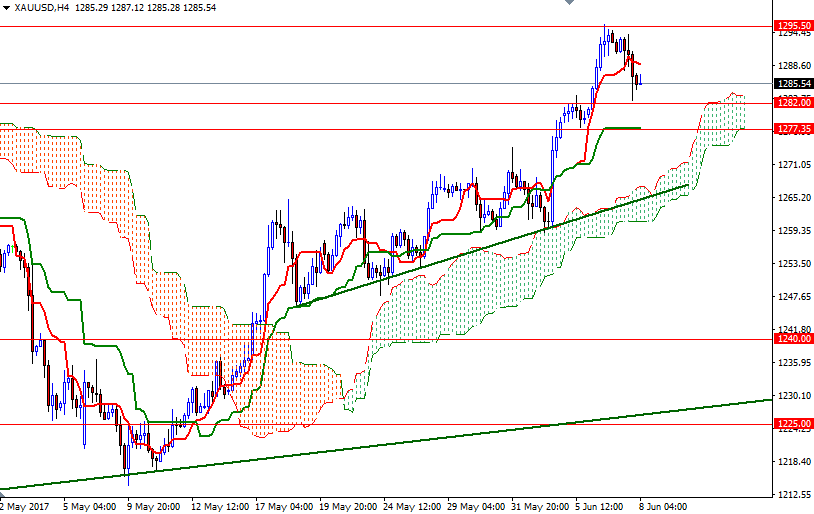

Gold prices ended Wednesday’s session down 0.6%, or $7.74, to settle at $1286.66 an ounce as investors took profits from a recent rally that pushed the market to the highest level in seven months. The major U.S. stock indexes were mostly higher, and gains in stocks dented investors’ appetite for the precious metal. The XAU/USD pair was not able to hold above the support in the $1288-$1286.40 area and as a result, prices returned to the $1282 level.

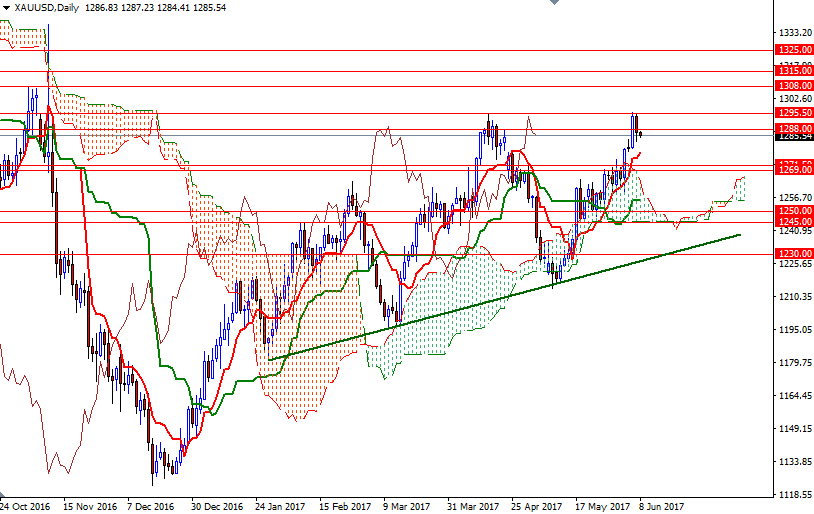

The market is trading above the Ichimoku clouds on the weekly, daily and 4-hourly charts, suggesting that the bulls have the medium-term technical advantage. In addition to that, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are positively aligned, and the Chikou-span (closing price plotted 26 periods behind, brown line) is above prices.

If the support at around 1282 remains intact, expect a push up towards the 1288 level. The top of the Ichimoku cloud sits at 1289.10, so we need to climb back above there to gather momentum for 1295.50, which is the first solid resistance on the charts. A successful breach of this key level would attract new buying, and would force shorts to cover their positions. In that case, the bulls will be targeting 1300 and 1308/4. A failure, however, could result in renewed liquidations. Breaking below the supportive 1282 level could see a fall to 1277.35-1276, where the Kijun-Sen resides on the H4 chart. If XAU/USD pierces below there, prices will tend to head back to the 1269/8 area.