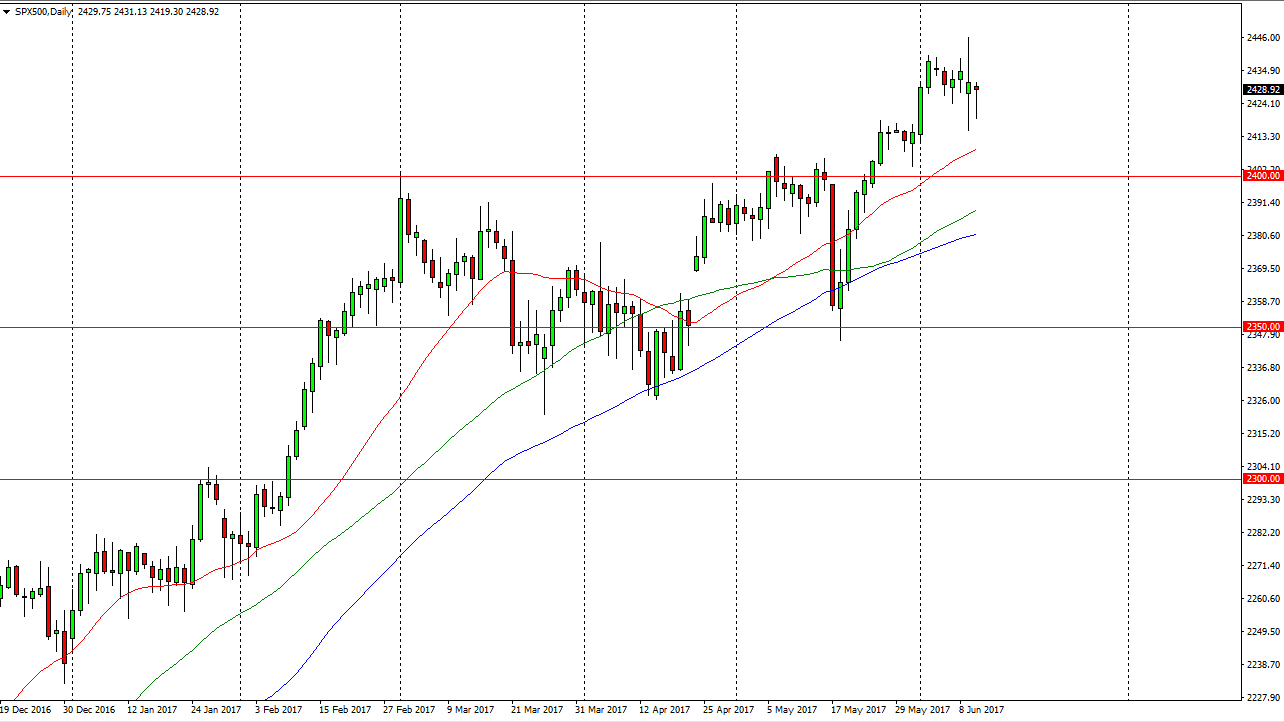

S&P 500

The S&P 500 had a very volatile session on Monday, but ultimately bounced enough to form a hammer. The hammer of course is a bullish sign, and I think that it’s only a matter of time before the S&P 500 should continue to go higher. The 2425 level offered support, and I believe that we are going towards the 2500 level over the longer term. The market should show quite a bit of volatility in this area, but I still believe that the buyers are going to continue to come back into the market and push to the upside. I believe that the 2400 level underneath continues to offer a floor, which should be very supportive for the longer-term uptrend. The 2500 level above is a large, round, psychologically significant number, and could offer quite a bit of bearish pressure.

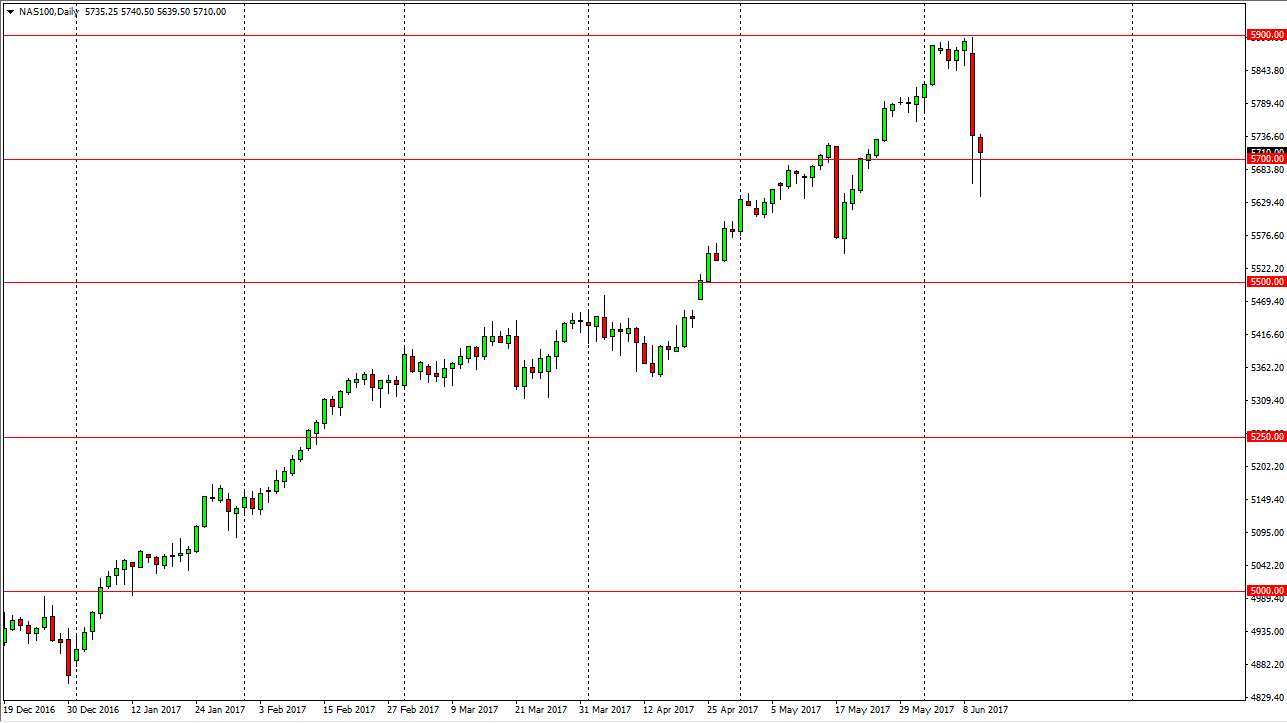

NASDAQ 100

The NASDAQ 100 had a very interesting day, initially filling below the 5700 level but turned around by the end of the day to form a nice-looking hammer. The hammer is right where you would want to see it to continue the longer-term uptrend, so a break above the top of the range for the day should send this market looking for the 5900 level. A break above there should then send the market to the 6000 handle. I believe the pullbacks going forward should be buying opportunities, and I have no interest in selling. I believe that a lot of people will now look at this as an opportunity to pick up value going forward. A breakdown below the bottom of the range would be a very strong signal to start selling, but at this point I think that the damage has already been done, and that value hunters are going to come jumping into this market and eventually send us towards the highs yet again.