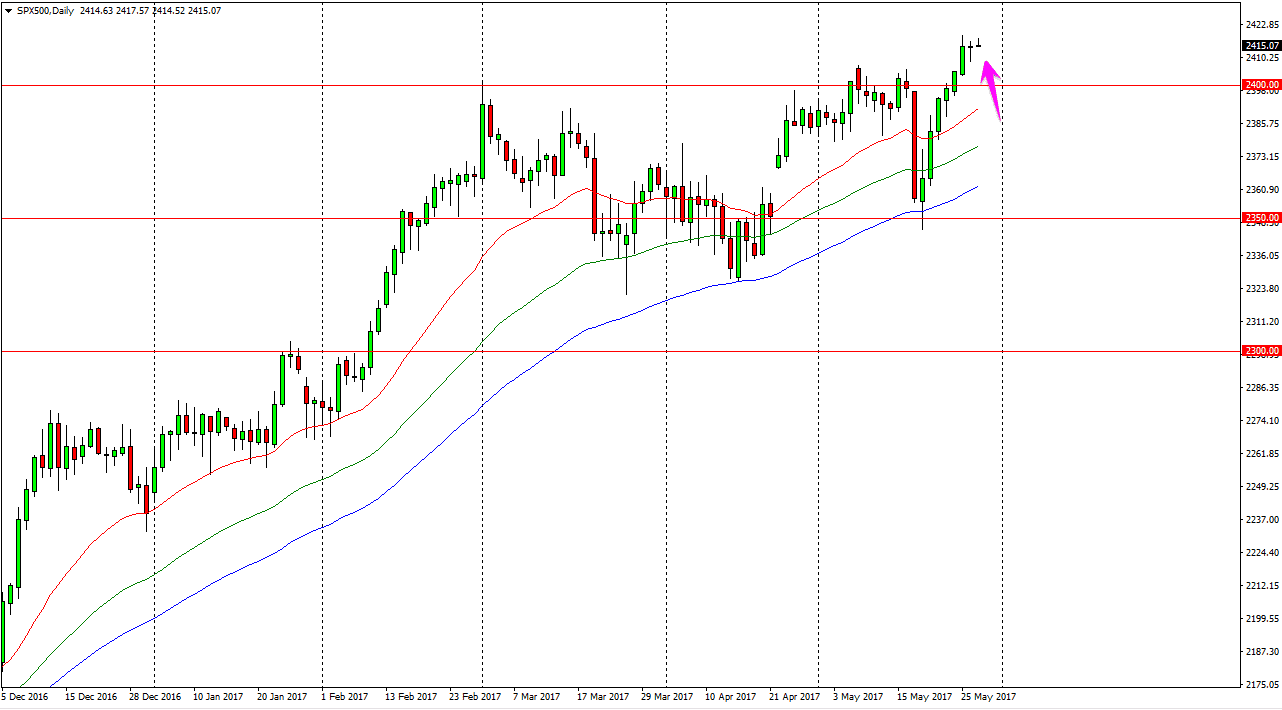

S&P 500

The S&P 500 did very little during the day on Monday, which of course was not a big surprise, as only the CFD markets would have been open. The underlying index of course was close for Memorial Day, but when I look at the longer-term chart, I can certainly see that there is a significant uptrend going on. The 2500 level above should be the target, just as the 2400 level below should be massively supportive. The market seems to be well supported every time it dips, so therefore I think that buying on the dips is all you can do. There is no play shorting this market as far as I can see, and when it pulls back it should continue to attract plenty of value hunters. Not only do I think we go to the 2500 level, but I think given enough time we will break above there as well.

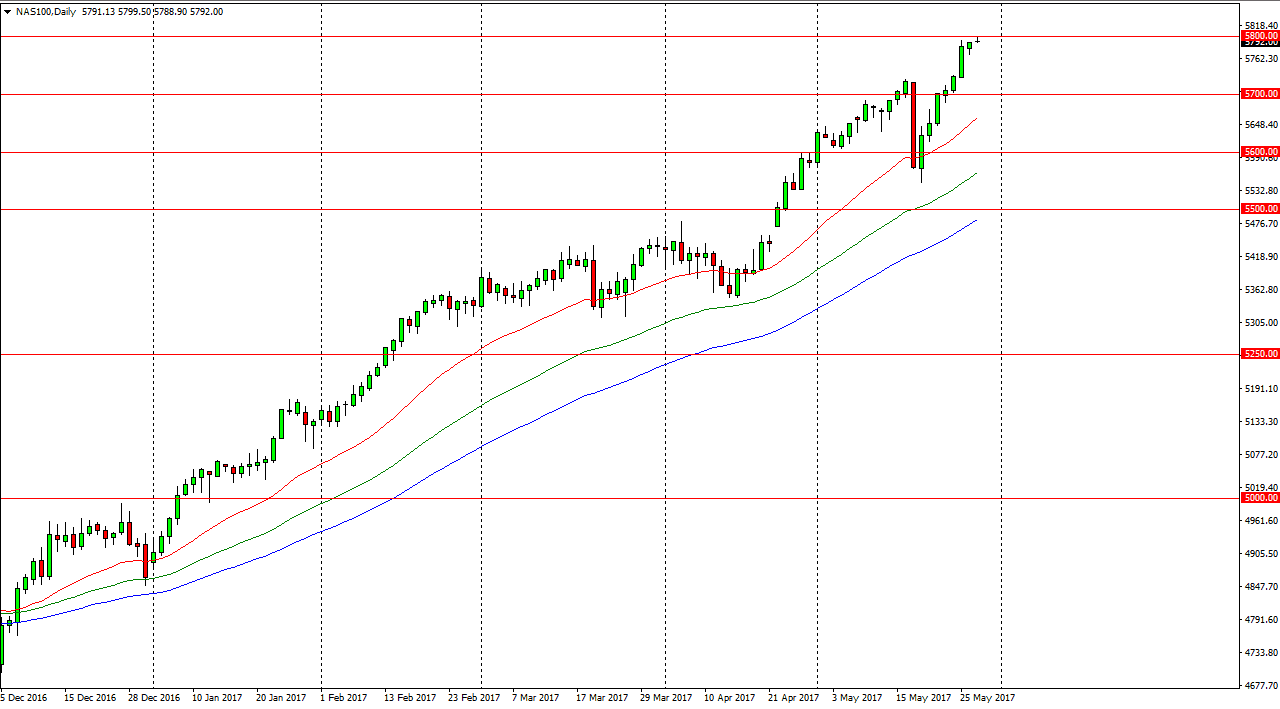

NASDAQ 100

The NASDAQ 100 did almost nothing as well, as the 5800 level continues to be resistance. I think we will break above there, so it’s only a matter of time before we continue to see buyers push this market towards the 5900, and then perhaps the 6000 handle. A pullback from here, I think has plenty of support near the 5700 level. Either way, this is a market that I have no interest in shorting and I believe that the NASDAQ 100 will continue to lead the rest of the US indices higher, as well as the rest of the world. The market is one that you certainly can’t sell, and that being the case I’m simply waiting for value or an impulsive candle to take advantage of. The market has been very reliable over the last several months, and I don’t see that changing anytime soon as tech companies continue to do quite well.