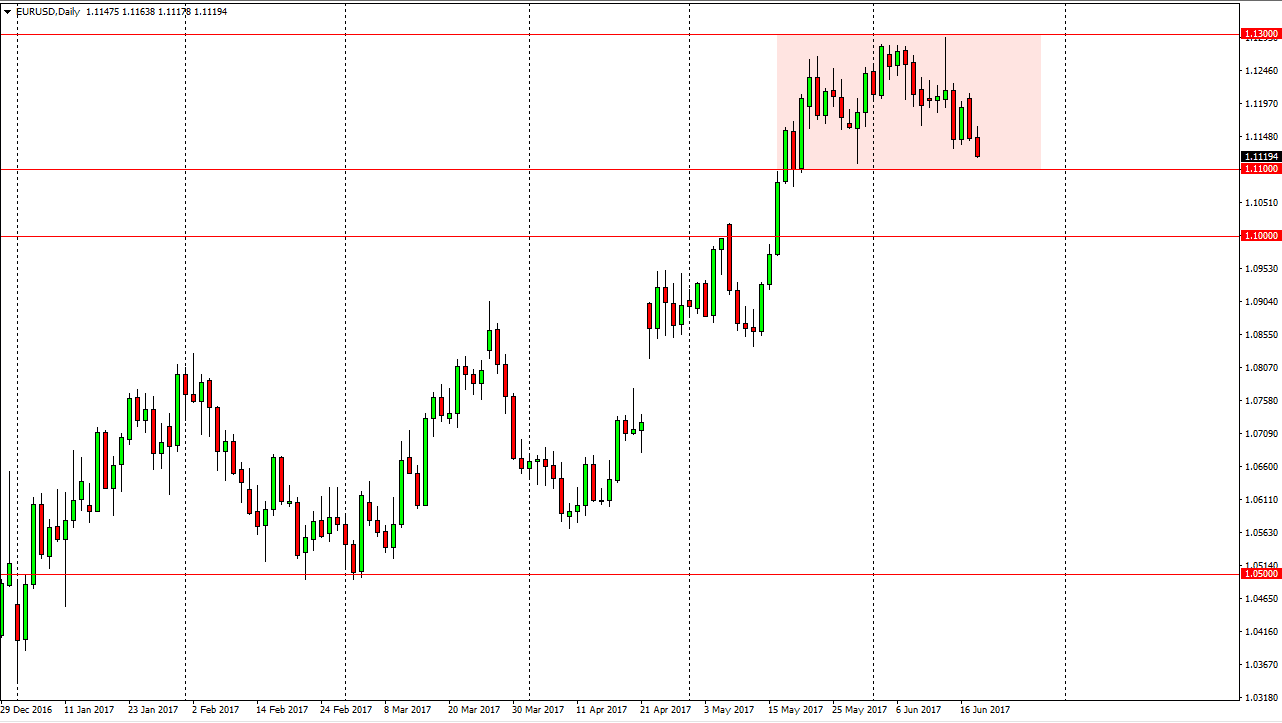

EUR/USD

The EUR/USD pair initially tried to rally, but then rolled over a bit during the day. The 1.11 level underneath should offer support, and I think that if we breakdown below there the market should then go looking towards the 1.10 level after that. Ultimately, I believe that some type of supportive candle could be a sign to start going long, but if we close below that level, the 1.11 handle, the market should then drop to the 1.10 level after that. Remove below there could send this market looking to fill the gap underneath. One thing I think that is going to continue to be an issue is that the lines crossing the wire from the European Union is going to continue to be an absolute mess when it comes to this market. On top of that, we have the Federal Reserve looking likely to raise interest rates over the next year, and that of course puts a lot of volatility into this pair as well.

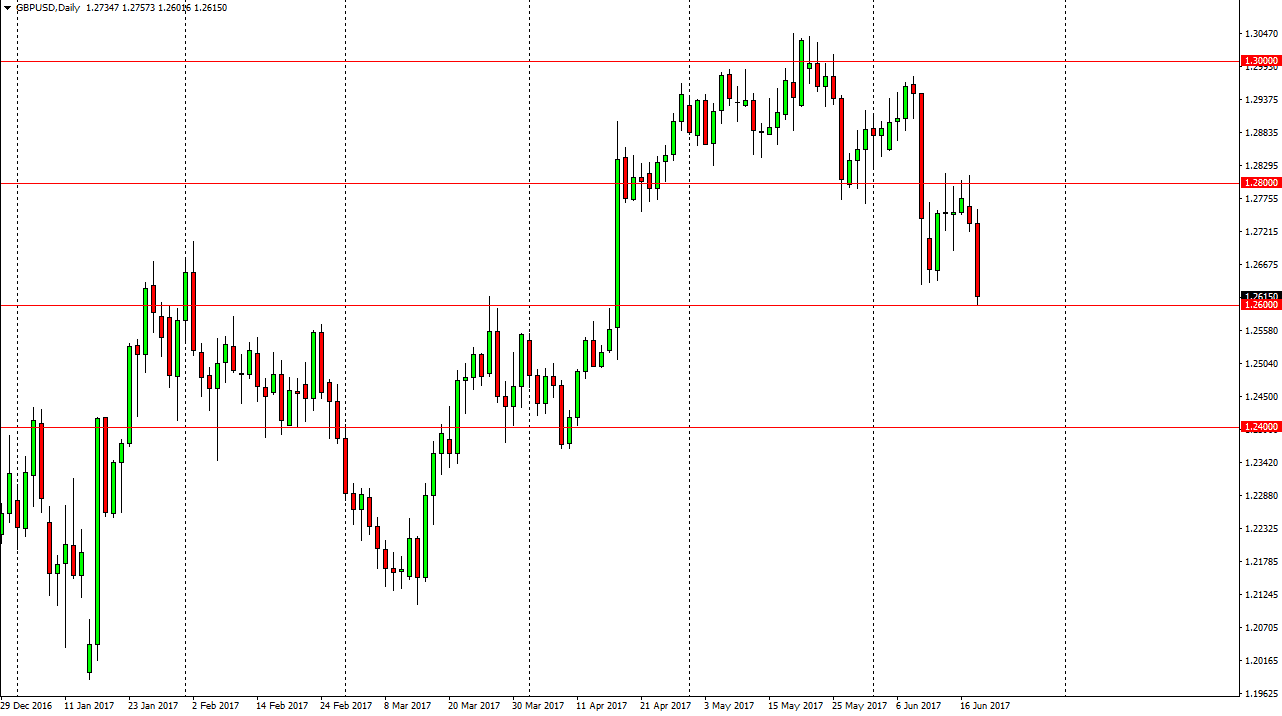

GBP/USD

The British pound fell during the day on Tuesday, testing the 1.26 handle. That’s an area that should be supportive, as it was resistive in the past, but it appears that we are going to try to break down below there. If we do breakdown below the level, I feel that the next obvious spot will be the 1.25 handle, and then eventually the 1.24 level after that. Some type of supportive candle or a bounce in this area could be a buying opportunity, as the market should then reach towards the 1.28 handle.

Ultimately, this is a market that should continue to find reasons to jump around, because of all the headlines coming out above London and Brussels. Starting to look like the 1.26 level will be the “line in the sand” one way or another.