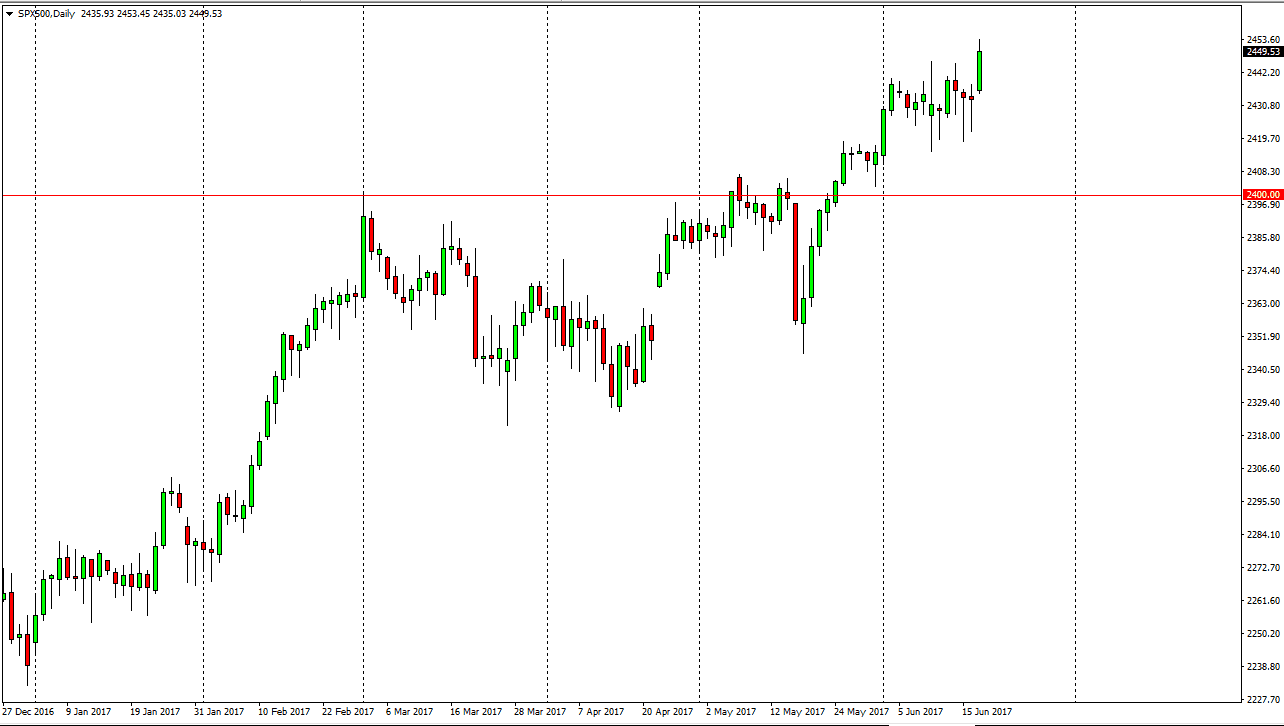

S&P 500

The S&P 500 showed a significant amount of bullish pressure as we broke above the top of a hammer on the daily chart. Because of this, the market looks as if it is ready to continue going higher, perhaps reaching towards the 2500 level. Because of this, I believe that the market should then find plenty of buyers every time we get involved. Ultimately, I think that short-term pullbacks offer buying opportunities, and that the market will find itself looking for value every time we drop. I have no interest in shorting, I recognize that this market continues to be one that should rise over time, as the earnings season was strong, and of course of the economy in the United States seems to be doing quite well.

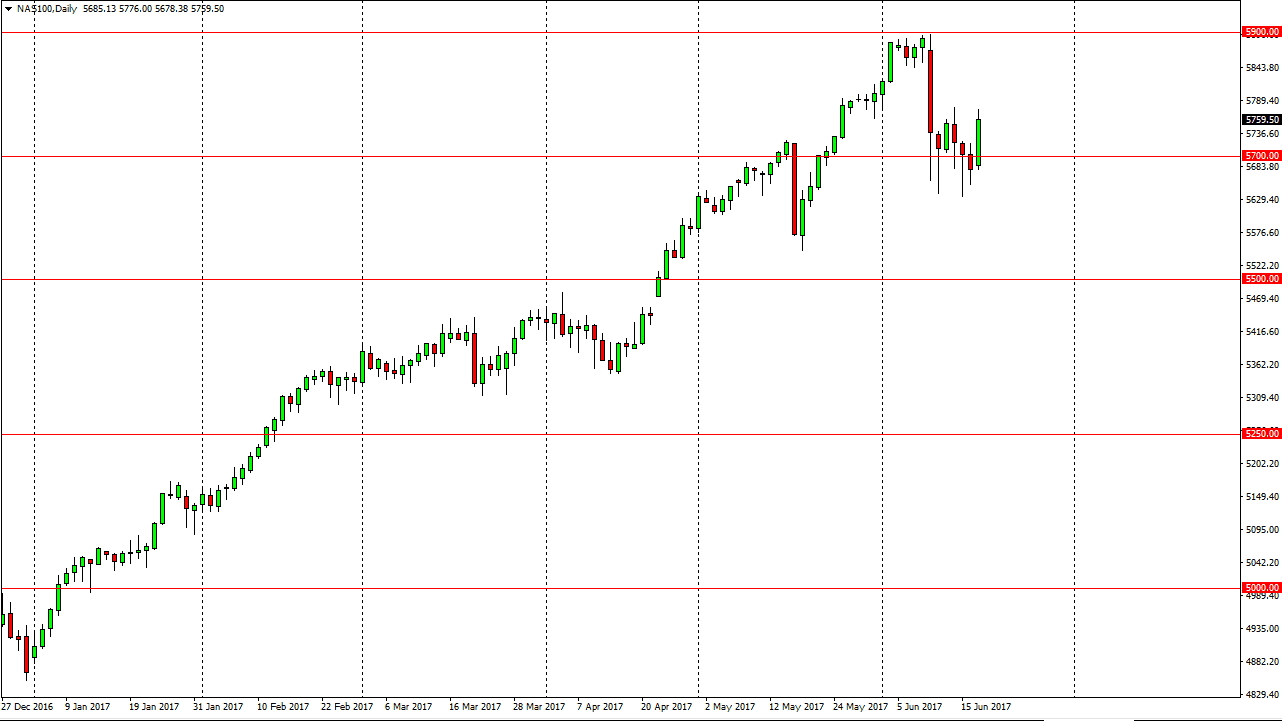

NASDAQ 100

The NASDAQ 100 continues to strengthen as well, as most of the selloff was due to a handful of stocks. We have gotten a bit of stability at the 5700 level, so I feel it’s only matter of time before the markets feel comfortable enough to start buying again. I believe that we will then go to the 5900 level, and then eventually the 6000 level over the longer-term. I believe dips continue to be buying opportunities and I believe that although technology has more or less taken a backseat, the reality is that it should continue to go higher, right along with the rest of the US indices that have seen so much in the way of bullish pressure. I think that it might be choppy, but at the end of the day you certainly can’t go against US indices as we continue to find 20 of reason to think that the market participants are looking to pick up value.