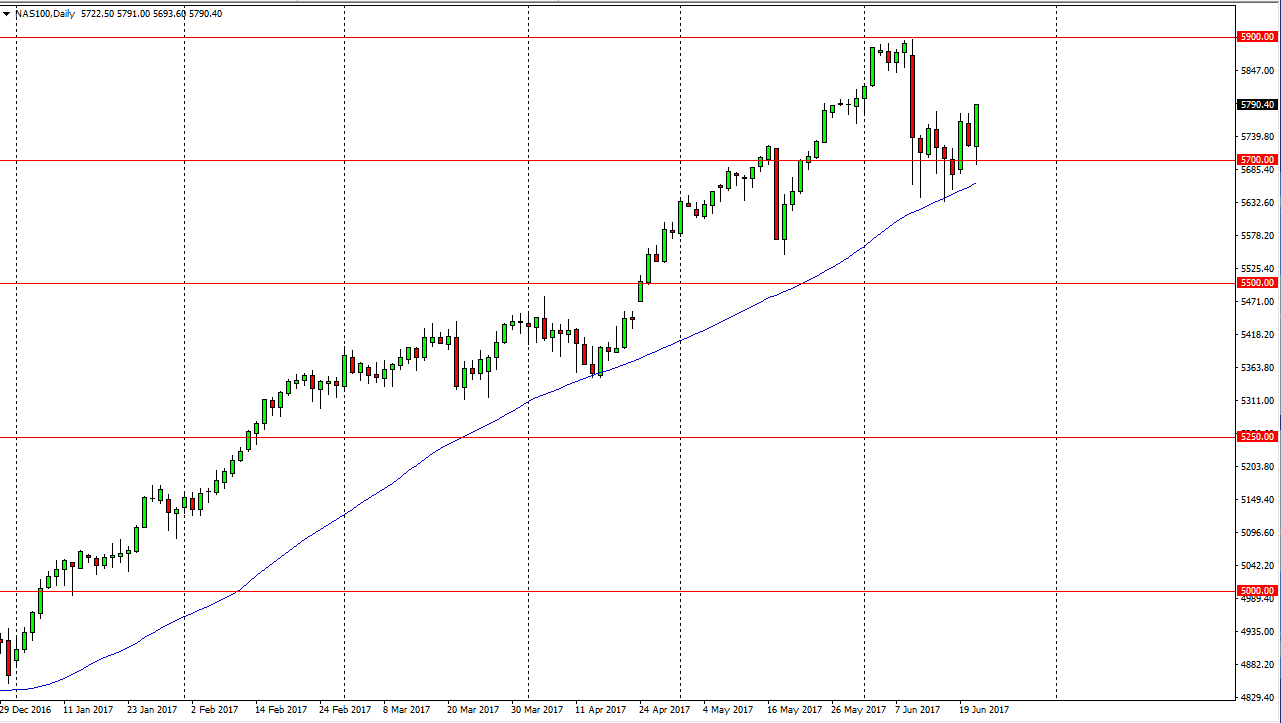

NASDAQ 100

The NASDAQ 100 initially fell but found enough support of the 5700 level to turn around and skyrocket. This is a very strong sign as the 50-day exponential moving average offered enough support to turn things around and it now looks as if we are going to go looking for the 5900 level. I believe the stock indices in general are going to be strong, and eventually we will break above the 5900 level to go looking for the 6000 handle. I think that the 5700 level will offer support, and of course a floor. I believe that the market is a “buy on the dips” type of situation, and will continue to be for the foreseeable future.

Break above the 5775 level was a very strong sign, and I think it should see some follow-through today, as the attitude of traders seem to change completely towards the end of the session on Wednesday. Quite often, follow-through happens when we close at the top of the session highs.