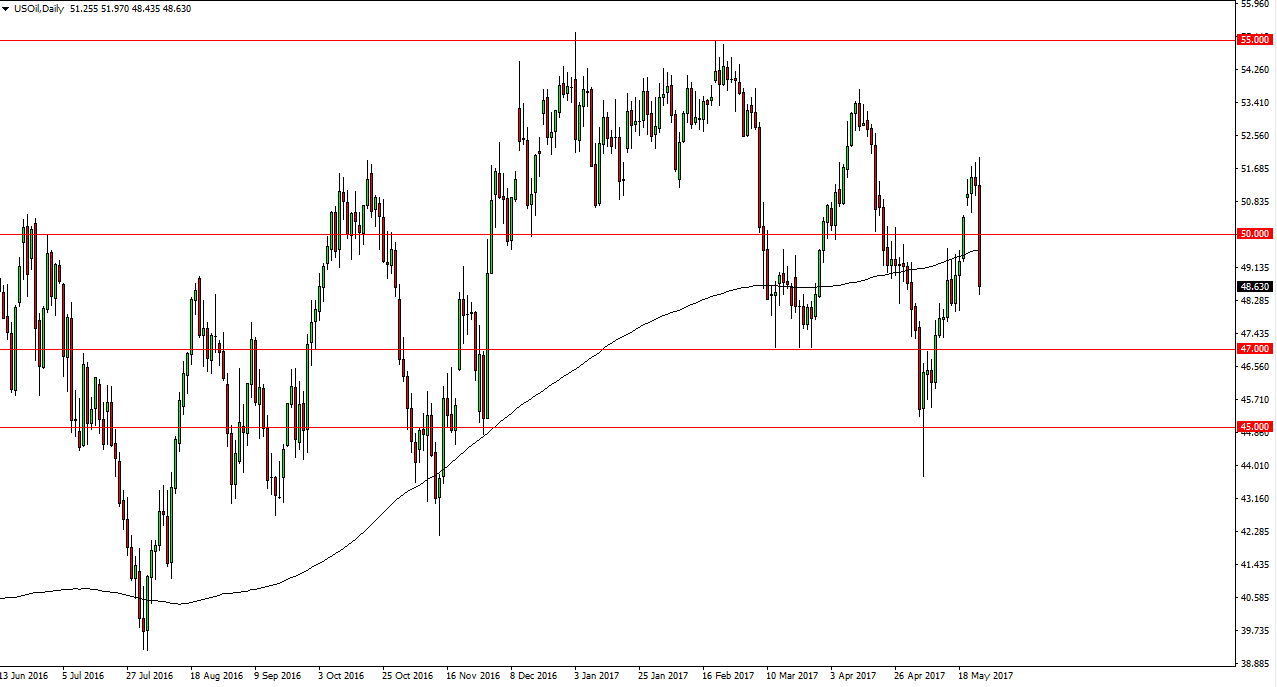

WTI Crude Oil

The WTI Crude Oil market initially tried to rally but after the OPEC announcement of an extension of the production cuts by 9 months, the market sold off. I had suggested that this could possibly be a “sell on the news” type of situation. This is exactly what has happened, and we now find ourselves not only below the $50 level, but below the 200-day exponential moving average. The massive negative candle suggests that we are to continue to see a bit of a muted response to the production cuts, and we could continue to go lower, perhaps towards the $47 handle. Ultimately, I believe that we will see a lot of back and forth trading over the next several sessions, with perhaps the $50 level being a bit of a focal point or even considered to be “fair price” as we go back and forth. However, if we break down below the $47 level, the market should then go down to the $45 level underneath.

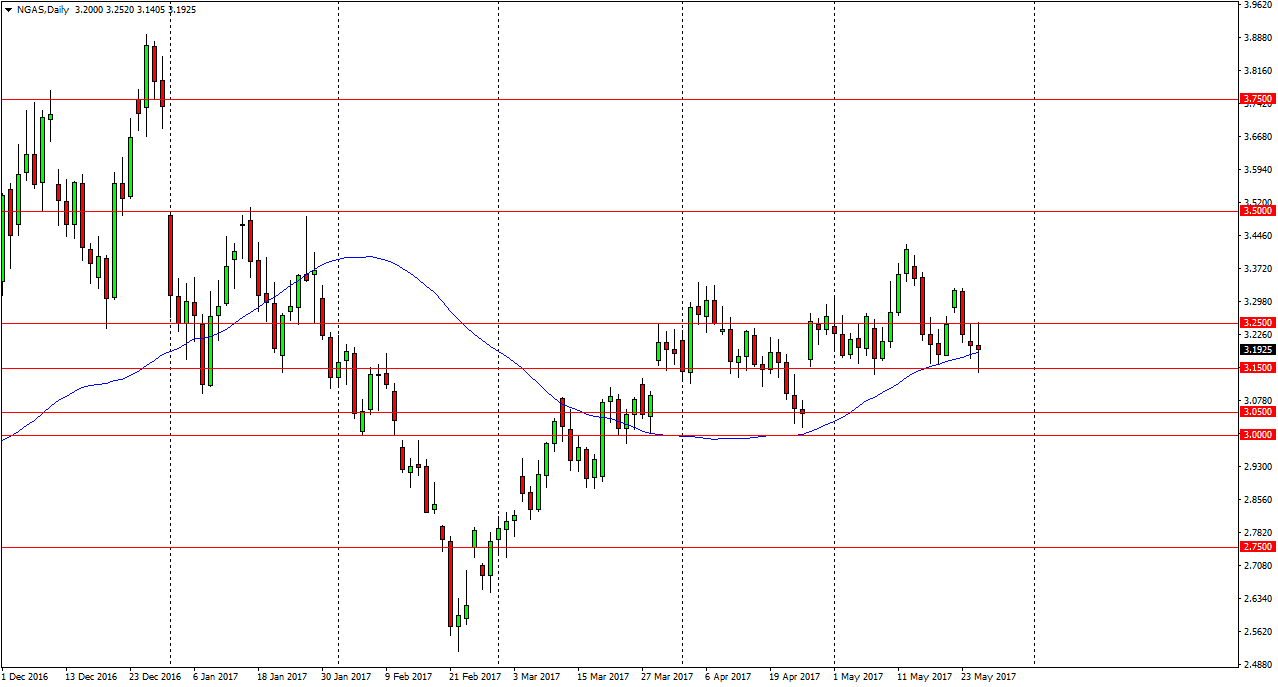

Natural Gas

The natural gas markets went back and forth during the session on Thursday, as the $3.15 level below continues to offer support while the $3.25 level above continues to offer resistance. With this being the case, it’s likely that the market will continue to be very volatile, and it’s not until we break out of this range that I feel comfortable putting any money to work. Above the $3.25 level, the market should then go to the $3.33 level above. Alternately, a breakdown below the $3.15 level should send the market down to the 3.05 level which was the gap that shot the market higher at the end of last month. Ultimately, this is a market that continues to be very short-term focus.