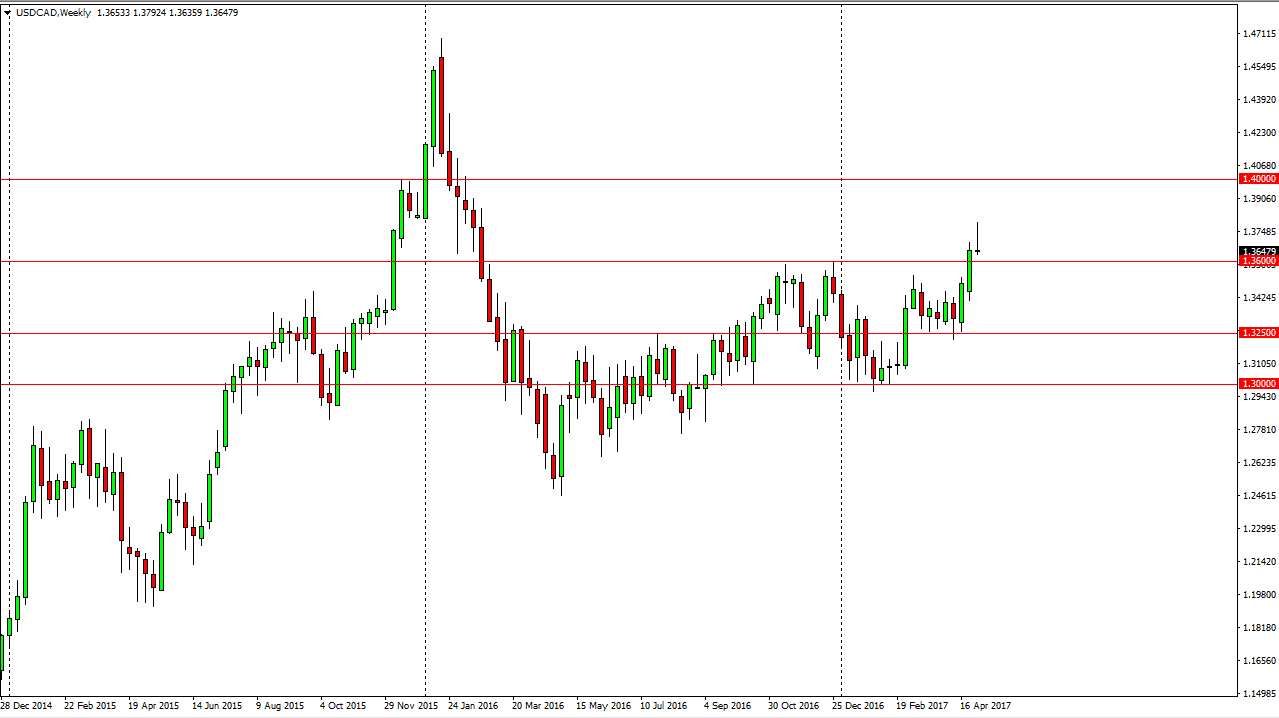

USD/CAD

The US dollar rallied against the Canadian dollar during most of the week, but fell apart on Friday as the jumps number came in stronger than anticipated. This drove up the price of oil, but oil has broken down below significant support, and the bounce that we have seen is a “dead cat bounce” in the oil market as far as I can tell. Because of this, I think we will see sellers in the oil market, translating to support underneath that the 1.36 region. I still believe in the uptrend, and am looking for a buying opportunity underneath.

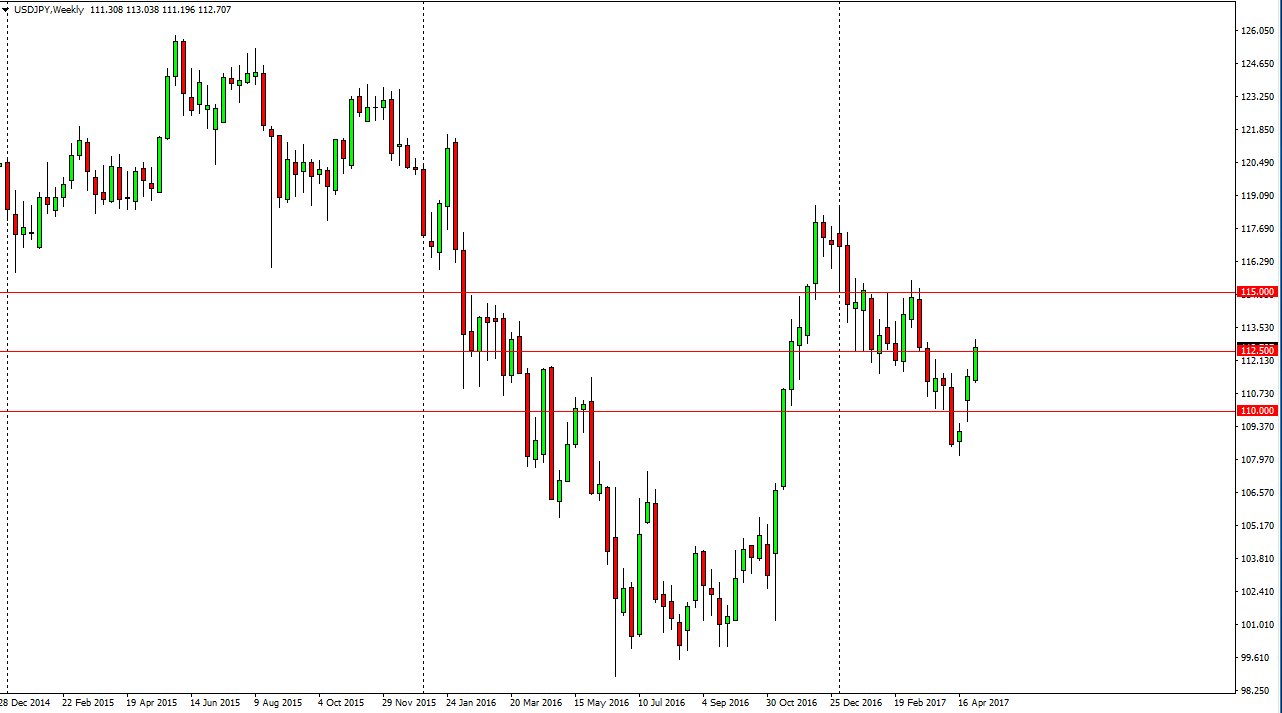

USD/JPY

The US dollar rallied against the Japanese yen during the week, breaking above the 112.50 level, and testing the 113 handle. I think we will eventually break above their, but it may take a little bit of time to do so. I think short-term pullbacks should offer buying opportunities, and this will be especially true of the stock markets can continue to go higher.

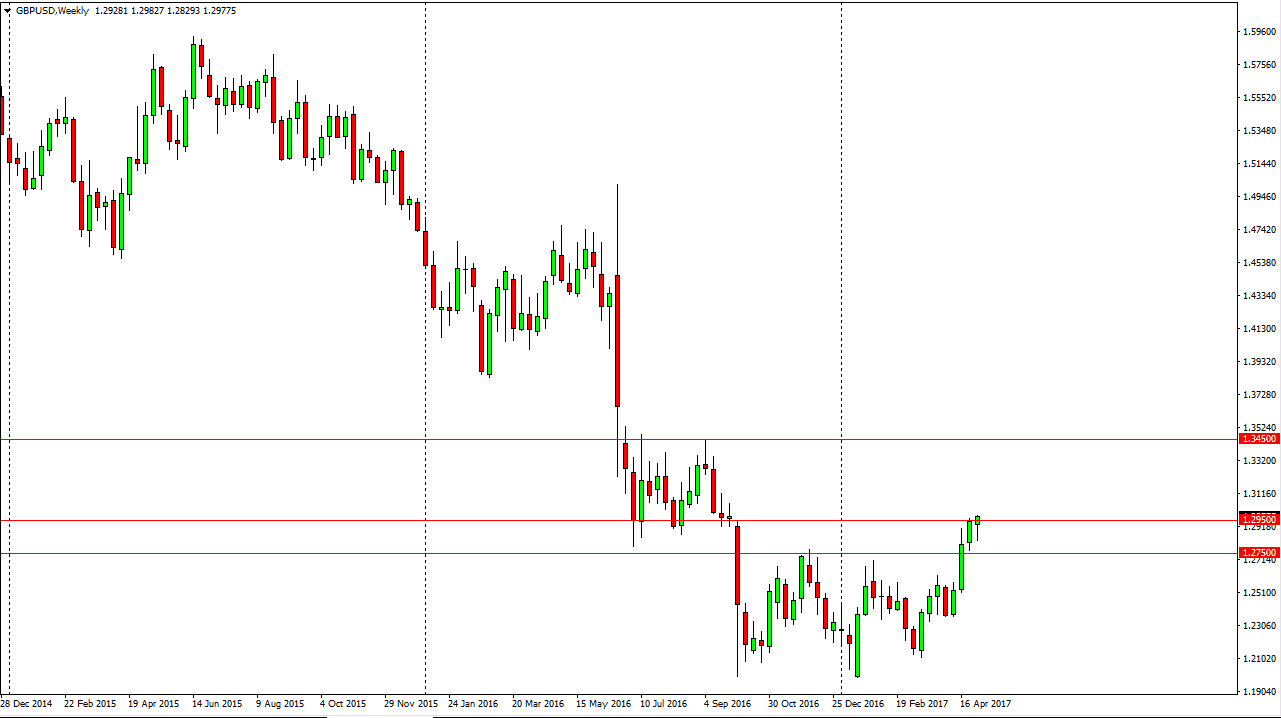

GBP/USD

The British pound initially fell during the week but found enough support at the 1.28 region to turn around and form a hammer. We broke above the 1.2950 level forming a hammer. It now looks as if we are going to continue to grind higher, and that the bullish pressure is building. I still believe that we are going to reach towards the 1.3450 handle above.

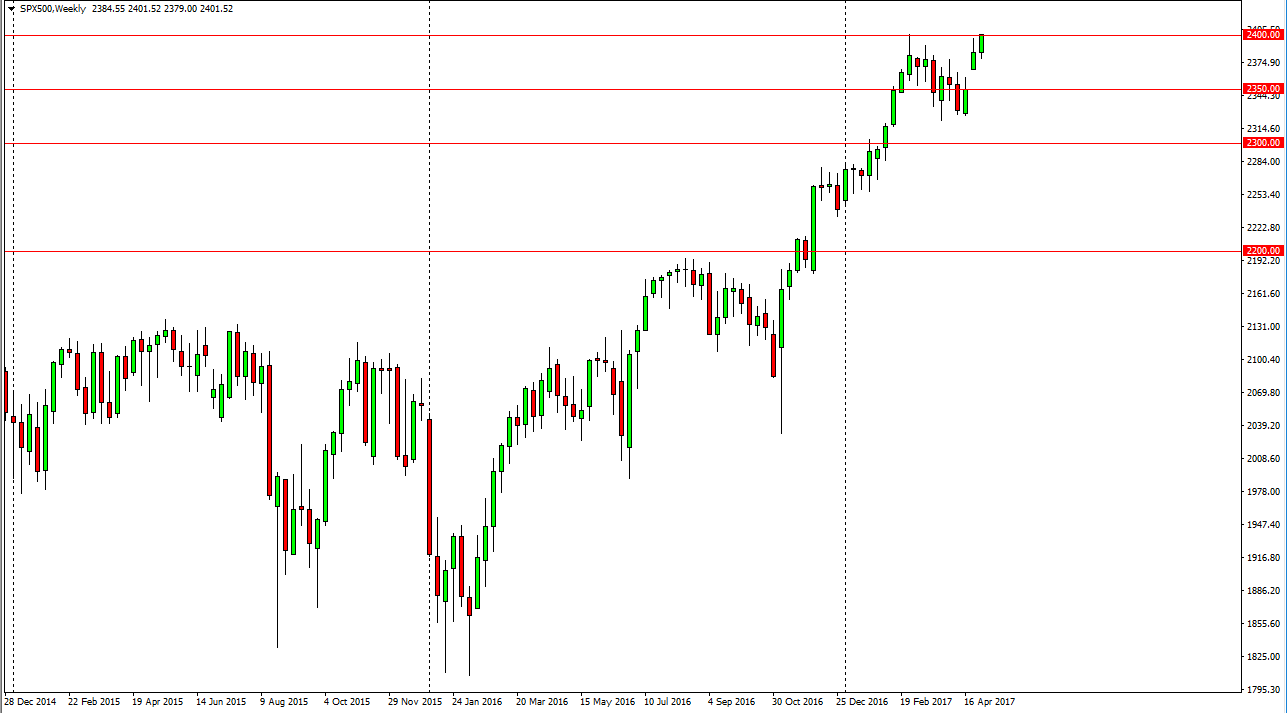

S&P 500

The S&P 500 continued the bullish pressure, reaching above the 2400 level. I believe that the market is ready to continue going higher, and we should then go looking for the 2500 level after that. Pullbacks continue to be value as far as I can see.