Gold prices ended Wednesday’s session down $5.24 an ounce as the dollar climbed in the wake of an FOMC statement and Fed Chair Janet Yellen’s press conference. The XAU/USD pair rallied earlier and traded as high as $1280.46 after retail sales recorded their biggest drop in 16 months and the Labor Department said its consumer price index dipped 0.1% in May, but fell sharply following the Federal Reserve’s statement. Prices hit the lowest price since May 26, before recovering slightly to the $1266 level.

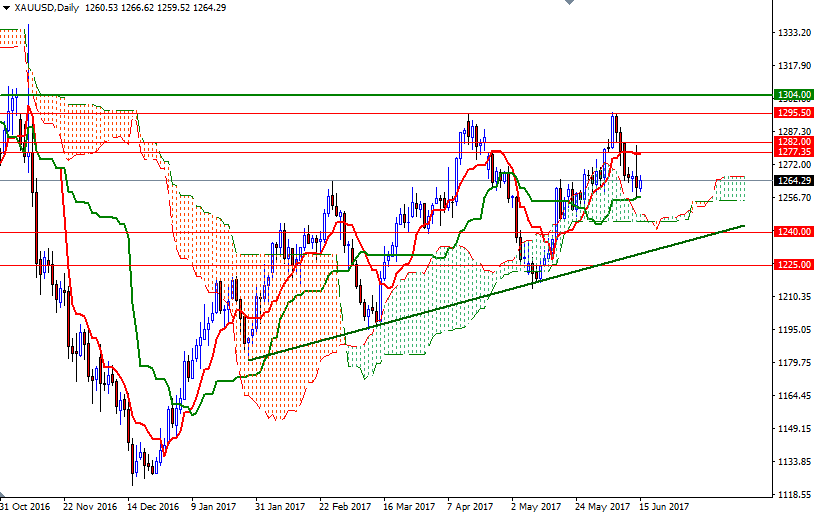

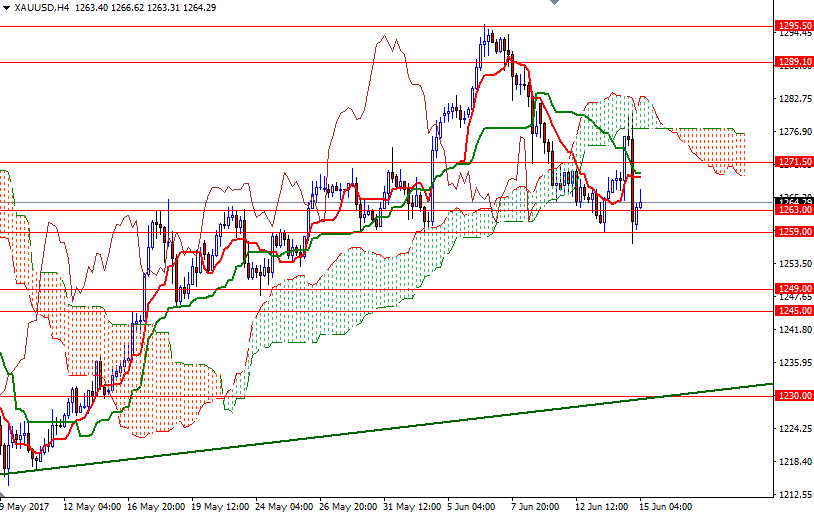

Fed Chair Yellen emphasized she is not worried about low inflation creating economic problems. It seems that the U.S. central bank will hike rates again in September and start unwinding its balance sheet in December. XAU/USD is currently wondering around the 1263 level as the market continues to digest yesterday’s monetary policy announcement from the Federal Reserve. From a chart perspective, trading below the 4-hourly Ichimoku cloud suggests that gold prices are vulnerable to the downside in the short-term. Negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines and the tall upper shadow of the daily candle also point in the same direction.

However, the market was not able to close below the 1260/59 area, and I think that support will play an important role. If the market convincingly drops through 1260/59, look for further downside with 1254.50 and 1250.70-1249 as targets. To the upside, the 1271.50-1269 area stands out as the initial barrier. The bulls will need to push prices beyond there if they intend to make a fresh move to penetrate the Ichimoku cloud on the H4 chart. A sustained break above 1283/2 would imply that the 1289.10-1288 zone might be the next port of call.