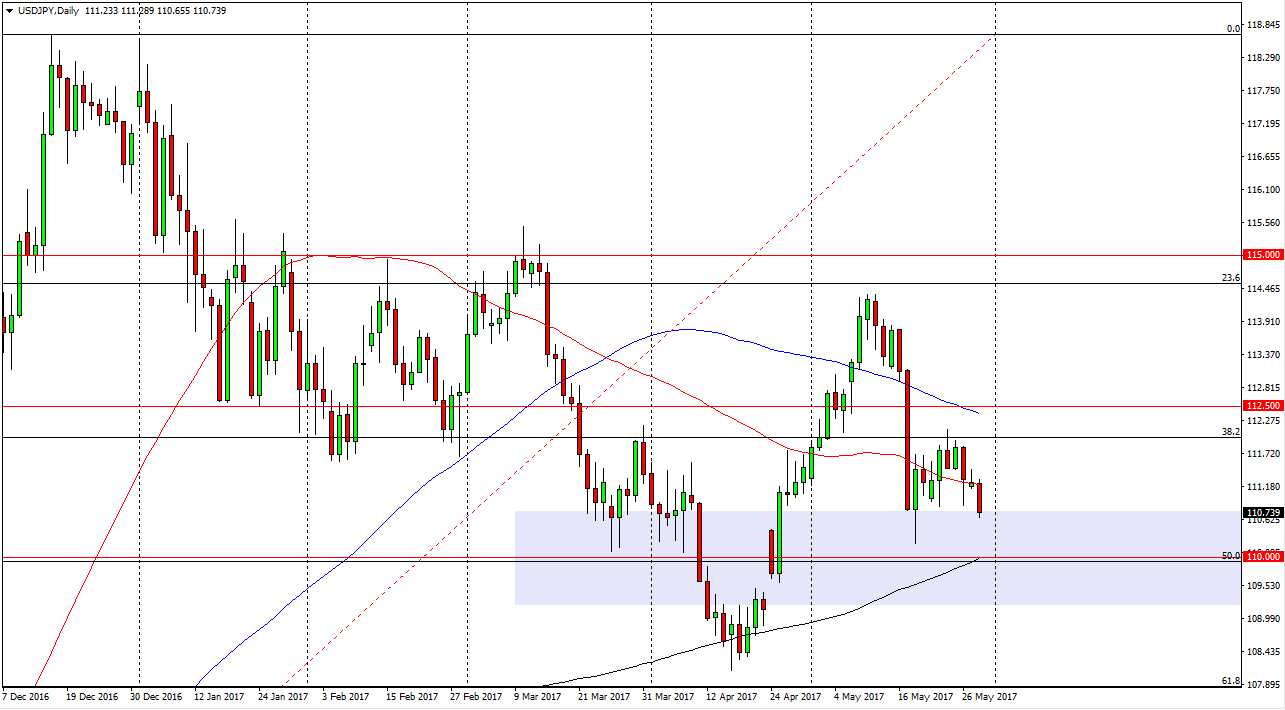

USD/JPY

The USD/JPY pair initially rally during the day on Tuesday, but found resistive enough to turn the market back around and sell off significantly. We are still looking at a market that is going to be a volatile due to all the moving pieces, and with this being the case it’s likely that we should continue to see trouble as the market has a lot think about. I believe that the 110-level underneath will offer a bit of support though, and there is a gap just below there that will come into play. Beyond that, we have the 200-day exponential moving average below at the 110 level as well, and of course that attracts a lot of longer-term traders. Because of this, I believe it is only a matter of time before the buyers get involved and start buying the US dollar. If we break down below the gap, then I think we could go to the 108 handle.

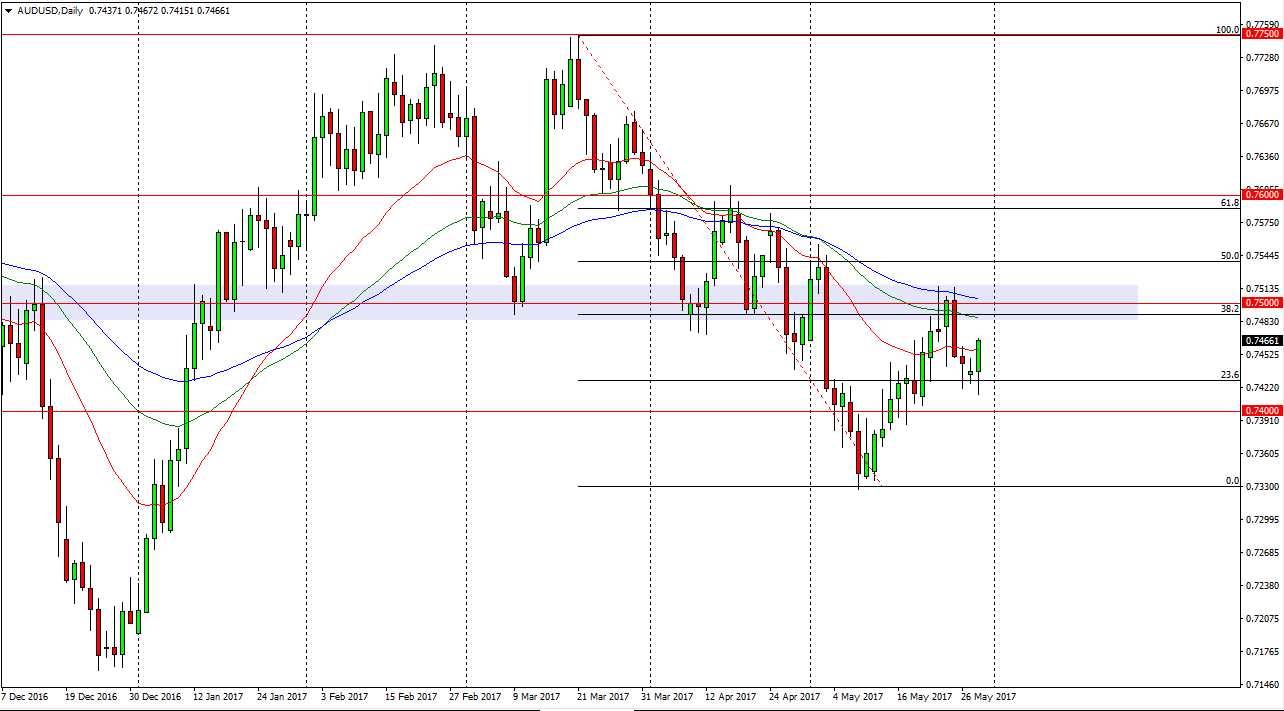

AUD/USD

The Australian dollar initially tried to fall during the day on Tuesday but found quite a bit of support below at the 0.74 level. The market now looks as if it is trying to go to the 0.75 handle, which is an area that has both been resistive and supportive in the recent past, so if we can break above there, that would be a very bullish sign. In the short term, I believe that short-term buyers are going to get involved, and any move above the 0.75 level should be thought of more or less as a bonus. I believe the 0.74 level underneath is supportive, and that should continue to be the consolidation area that the market trades in for short-term scalpers. If we break down below the 0.74 level, the market should then go to the 0.7330 level underneath.