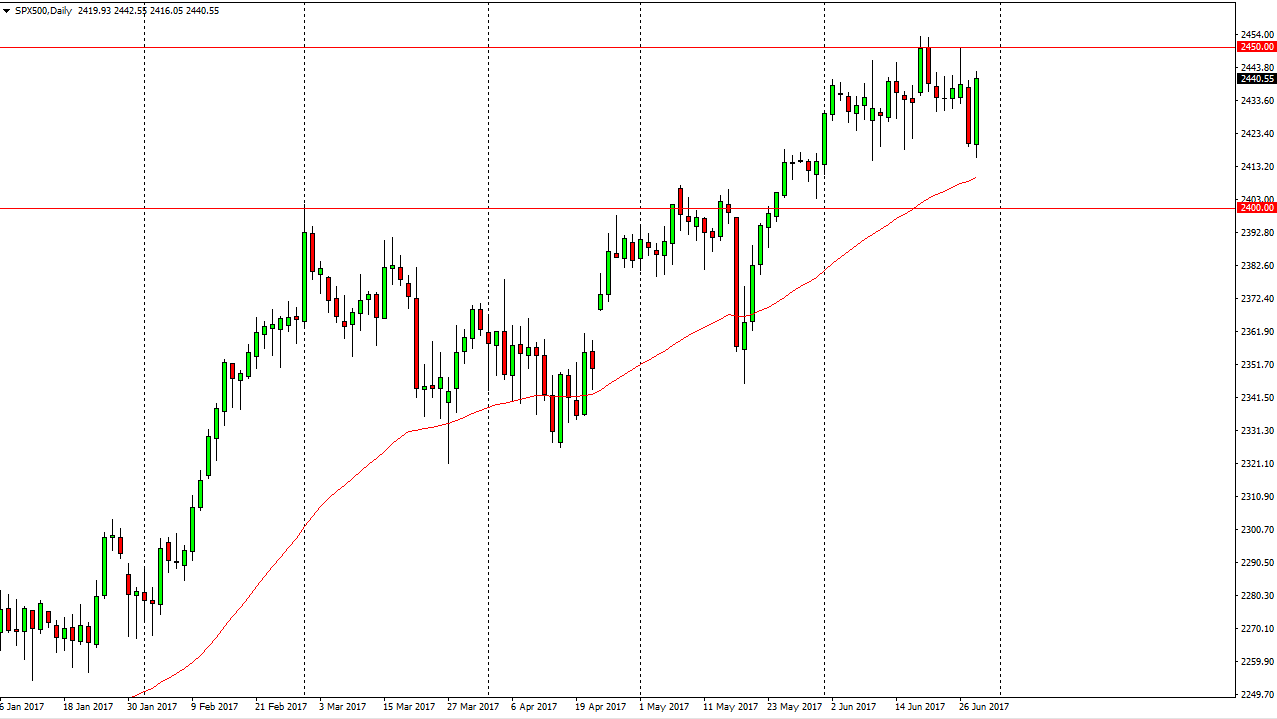

S&P 500

The S&P 500 rallied significantly during the day on Wednesday, reaching towards the 2440 handle. The 2450 level above should continue to be resistance, so I think that breaking above that level will be a very bullish sign. In the meantime, I suspect that the markets are going to try to do that though, so short-term we should rally. If we do break above that level, then I think we go to the 2500 level which is a large, round, psychologically significant number. Pullbacks continue to be buying opportunities, and I believe that the rally shows just how much bullish pressure there is in the market longer term.

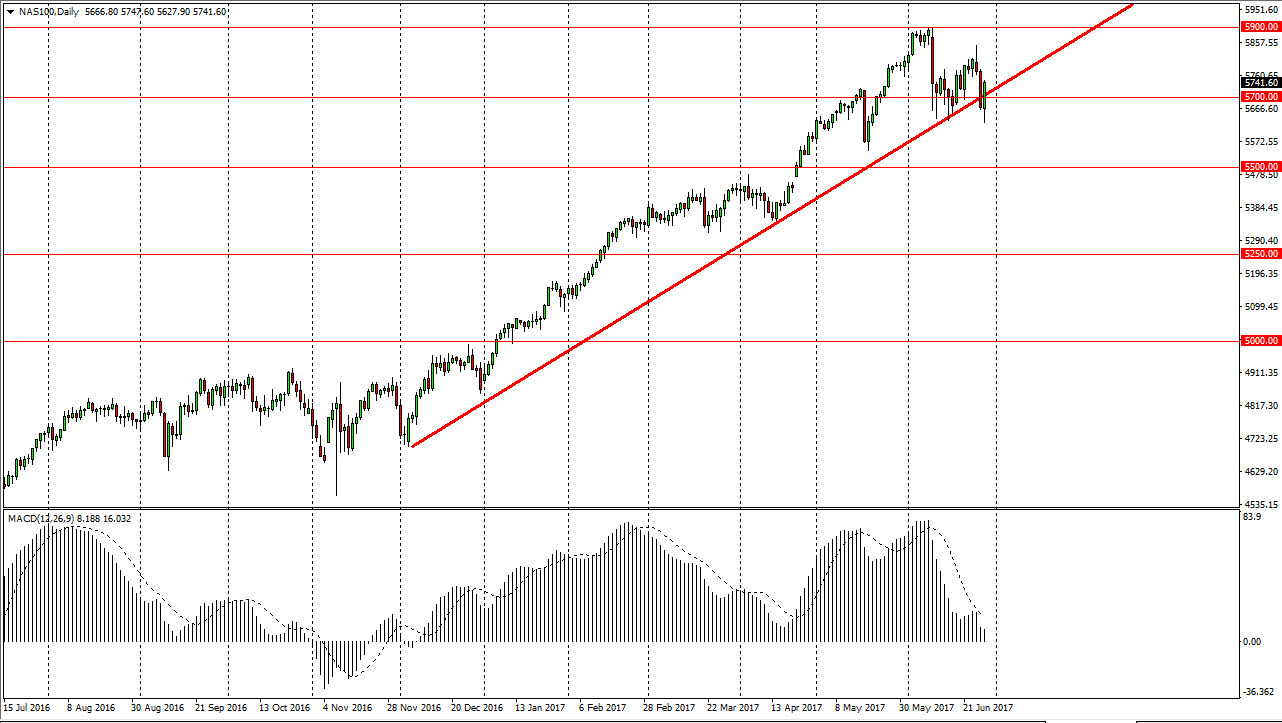

NASDAQ 100

The NASDAQ 100 fell initially during the day but turned around to form a very bullish candle. This saved of the uptrend for the short-term, as we are sitting on top of an uptrend line. Ultimately, I think we’re going to try to grind to the 5900 level but if we were to break down below the bottom of the range for the session on Wednesday, that would be an extraordinarily bearish sign. This market continues to be very volatile, but I think that most traders are of the uptrend variety, and I believe that we will probably see quite a bit of choppiness. If we did break above the 5900 level, then we go to my longer-term target of 6000. If we were to breakdown, this is a very negative sign, and it should send the market down to the 5500 handle. One thing that I think will continue to offer opportunity is short-term pullbacks. If you are a back and forth type of traitor, this might be a nice opportunity just waiting to happen. I believe that the stock markets overall are looking for reason to rally.