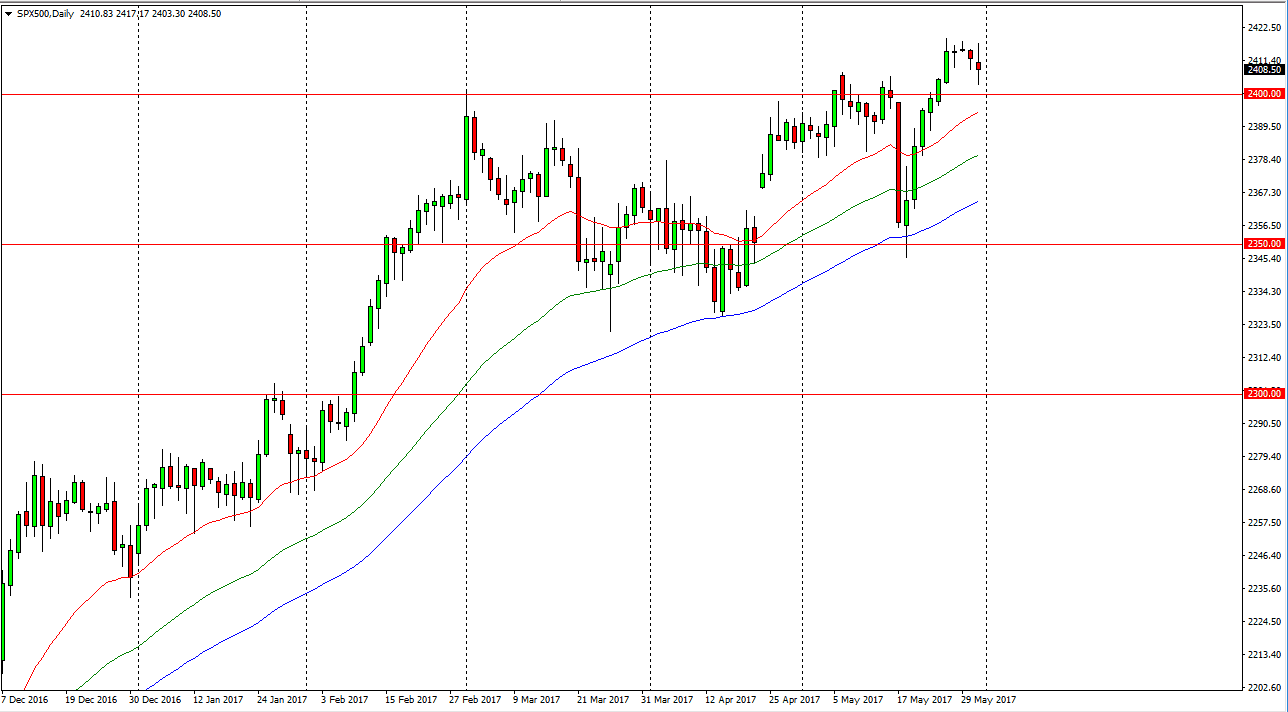

S&P 500

The S&P 500 went back and forth during the Wednesday session, as we continue to see volatility after a significant break out. I believe that breaking above the 2400 level was a very significant sign, so I think it’s only a matter of time before the buyers get involved. I think the 2500 level is a nice large round number for the market to chase, and that this pullback will present itself as value to most traders. Traders will continue to look at the S&P 500 as a positive index, just as they have most other indices that we follow here at Daily Forex. I believe that short-term pullbacks offer indices into the market that you can take advantage of.

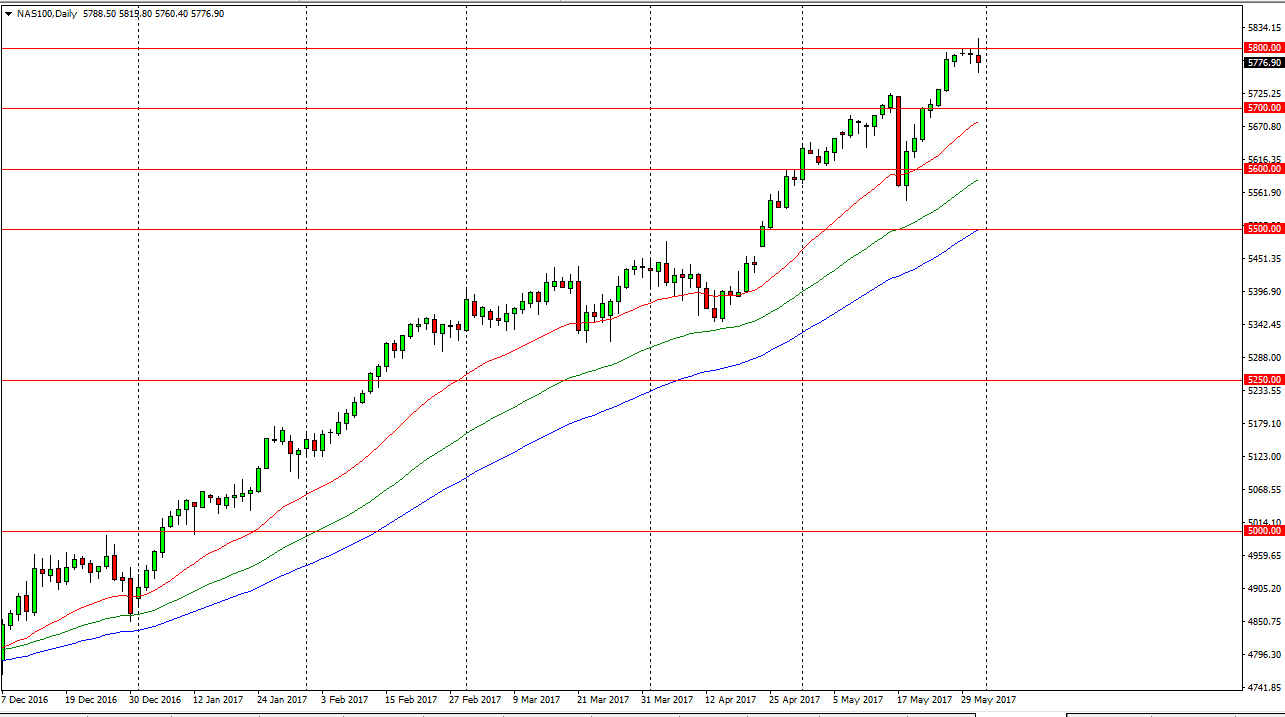

NASDAQ 100

The NASDAQ 100 has lead the way for all other indices, and even managed to break above the 5800 level during the session on Wednesday. However, we turned around and it looks somewhat stagnant. I think a short-term pullback is probably going to be a nice buying opportunity, as the markets will look for momentum and volume 2 continue the longer-term grind to the upside. I have no interest in shorting, I believe the market will eventually look towards the 5900 level above, and then possibly the 6000 level after that. I think the 5700 level below is going to be massively supportive as the longer-term uptrend has been so reliable in this market. You can probably use the NASDAQ 100 as a barometer for other indices, as it has continued to push this market to the upside, dragging the rest of the indices and not only the United States but Europe right behind it. Ultimately, this is a market that cannot be sold and continues to offer a lot of bullish pressure going forward.