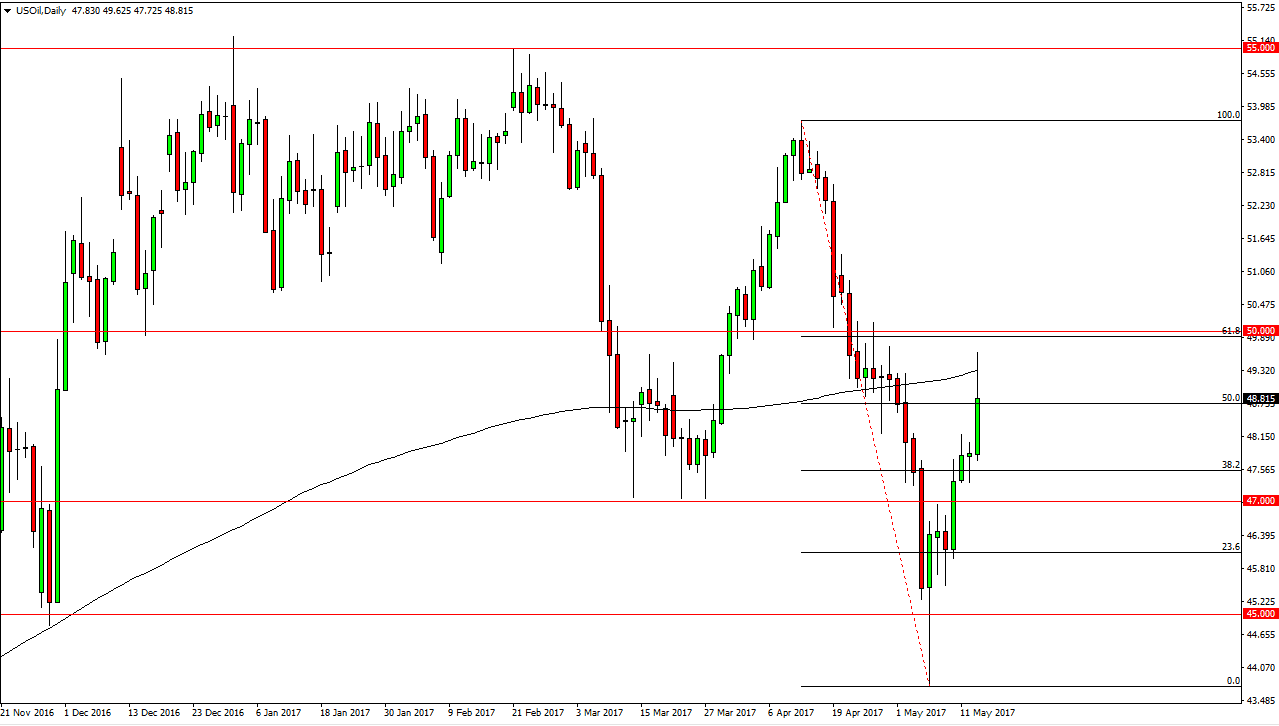

WTI Crude Oil

The WTI Crude Oil market rallied on Monday, showing signs of strength as we tried to go to the $50 handle. However, the move was based upon the idea of Russia and Saudi Arabia suggesting that more production cuts needed in the oil markets might be coming. That of course is bullish for price, but the reality is that production cuts have not held up longer term. Because of this, I believe that the move is probably short-lived. You will notice on the chart that the 61.8% Fibonacci retracement level, the large round number, and of course the 200-day moving average have all conspired to keep prices lower. I’m not willing to short yet, but I’m thinking about doing it on signs of exhaustion.

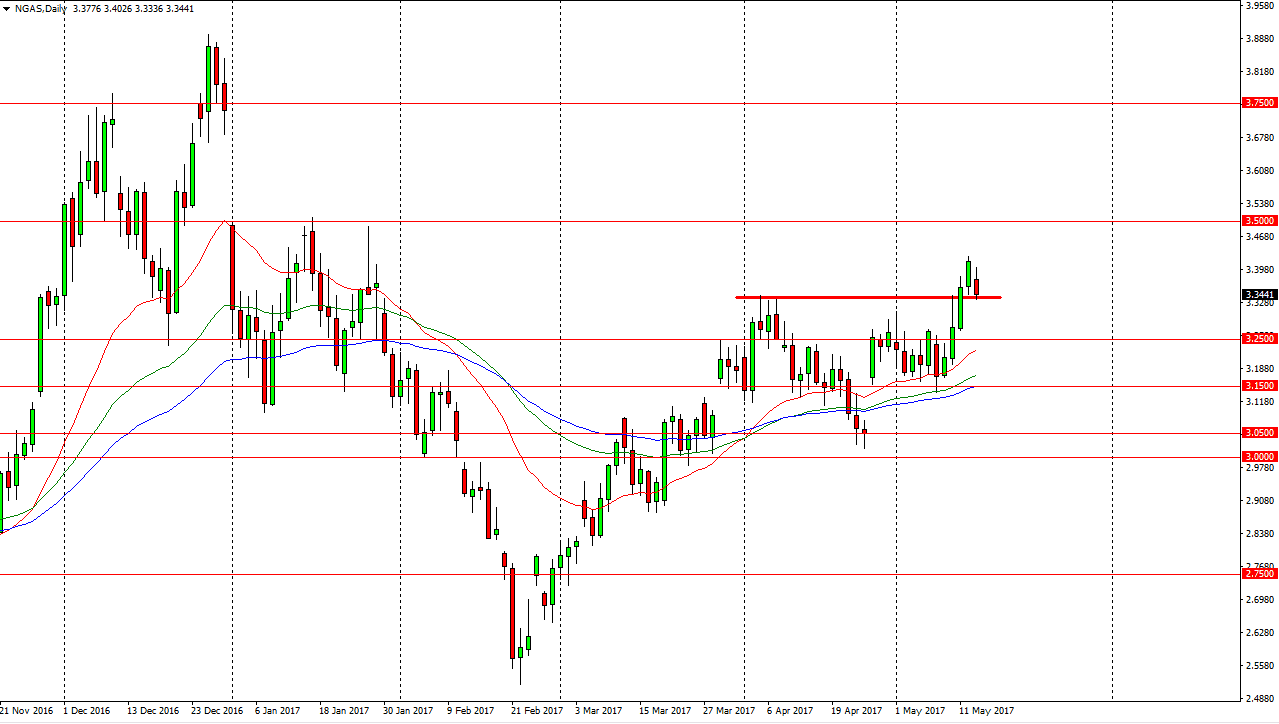

Natural Gas

Natural gas markets fell during the day after initially tried to rally on Monday, but found the area a bit too lofty. Because of this, we fell to the $3.33 level underneath, which had previously been resistance. It should now offer support, but I don’t have a supportive candle that I can serve buying quite yet. A supportive candle would be a nice buying opportunity if we get it, as the breakout of course was significant. I believe that we will go higher, perhaps reaching towards the 3.50 level above, and a break above there sends the market looking for the gap above there to the $3.74 level. Matter what happens, it’s good to be volatile, but even if we break down from here I’m not willing to sell until we clear the $3.25 level, something that seems very unlikely to happen. Natural gas markets typically are volatile anyway, so perhaps using small positions will be the way to go but the market has broken out and I’m not looking to fight that momentum.