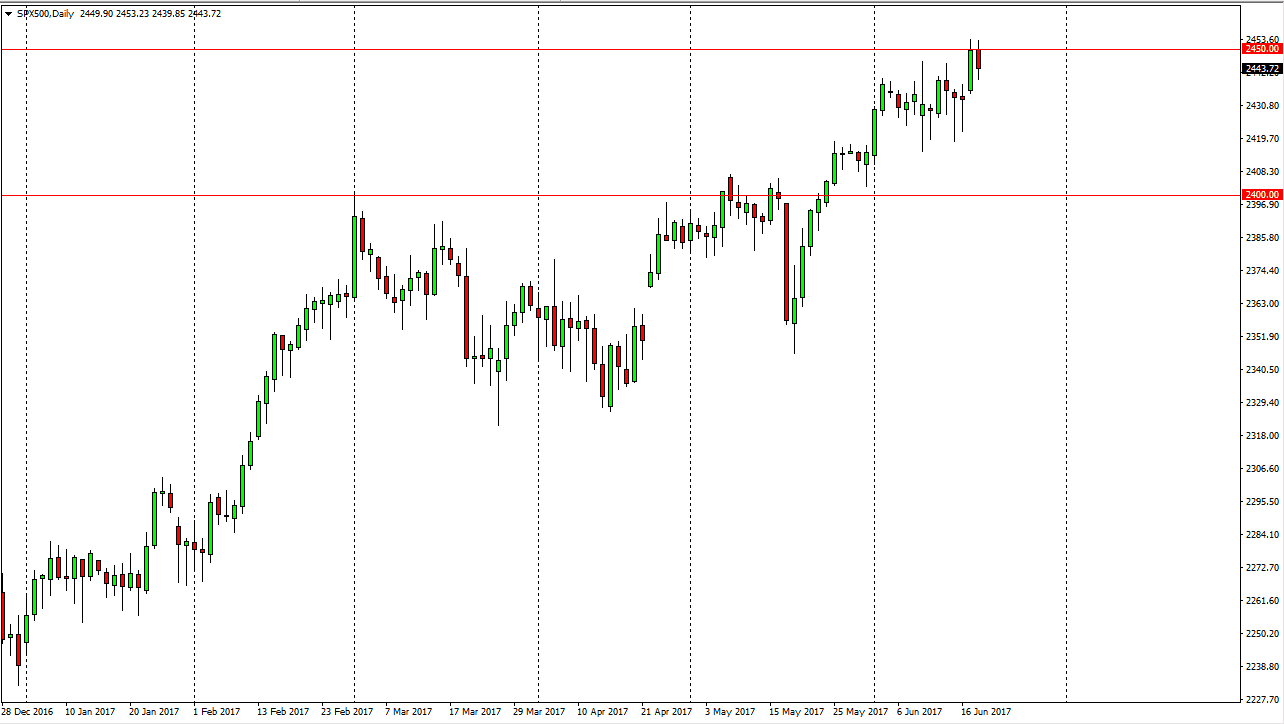

S&P 500

The S&P 500 fell slightly during the course of the session on Tuesday, as the 2450 level looks to be resistant. Because of this, I believe that a pullback should be a buying opportunity, and that the market is simply trying to build up enough momentum to finally break out to the upside. If we can break above the 2450 handle, the market should then go looking for the 2500 level. Earnings season was much better, and with this being the case I think that the buyers will return. This pullback represents value that people should be looking to take advantage of longer term, and I believe that the 2500 level will be targeted over the next several weeks. Selling isn’t even a thought as we continue to see a lot in the way of bullish pressure.

NASDAQ 100

The NASDAQ 100 fell a bit during the day, as the 5750-level offered resistance. I believe a break above there should send this market looking for the 5900 level after that, and then the 6000 level as it is my longer-term target. I believe that the NASDAQ 100 should continue to be a market that attracts attention, but currently it looks as if we are consolidating. Because of this a pullback should be a buying opportunity, perhaps reaching down to the 5650 handle. To break above the top of the candle for the day census market looking towards the 5900 level, perhaps eventually my 6000 level. This is an uptrend that should continue, and I believe that the oversold condition has been attracting traders who are looking to take advantage of weakness in this market as it gives us value. I believe that the short-term consolidation is simply accumulation the people are willing to take advantage of.

chris.png)