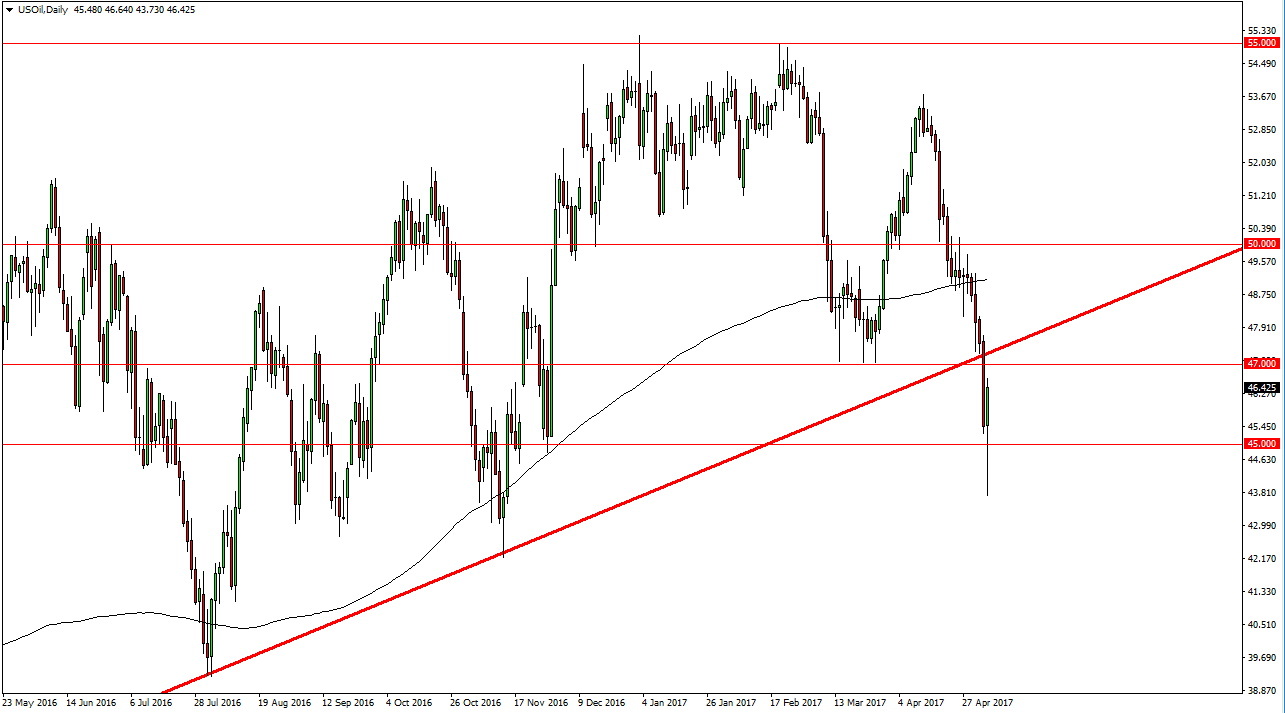

WTI Crude Oil

The WTI Crude Oil market broke down significantly during the session on Friday, slicing through the $45 level. That’s an area that of course caused a bit of support due to the fact that it is a large, round, psychologically significant number, but this had more to do with the jobs number being stronger than anticipated. In theory, this suggests that there should be plenty of demand due to industrial consumption, but quite frankly I think that longer term we still have a lot of issues. The market breaking below the $47 level and of course the uptrend line should continue to offer resistance above, so I’m waiting to see and exhaustive candles that I can start selling. The signs of the candle during the Friday session was impressive, but quite frankly, after that massive breakdown it’s not that surprising that we would get a snap back.

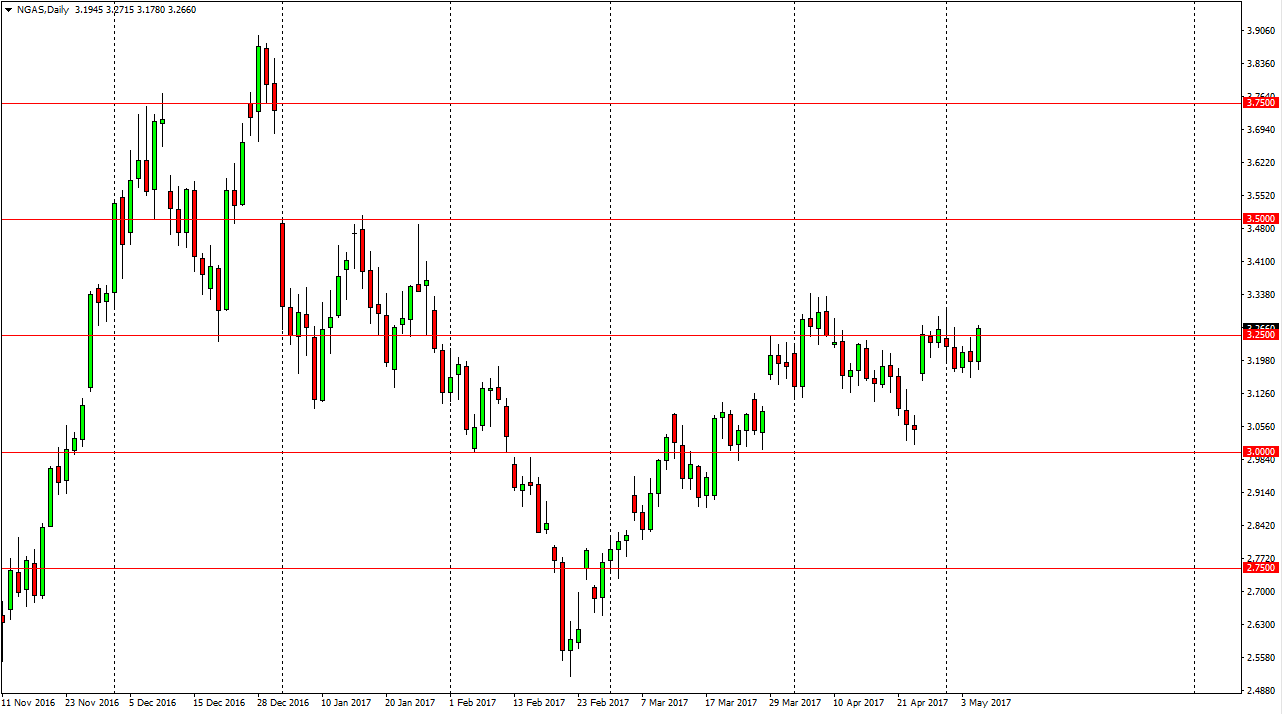

Natural Gas

The natural gas markets had a rally during the Friday session as we continue to consolidate around the $3.25 level. I think the market is going to continue to chop around in general, and as a result of this I prefer to stick to short term trades. All things being equal though, I believe that the buyers have an upper hand, so I would not be surprised to see this market reach towards the $3.33 level above. If we can break above their, then the market can go much higher, perhaps towards the $3.50 level.

The $3.15 level underneath is massively supportive, and I think if we can break down below there, the market will probably go looking for the $3.05 level. After all, the gap has not been filled, and that typically happens sooner or later. Currently though, it looks as if the buyers are in control and it’s difficult to see this market breaking down significantly.