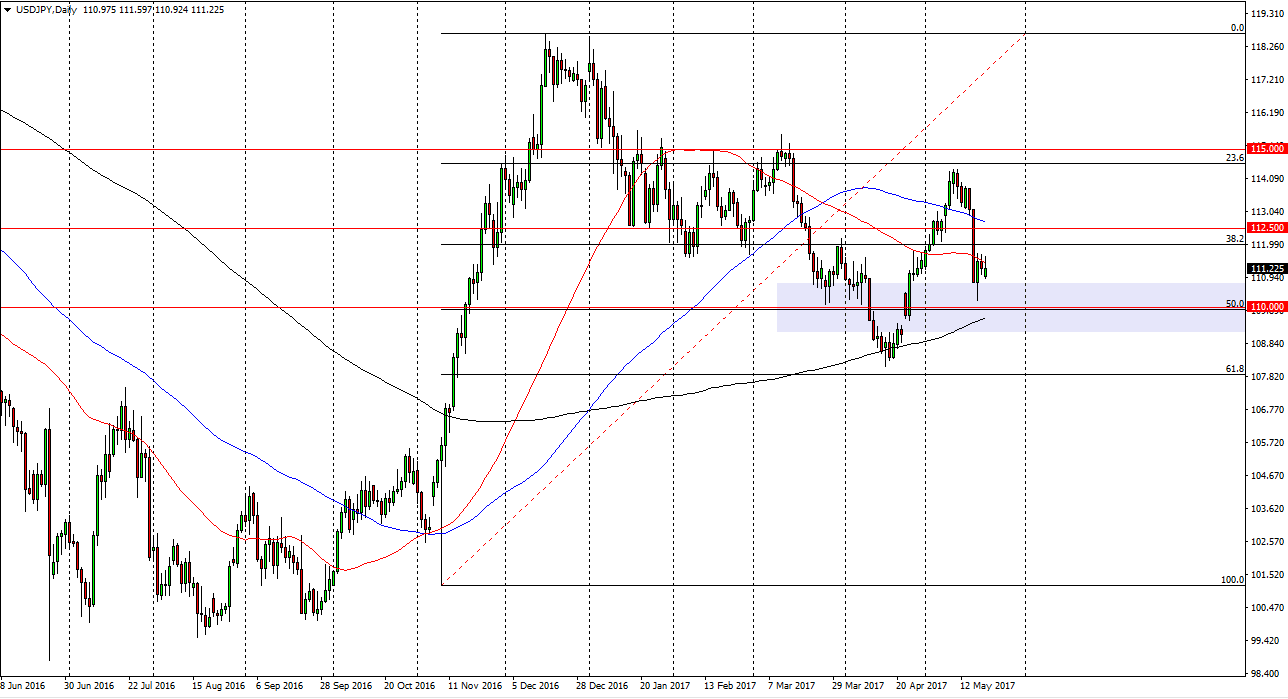

USD/JPY

The USD/JPY pair initially tried to rally on Monday, but turned around to fall significantly. We bounce from there, and the 111 level has offered support. That is the beginning of a support zone that is centered around the 110 handle and of course the 50% Fibonacci retracement level from the previous move higher. The 200 day exponential moving average is just below, and it should continue to offer buying opportunities. If we can break above the 112.50 level, the market should then go to the 115 handle. If we break down below the 110 level underneath, then the market will probably go to the lows again which consequently happen to be the 61.8% Fibonacci retracement level at the 108 handle. Keep in mind that the pair is highly sensitive to risk appetite in general.

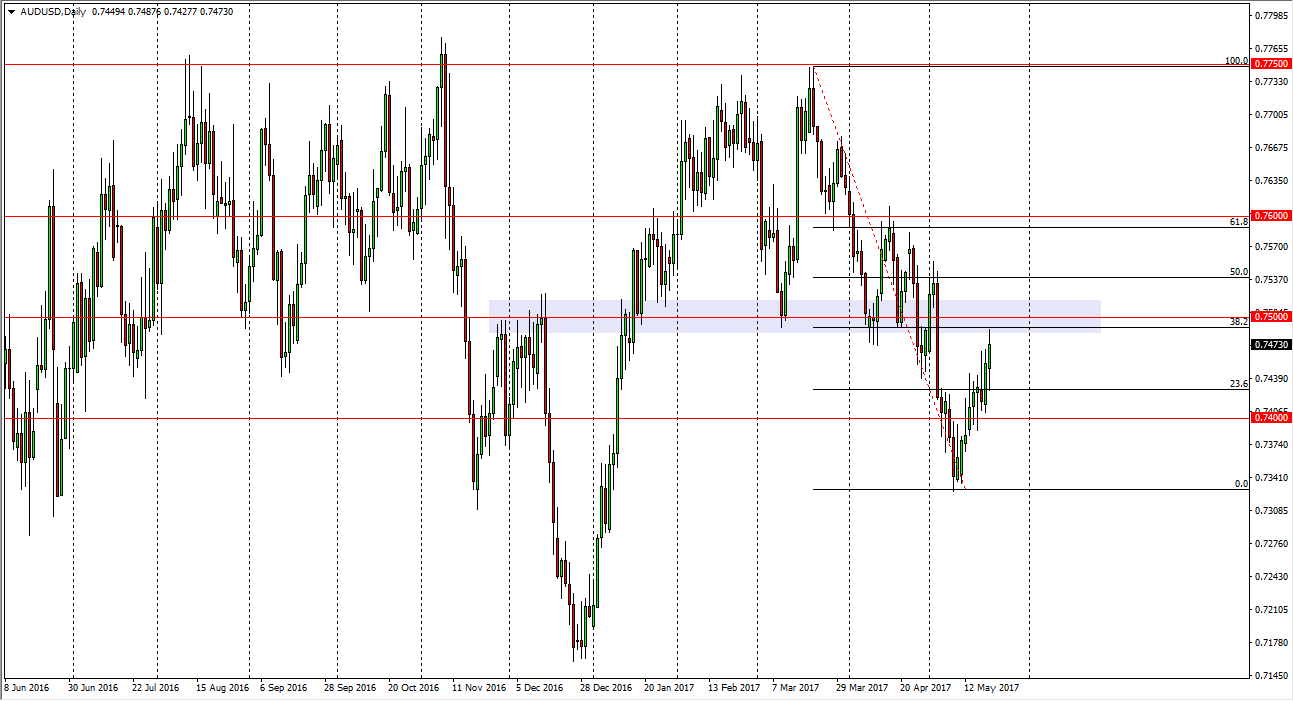

AUD/USD

The Australian dollar had a positive session after initially falling, and finding support. We found the region just below the 0.75 level to be resistive, which is the 38.2% Fibonacci retracement level from the recent pullback. If we can break above that round number, I think at that point the market will be free to go higher, but obviously we need the gold markets to behave in the same manner. This pair tends to follow gold overall, and I believe that it’s only a matter of time before the market should then go to the 0.76 level above. That should coincide nicely with the move in gold to higher levels, which is possible, but I do see a significant amount of resistance just above. If we do fall, the market should then go down to the 0.74 level, and perhaps even lower than that to completely retrace the bounce. Either way, I think were going to see a lot of noise and volatility in the Australian dollar.