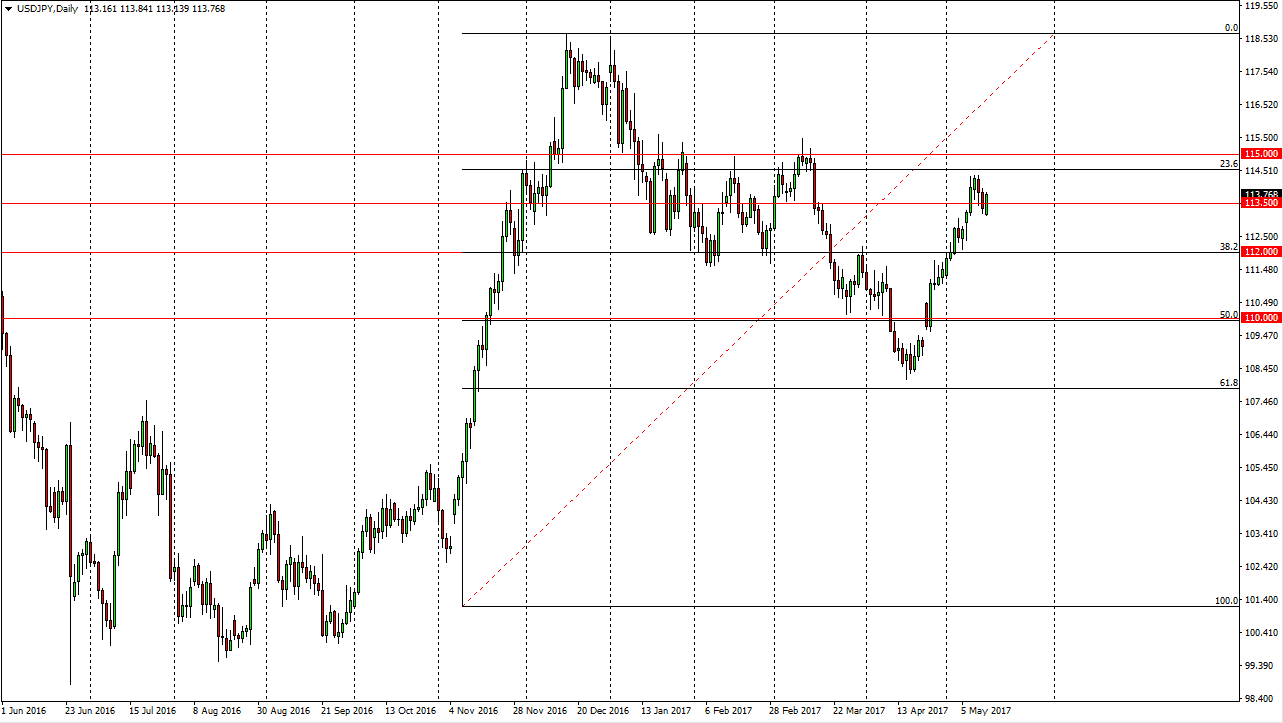

USD/JPY

The US dollar rallied against the Japanese yen during the session on Monday, as the 113.50 level has offered support. We have bounced significantly, and it now looks as if we are ready to reach towards the 115 handle. A break above that level should extend the longer-term moved to the upside. We have recently seen the 61.8% Fibonacci retracement level offer significant support, and it now looks like the market is trying to make a longer-term moved to the upside. I have no interest in shorting this market, and I believe the pullbacks offer value. This is especially true near the 112 handle, an area where we had seen previous and stringent support. The 118.50 level is my longer-term target, and then perhaps extend beyond that.

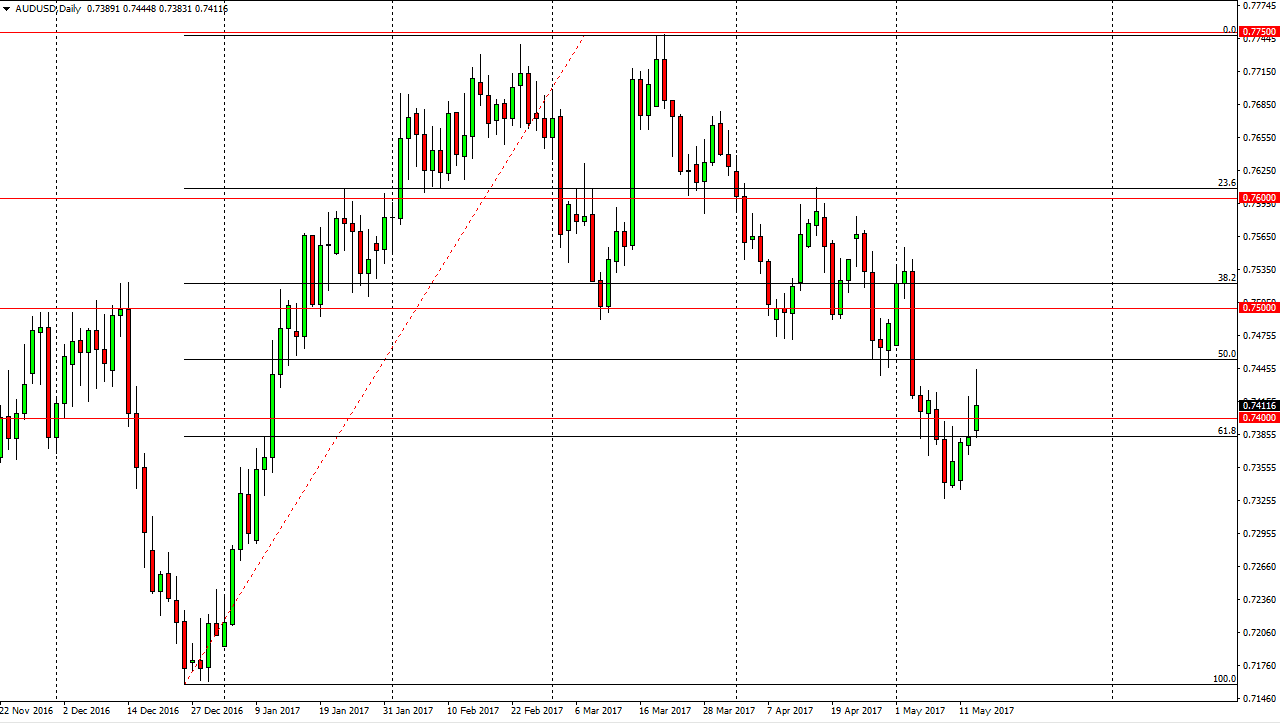

AUD/USD

The Australian dollar rallied during the day on Monday, but found quite a bit of resistance near the 0.7450 level. We turned around to form a shooting star like candle, and the 50% Fibonacci retracement level of course was resistance. If we can break down below the bottom of the candle for the session on Monday, it’s likely that the market will continue to go much lower. Pay attention to the gold markets may have such a strong influence on the Aussie that it is almost impossible to trade one market without watching the other. They do tend to move in the same direction, so pay attention to what gold does, as if we start to breakdown in that market, this pair will more than likely do the same thing. Alternately, gold rising will be good for the Australian dollar, and send us the much higher levels. Either way, it’s going to be a very volatile market going forward, so keep in mind that the markets will be one that you have to be careful with.