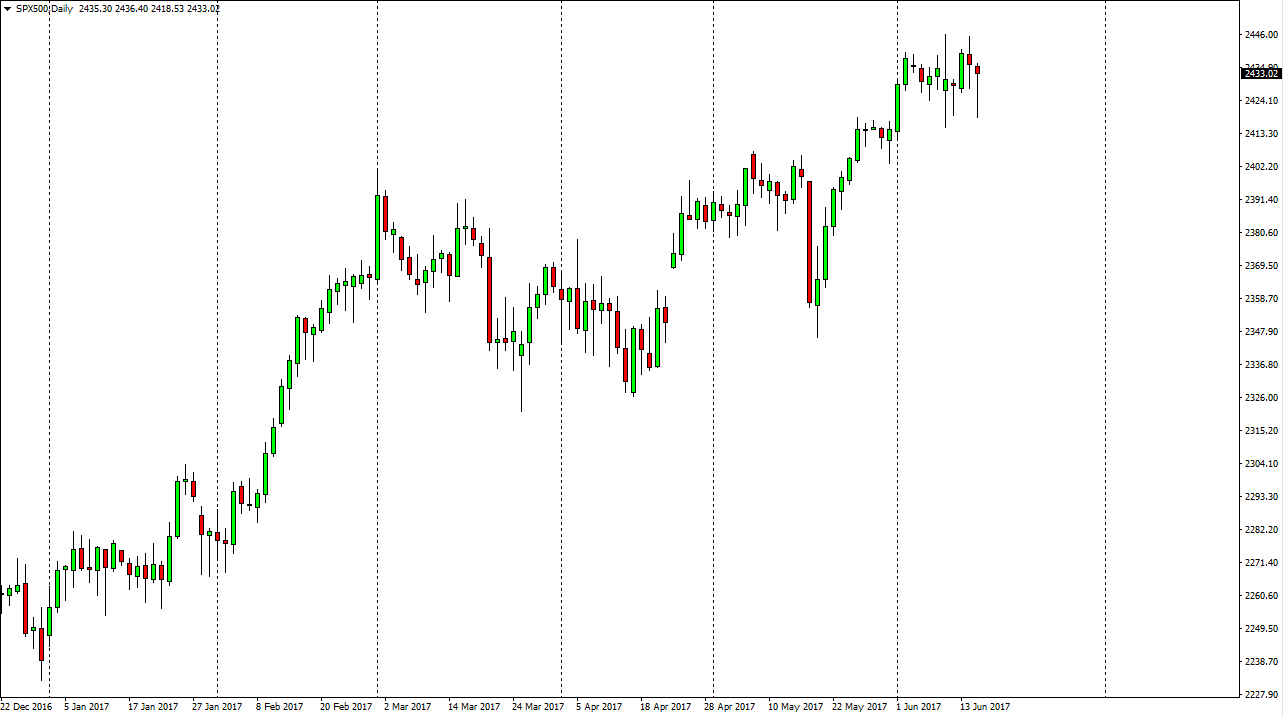

S&P 500

The S&P 500 fell during the day on Thursday, but found enough support underneath to turn things around to form a hammer. The hammer is a very bullish sign, and the market looks very likely to continue going to the upside. We have been in an uptrend for some time, and I believe that the value hunters are still out there looking to take advantage of this market as it is so bullish longer-term. I think that the reason pullback is simply more consolidation in order to build up momentum. Given enough time, I still believe that this market reaches towards the 2500 level, which is my longer-term target. I recognize it may take some time to get above there as it is such a momentous number, but I think a couple of attempts will be made and then eventually the longer-term uptrend continues. I have no interest in selling and believe that the 2400 level remains the “floor.”

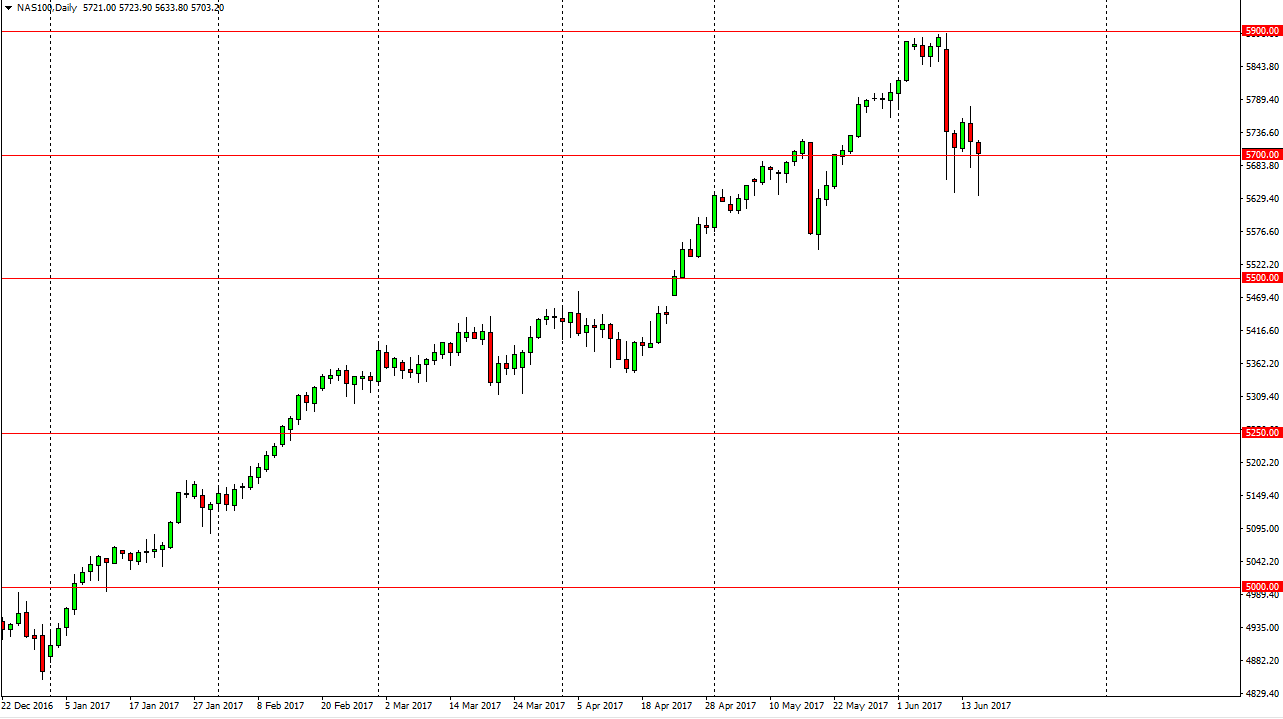

NASDAQ 100

The NASDAQ 100 fell again during the day on Thursday but also on Thursday found enough support underneath the 5700 level to turn things around to form a nice-looking hammer on the daily chart. To break above the top of a hammer should send this market higher, as the NASDAQ 100 continues to look like it is trying to build up enough momentum to continue the longer-term uptrend after the vicious selloff during sector rotation last week. I believe this is a temporary problem, and that the NASDAQ 100 will continue to find buyers based upon longer-term “buy-and-hold” strategies. I still believe that we go looking for the 6000 level, but we may have a few bumps along the way. The 5900 level is obviously a source of resistance, so we may have to take a couple of attempts to finally clear it.