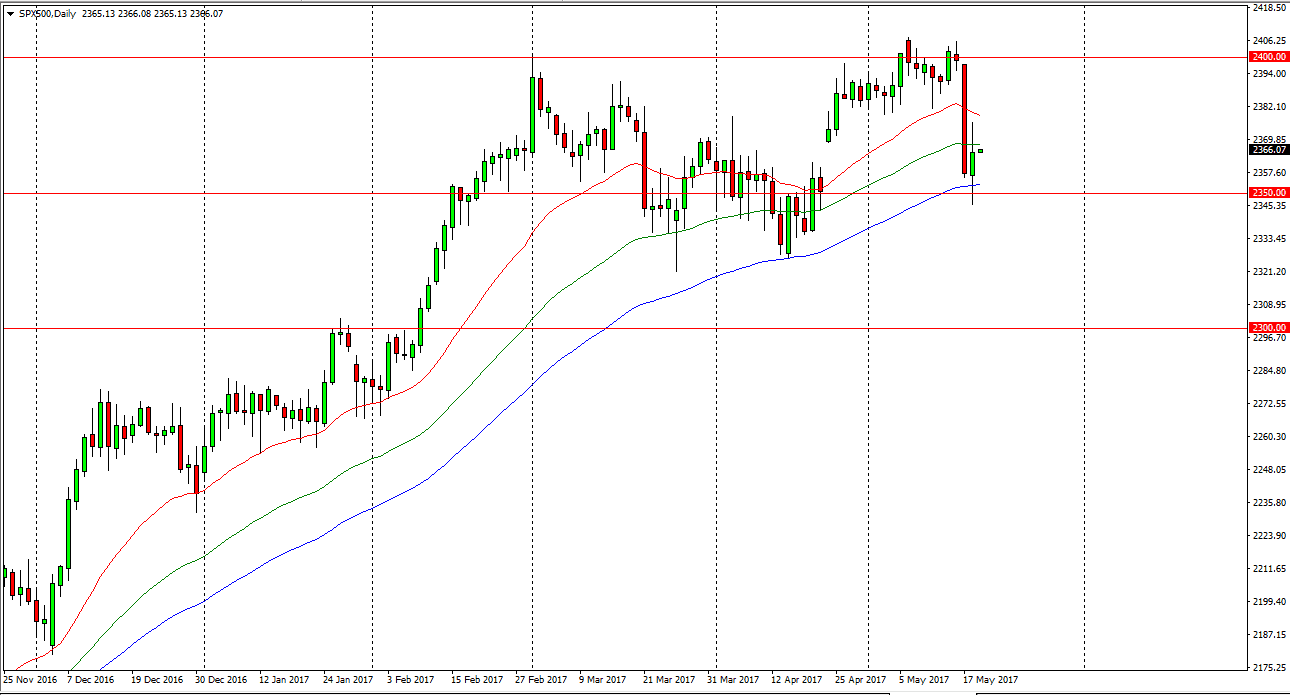

S&P 500

The S&P 500 had a volatile session on Thursday, initially falling but finding enough support at the 2350 handle to form a supportive move and go much higher. However, we gave back some of the gains at the end of the session, essentially making a neutral candle. That suggests that we are going to continue to grind sideways, as the market might perhaps be looking for a little bit of stability so we can continue the move higher. A break above the top of the range for the day of course is very bullish, while a breakdown below the bottom of the range for the day is negative. I think it’s that simple, you simply follow whichever way the market breaks from here. I prefer the upside longer-term, and I do think that the selloff is going to be temporary in nature.

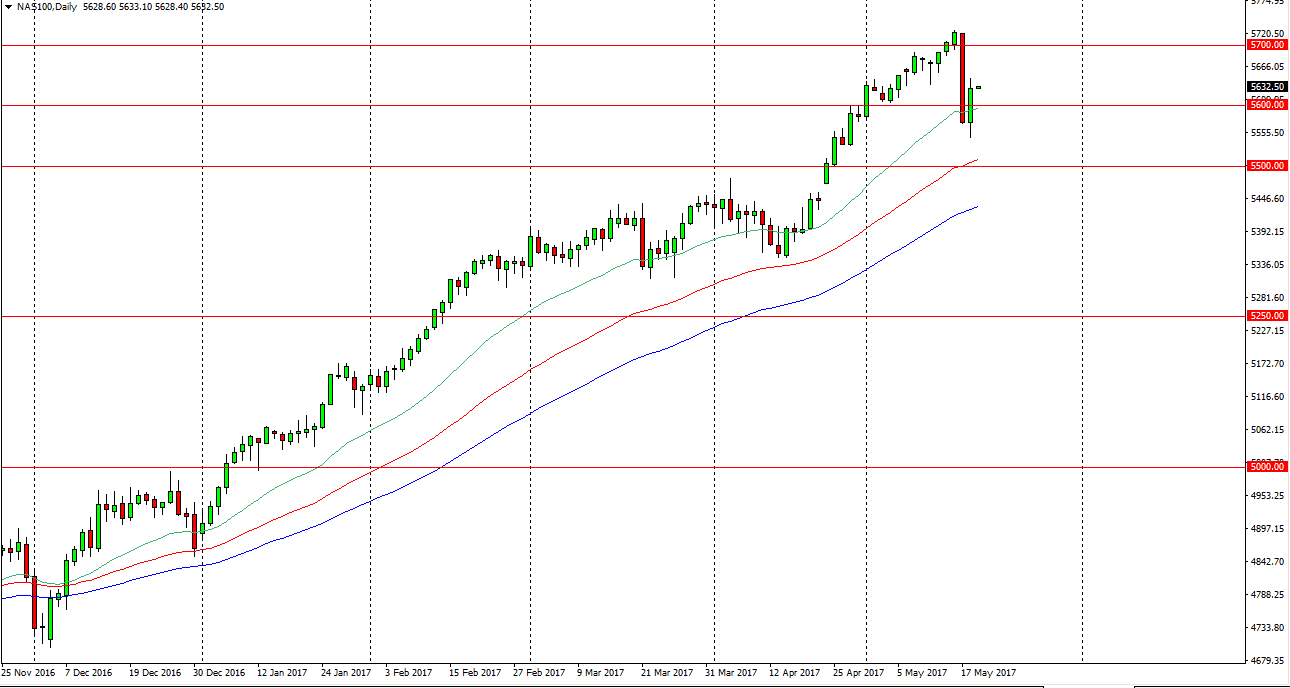

NASDAQ 100

The NASDAQ 100 had a much more solid gain during the day after initially falling, finding the 5550 handle to be supportive enough to turn things around. By breaking above the 5600 level and closing towards the highs, it suggests that the NASDAQ 100 is going to fight the selling pressure that we had seen. We are not out of the woods yet, but I do believe that the longer-term uptrend continues, and therefore I’m looking at pullbacks as opportunities to pick up value in what has been one of the leading indices that I follow. I also believe that we will not only reach the highs again, but we will eventually break out above them also. I still have a target of 6000 longer-term, but it may take some time to get there obviously. I believe that the 5500 level below will be massively supportive as well, so if we were to break down I would be looking there for value.