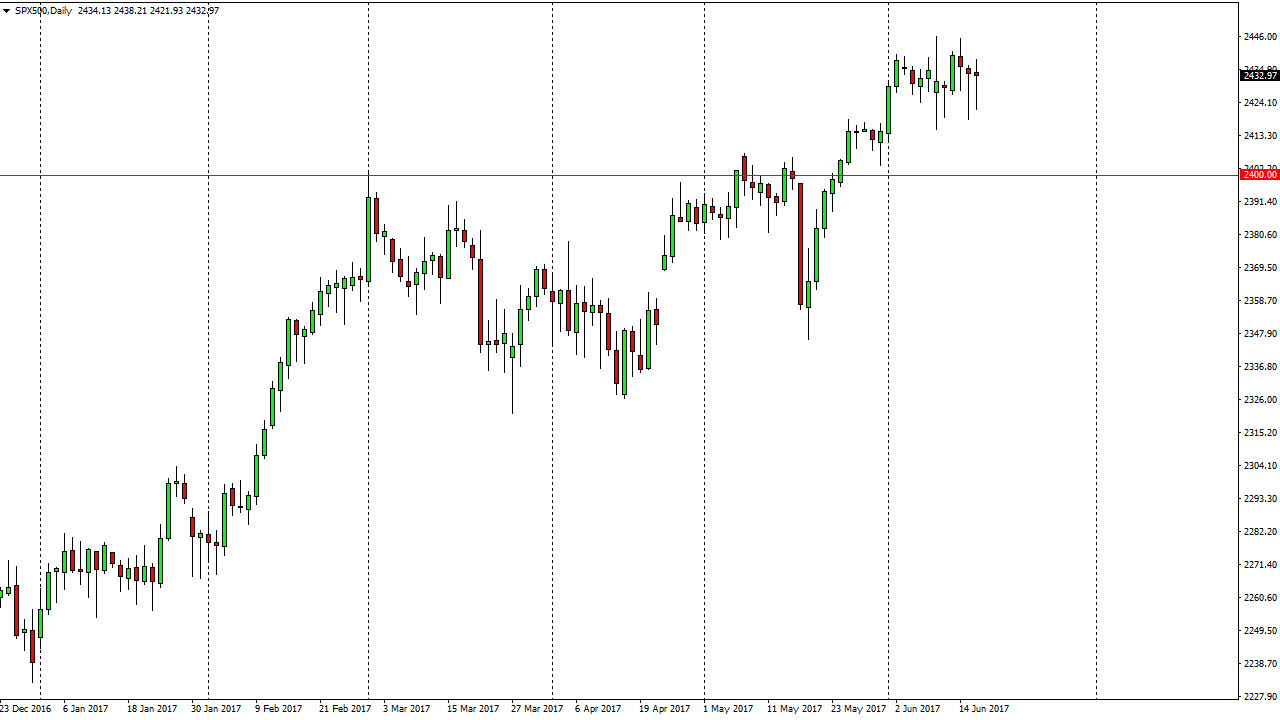

S&P 500

The S&P 500 initially fell during the day on Friday, but turned around to show support yet again as we form yet another hammer. The hammer is a bullish opportunity as far as I can see, and I believe in buying dips as the market looks as if it is ready to go higher. I think the 2400 level underneath is going to be a bit of a “floor” in the market, and because of this I think that buying on the dips continues to be a buying opportunity for those that are willing to be patient. The market should then go to the 2450 handle, and then eventually the 2500 level after that. Ultimately, we may see some volatility but I still believe in the longer-term uptrend.

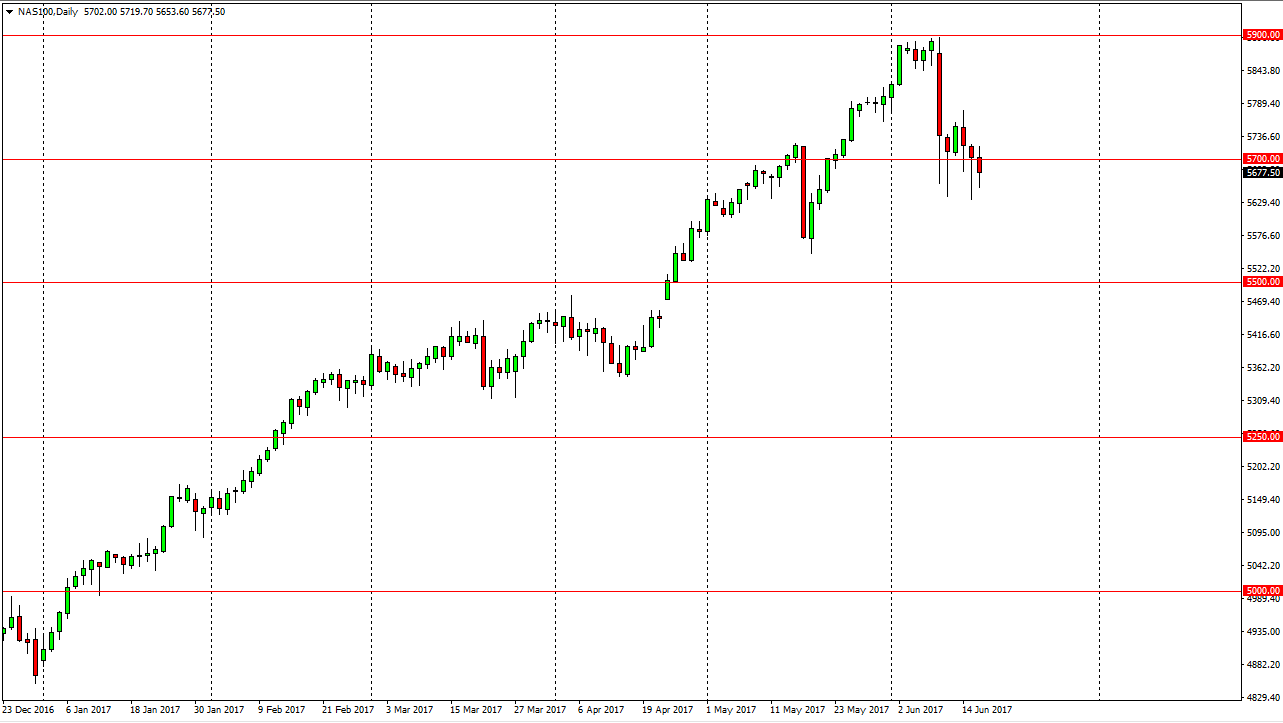

NASDAQ 100

The NASDAQ 100 fell a bit during the day, but continues to find support just below. I think that the market will eventually go looking towards the 5900 level above, and then possibly the 6000 level after that. I don’t have any interest in shorting the NASDAQ 100 although it is a lot less bullish than the S&P 500 in the short-term, longer-term, the NASDAQ 100 has been a leader for several months and should eventually attract more attention. The 5500 level underneath should continue to be massively supportive, and because of this I think that the market should find buyers every time it falls, and the longer-term trader out there may be willing to take advantage of a “buy-and-hold” type of mentality that seems to permeate this market in general. Given enough time, profits are to be made to the upside in this market and because of this I will not be selling the NASDAQ 100 in the foreseeable future and believe that not only will we reach towards 6000, but we may break while above there.