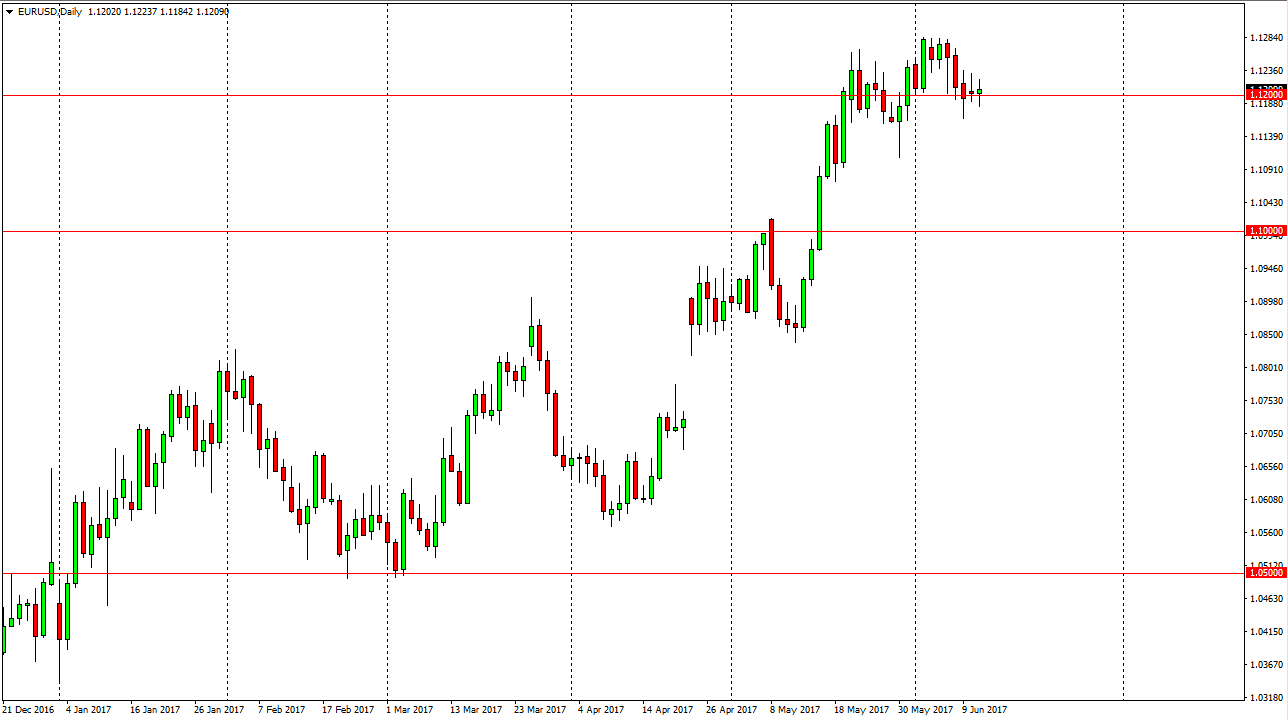

EUR/USD

The EUR had a volatile session during the Tuesday trading hours as the 1.12 level continues to be a magnet for price. This makes quite a bit of sense, with the Federal Reserve releasing a statement after the interest rate announcement during the day of course has taken all the headlines and more importantly, the volume out of the market. I believe that it is probably best to leave this market alone until we get that announcement, and more importantly the reaction. If we do breakdown, I believe that the 1.11 level underneath is massively supportive, and that supportive candles could be buying opportunities because we are still in consolidation over the last 3 years. The 1.15 level above is the top of the overall range of the market, and I believe that we will eventually get there one way or another.

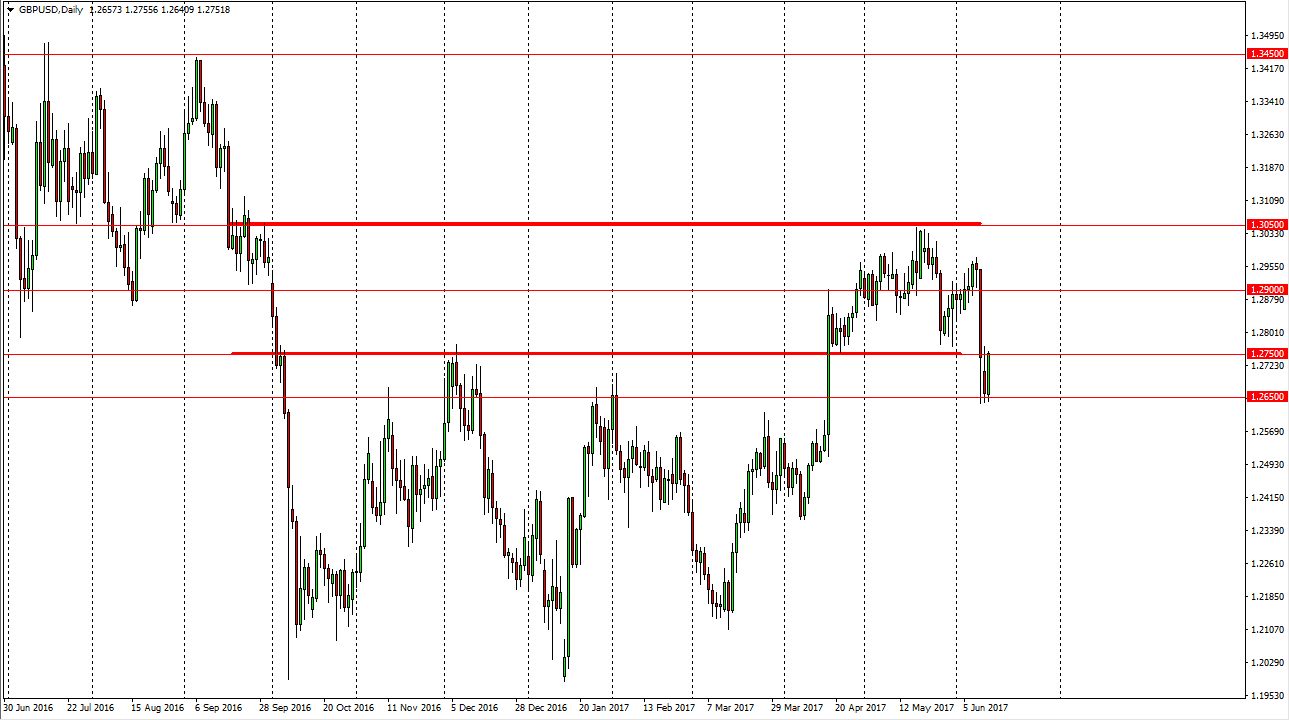

GBP/USD

The British pound bounced during the day on Tuesday, reaching towards the 1.2750 level, an area that was previously supportive. That should now be resistance, but if we can break above the top of the range during the day on Monday, that should send this market looking for the 1.29 handle. That would be a reemergence into the consolidation area that the market has been in for some time, just before breaking down the other day. Alternately, if we break down below the bottom of the 1.2650 level, we would be very bearish all of a sudden. I believe that the interest rate announcement and more importantly, the statement, is what we are going to look towards to see where this market goes next. Pay attention to the reaction, and more importantly the daily close as it will give us an idea as to which direction to trade this market in over the next 24 hours or so.