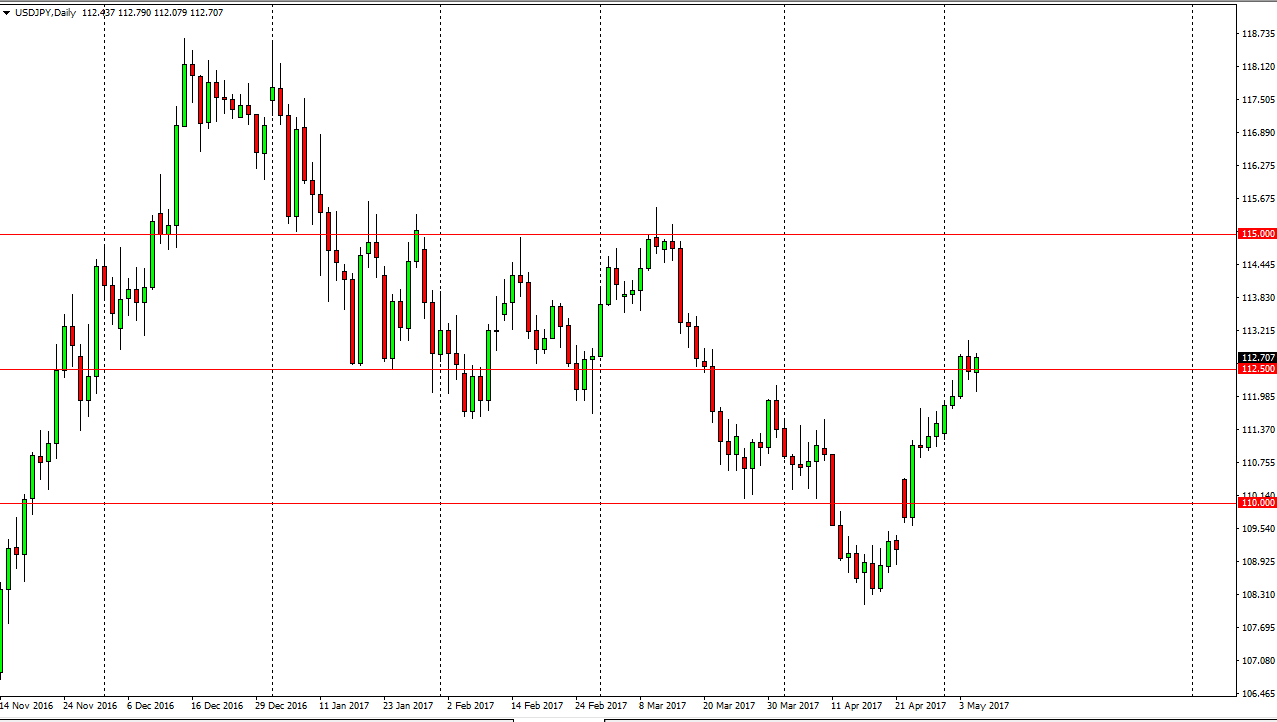

USD/JPY

The US dollar initially fell against the Japanese yen during the session on Friday, but the jobs number was strong enough to turn the market around and send us back above the 112.50 level. By doing so, we ended up forming a hammer and that of course is a bullish sign. I believe that we are going to continue to see the bullish pressure, and reach towards the 115 level above which had previously been so resistive. That’s not to say that the market is going to be called, I believe that it will be quite volatile. However, it looks as if the buyers have retained control of this market again, and I believe it is only a matter of time before they push too much higher levels.

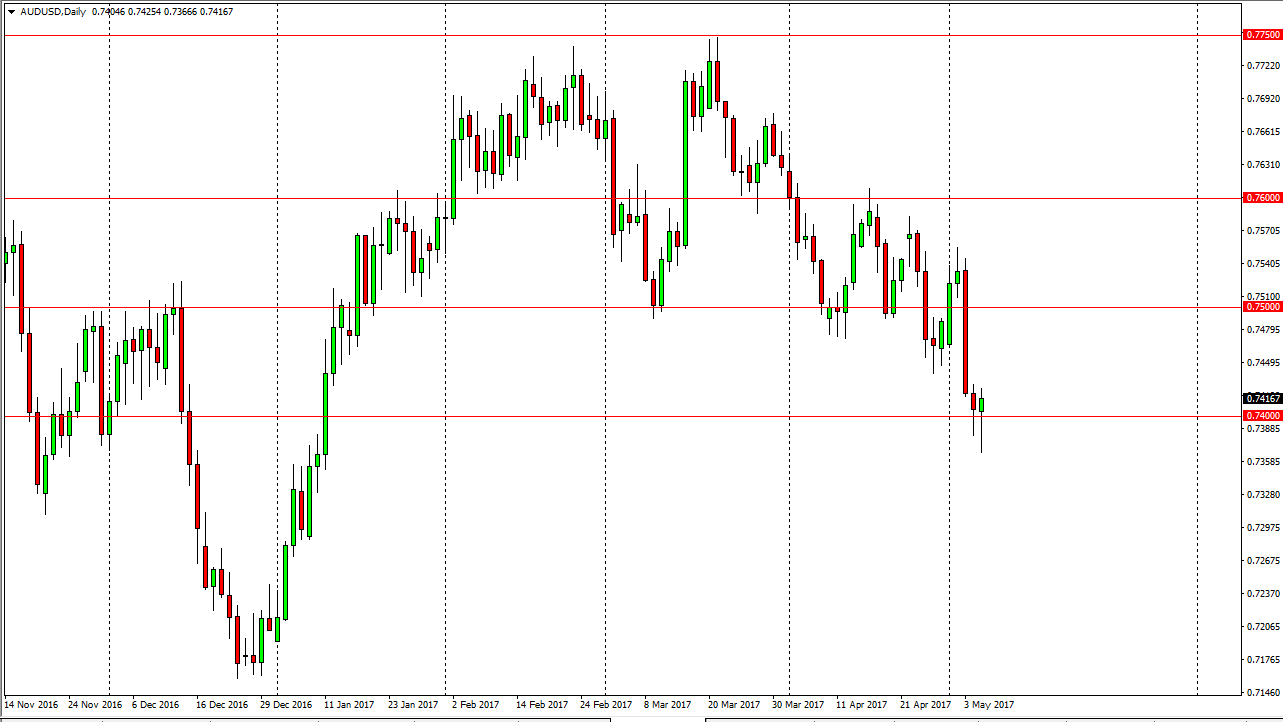

AUD/USD

The Australian dollar fell initially during the Friday session as gold markets have fallen apart. However, we have turned around to form a nice-looking hammer, which is coincidentally at the 61.8% Fibonacci retracement level. Because of this, I think we could get a bit of a bounce, but I think that the 0.7450 level will probably offer a bit of resistance. If we can break above their, then I think the market goes to the 0.75 handle. Alternately, if we breakdown below the bottom of the hammer, that’s a very negative sign and should send this market much lower. I believe ultimately we do see selling pressure, as not only do we have issues with the goal markets, but we have a severe lack of demand coming out of China when it comes to metals such as copper and iron. Because of this, it is only a matter of time before the bearish pressure ways upon the Aussie again, and I think that will continue to be a theme in this currency pair.