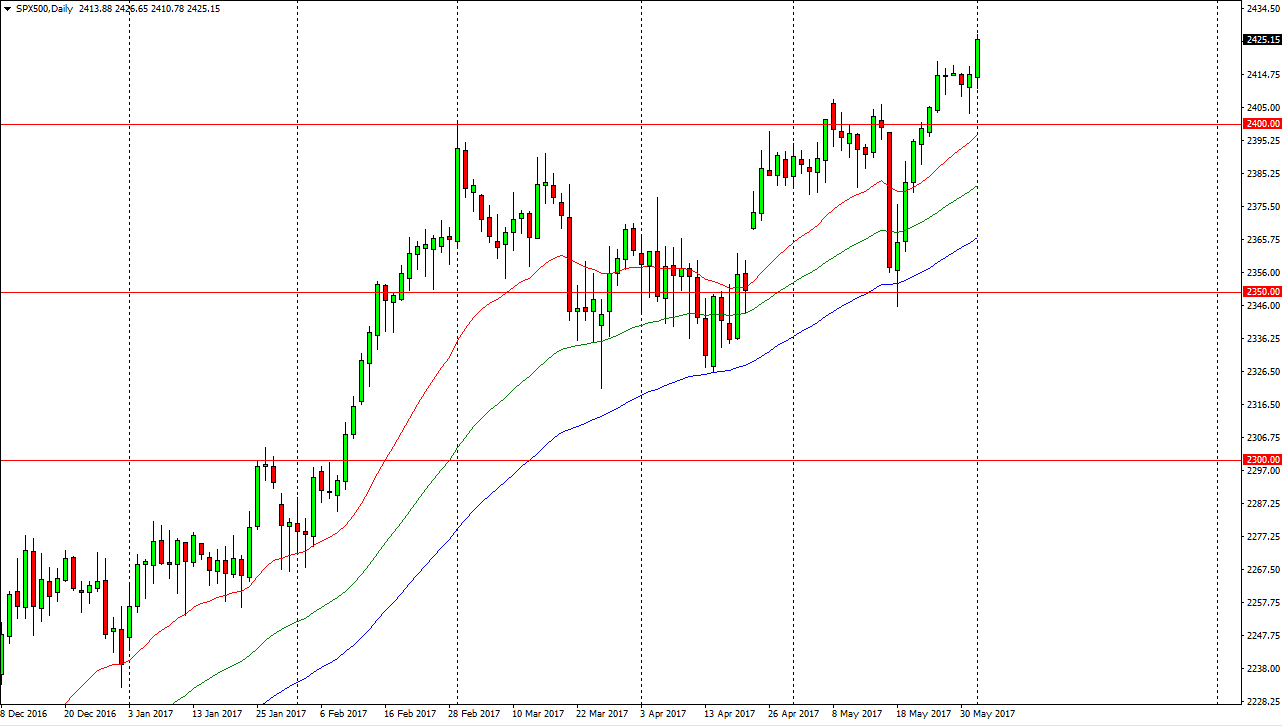

S&P 500

The S&P 500 broke out to the upside during the session on Thursday, making fresh, new highs. We have the jobs number coming out today though, so that could cause a bit of volatility and therefore pullbacks may happen. This pullback should be buying opportunities though, so I think it’s only a matter of time before the buyers would get involved and I believe that the 2400 level underneath should offer a bit of a “floor” in this market. I have a target of 2450, and then eventually 2500 after that. The S&P 500 is not a market that I wish to sell, and the lower it gets, the more interest I have been trying to find value in a market that should continue to offer nice buying opportunities over the longer term.

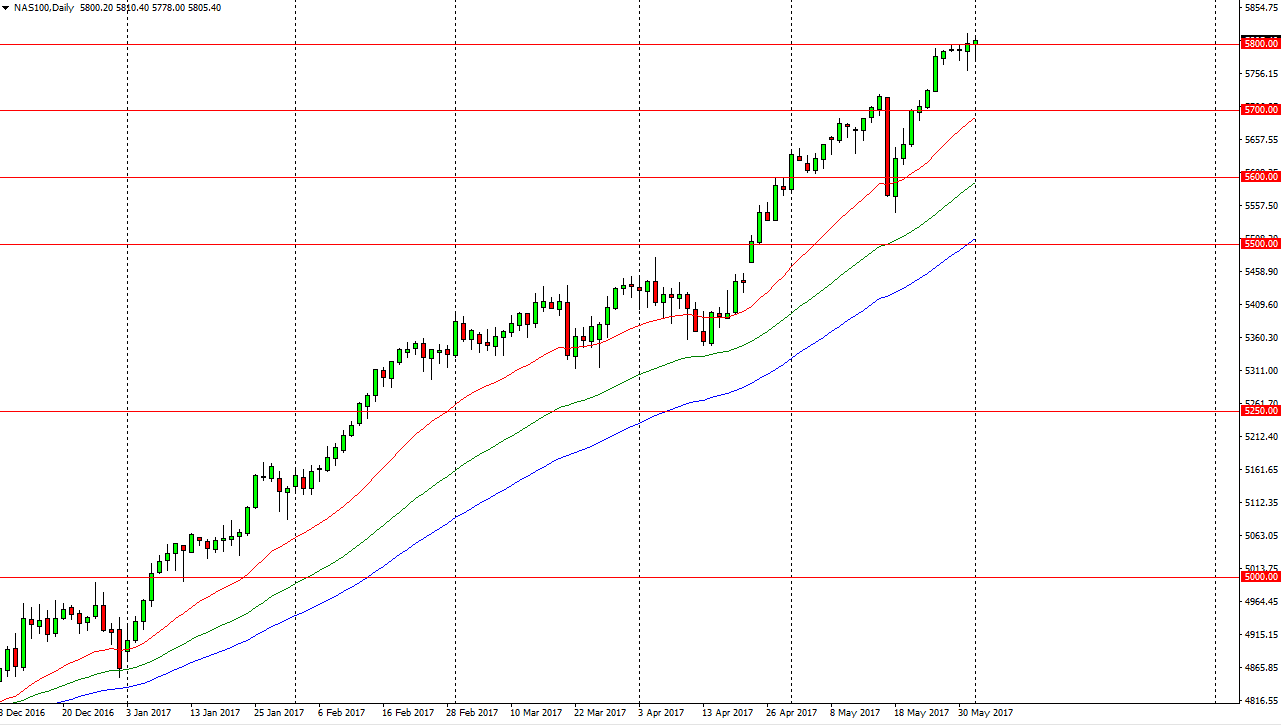

NASDAQ 100

The NASDAQ 100 has been volatile on Thursday as well, but just as the S&P 500 saw selling initially, we also saw the buyers come back to this market later in the day. It appears that the Americans are still very bullish as most of the buying pressure happened after the Europeans went home from work. I believe that the market is going to reach towards the 5900 level above, and then eventually the 6000 level. I have no interest in shorting this market, and has lead the rest of the stock indices in the United States, so if I were to short US stocks at all, it would not be in this index. This index should continue to be buying opportunities upon buying opportunities every time we pull back. I think that 6000 is far too juicy of a target for traders to ignore, and I feel that unless something massive happens, we will see this market continue to reach for it.