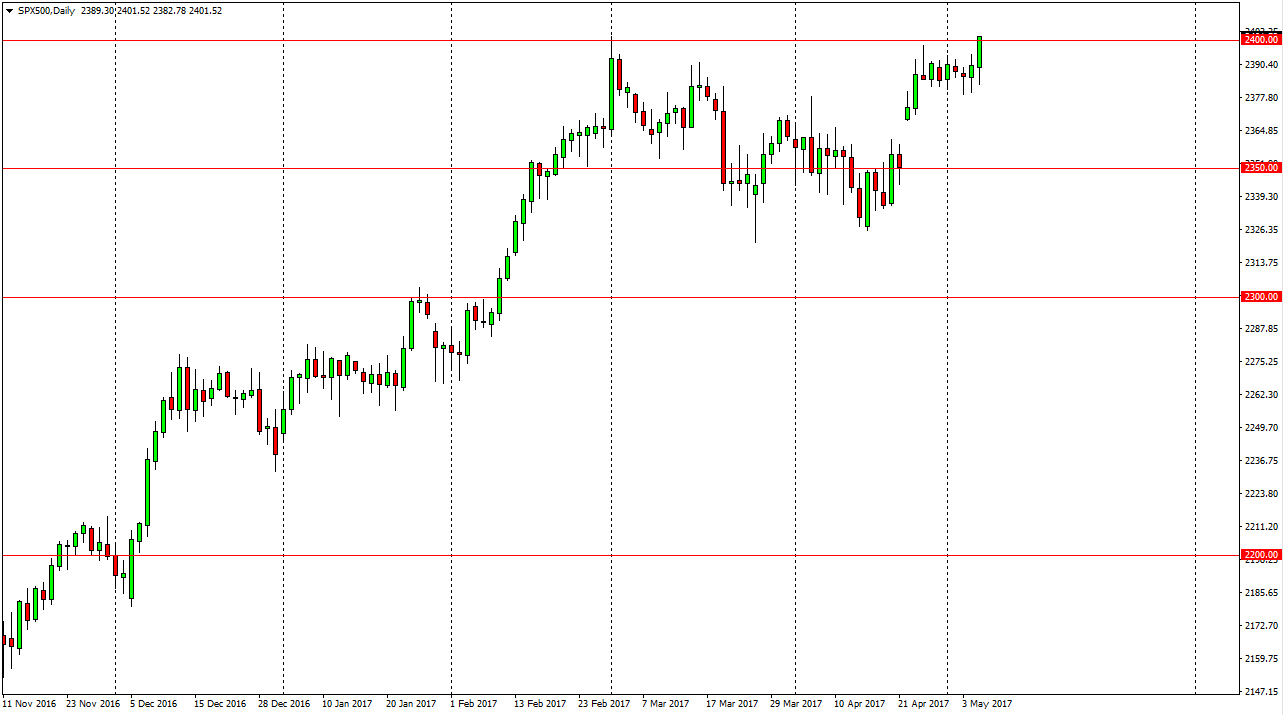

S&P 500

The S&P 500 had an interesting session on Friday as the jobs never came out of the United States. We initially fell, but found enough support near the 2380 handle to turn around and break above the 2400 level above. I think that the market will eventually continue to go higher, and this move above the large round handle of course should attract quite a bit of attention. I believe that the market will look for the 2500 level over the longer-term, but it may take some time to get there. I believe that short-term pullbacks continue to offer value, and that the market will continue to look very strong. I have no interest in selling, as we have seen such an impulsive move to the upside.

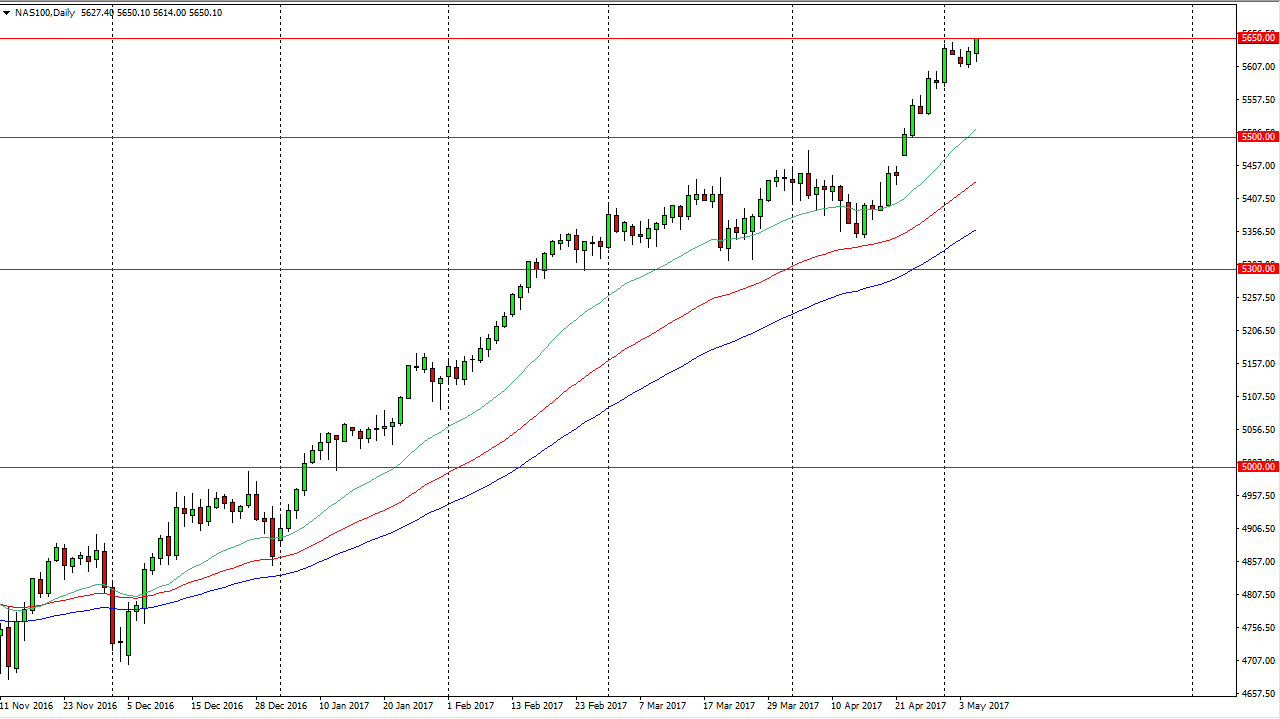

NASDAQ 100

The NASDAQ 100 of course looks very healthy as we are pressing the 5650 handle. That’s an area that would cause a little bit of psychological resistance, but I think any pullback at this point in time would more than likely attract more traders looking for value. I feel that the market is going to go hunting for the 5700 level above, and with that I am a buyer of pullbacks and of course an impulsive move to the upside. To break above the 5650 level is a good start for a move to the upside.

I believe that all of the moving averages are telling us the same thing, mainly that the buyers are in control. The 5500 level should be the “bottom” of the market, and therefore I don’t think we breakdown below there. The NASDAQ 100 has been leading the way for some time, and I think will continue to do so. If this market rallies, I think all the rest of the US indices will do the same, as we continue to see a “risk on” type of attitude.