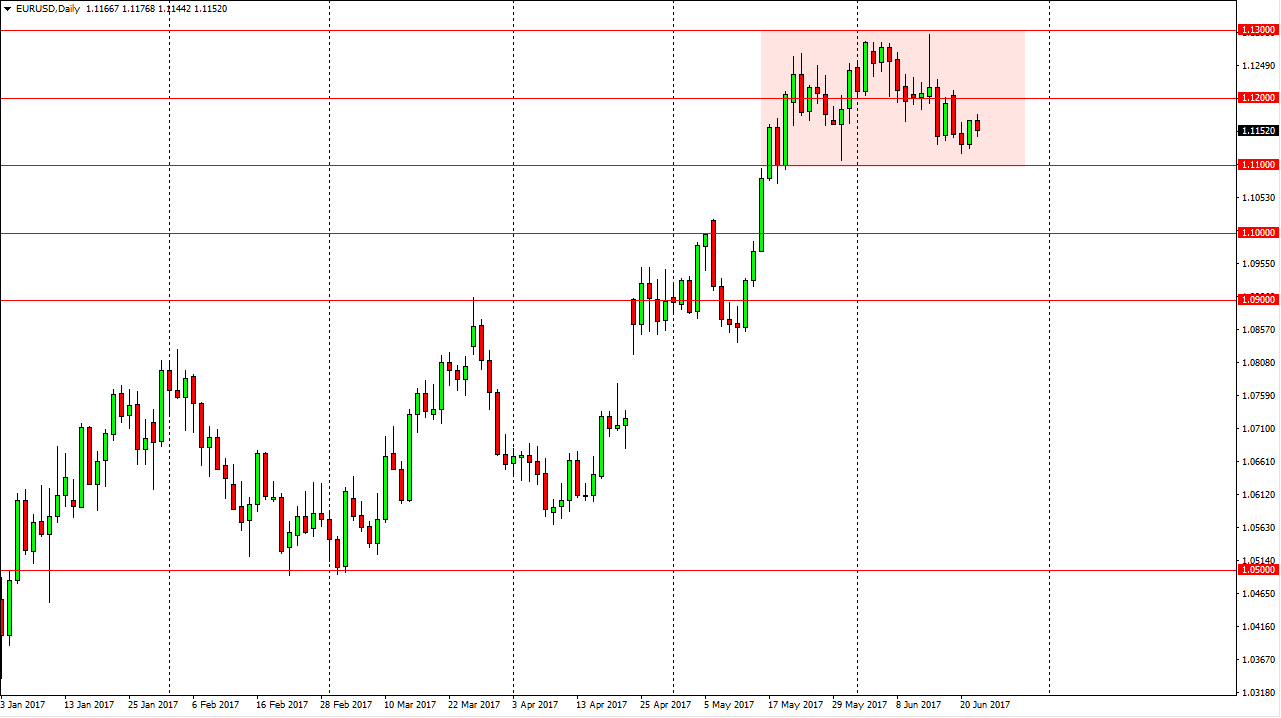

EUR/USD

The EUR/USD pair rolled over slightly during the day on Thursday, as we continue to see the 1.12 level offer resistance. However, I think that the 1.11 level will also offer a significant amount of support, so pay attention to that area down there. Ultimately, the market should find buyers, and I look at pullbacks as potential buying opportunities. However, if we break down below the 1.11 level, the market should then go looking for the 1.10 level under that. Because of this, short-term pullbacks look to me as if they are offering value. I know that most pundits are starting to pay attention to the European Union, and all the positive news coming out of that area. Yes, there are interest rates coming out of the United States but the market already knows this.

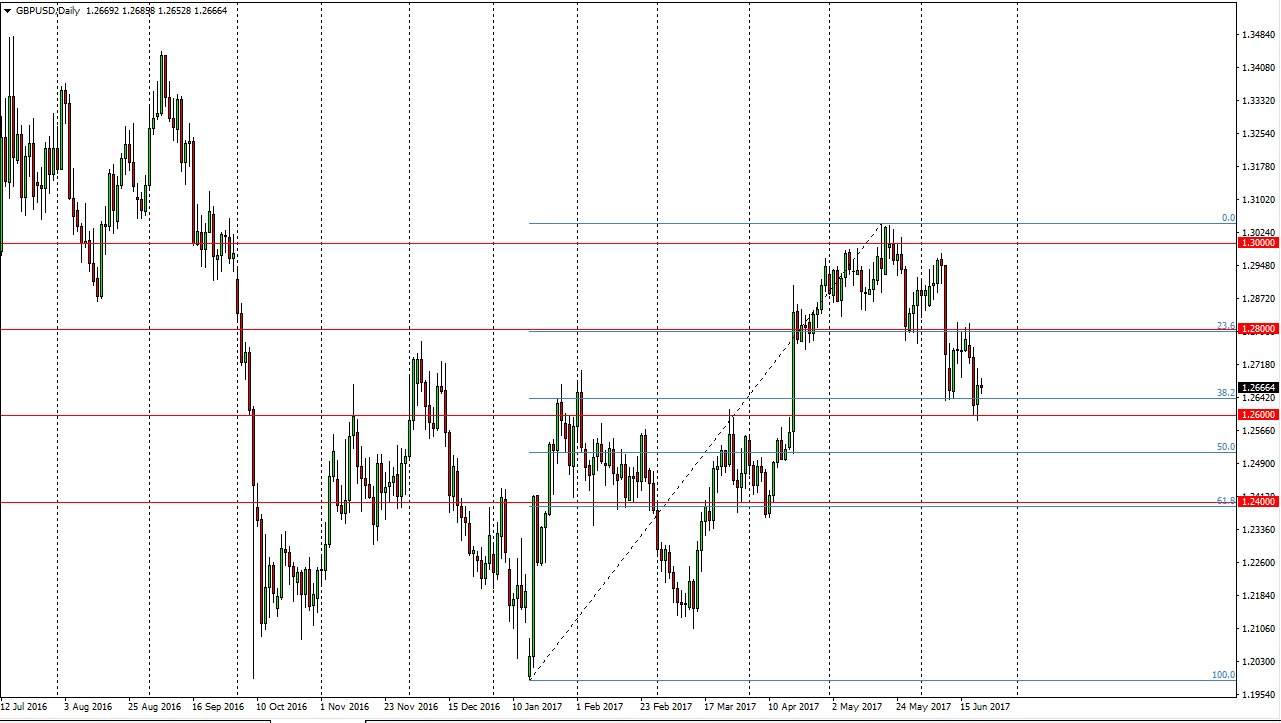

GBP/USD

The British pound had a quiet session on Thursday as we continue to see the 1.26 level for support. I believe that the 38.2% Fibonacci retracement level has of course offered a significant amount of support, and ultimately, we could bounce to the 1.28 level. If we did breakdown below the 1.26 level, the market probably goes looking for the 50% Fibonacci retracement level, which is closer to the 1.25 level. Of course, there is a lot of concern when it comes to the United Kingdom and the divorce talks with the European Union, so headlights could come across at any time that rock the market. I believe that the longer-term trend is starting to change, and therefore I like buying this pair on signs of strength, and of course pullbacks that show signs of support.

We already know that the Federal Reserve is looking to raise interest rates, so that shouldn’t be much of an issue going forward. I believe that the market continues to offer opportunity for those who are more long-term inclined.