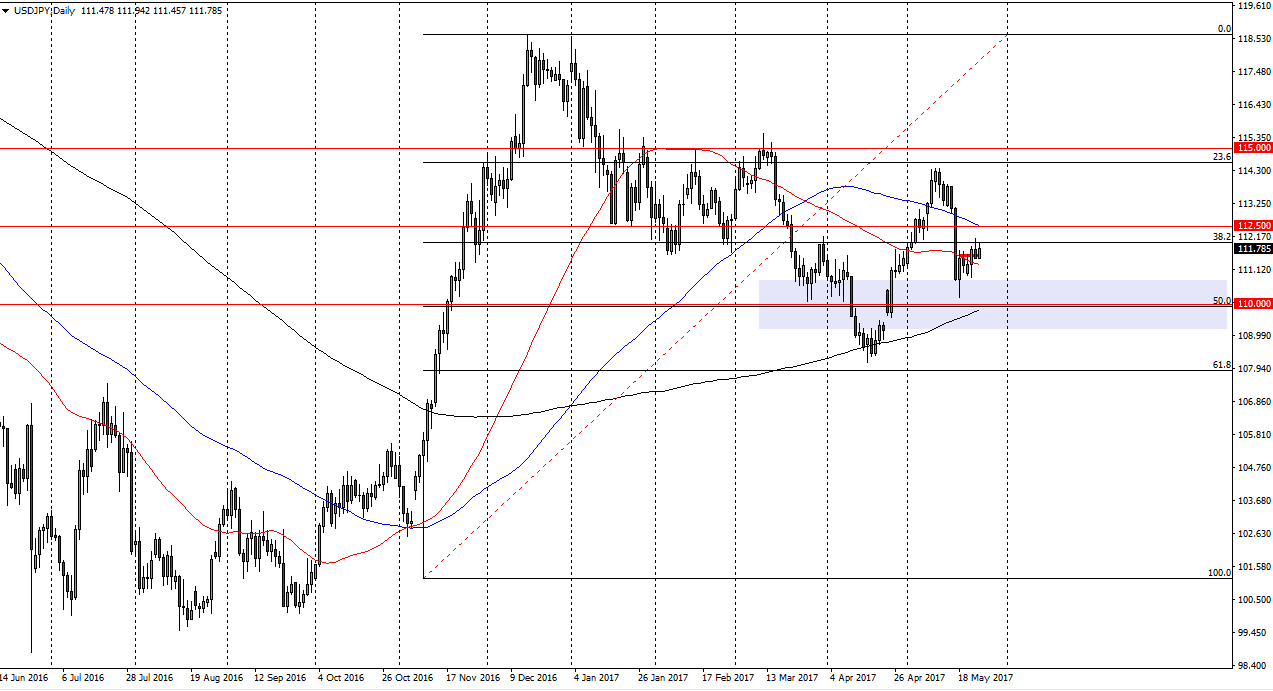

USD/JPY

The USD/JPY pair rose slightly during the day on Thursday, as we continue to bounce around just below the 112 level. This is a market that seems to be very skittish at the moment, so therefore it is going to be difficult to trade. However, if we can break above the 112.50 level I feel that the market can go much higher. Alternately, if we roll over I think that there is a significant amount of support at the 110 level. A breakdown below there should have this market looking for the 109 level as it would fill the gap. Keep in mind that this pair tends to be very sensitive to news and headlines, especially in the risk appetite sense, so if bad news comes out, this pair typically will fall.

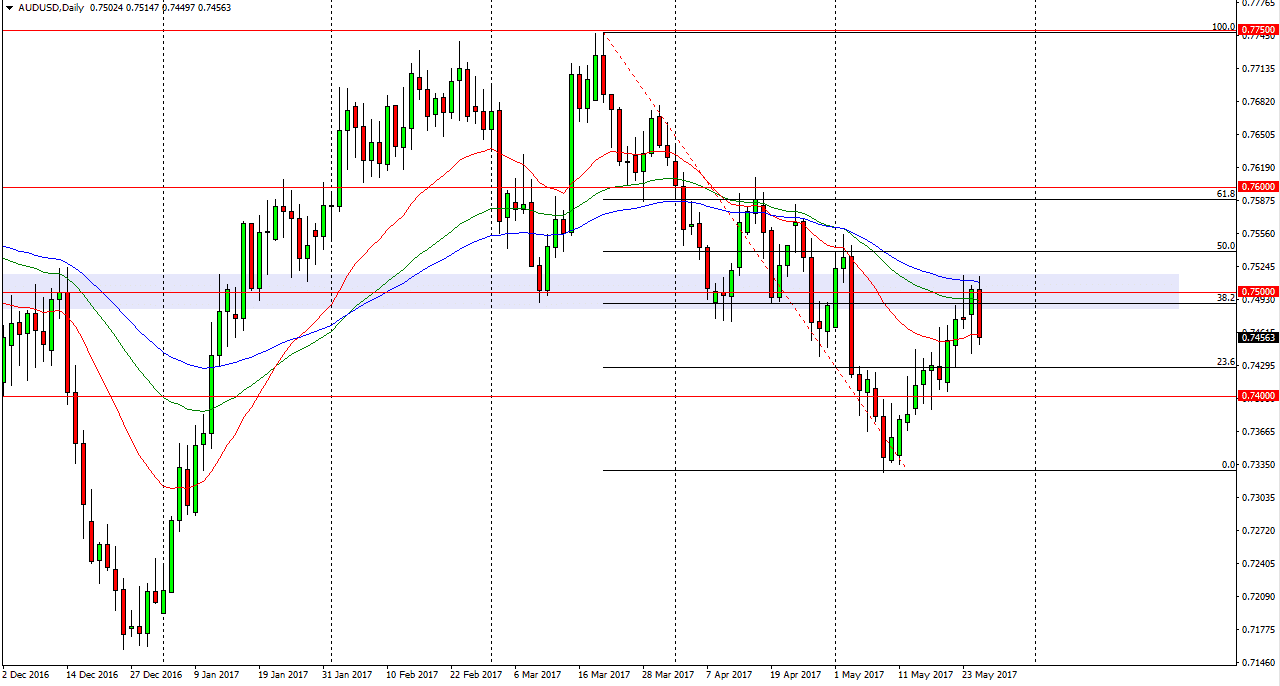

AUD/USD

The Australian dollar initially tried to rally, but then rolled around and showed a very bearish price action. Because of this, it looks as if we may continue to grind lower. A break below the hammer from the Wednesday session has me selling, and I believe that a breakdown below the 0.74 level sends this market down to the 0.7335 handle. A breakdown below there is even more bearish and at that point I think we can go down to the 0.7150 handle. Alternately, if we can break above the top of the shooting star that formed on Tuesday, the market should continue to go higher. In general, looks as if the 38.2% Fibonacci retracement level is being respected, so I think that although the market is very volatile, I think we still have a certain amount of bearish bias when it comes to the Aussie dollar. The recent downgrade of creditworthiness of Chinese bonds of course ways upon the Australian dollars well as it is traded as a proxy for the mainland.