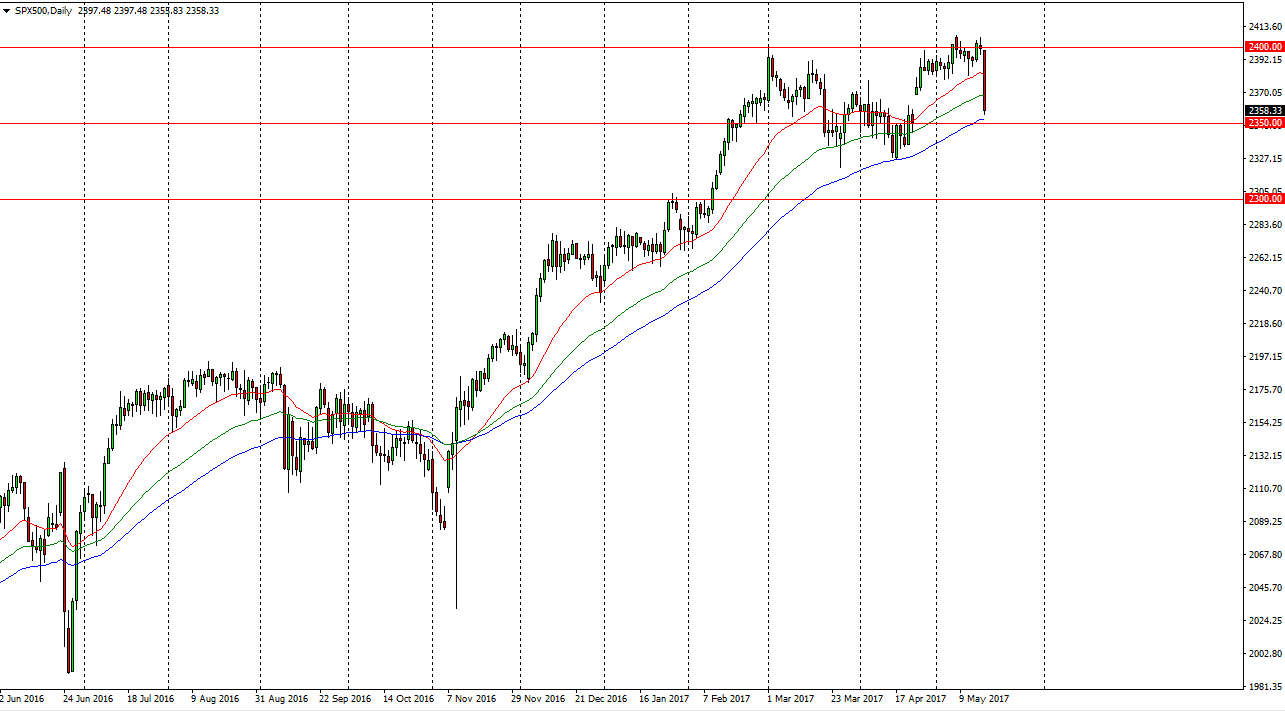

S&P 500

The S&P 500 broke down significantly during the session on Wednesday, testing the 2350 region. This market has been very bullish for quite some time, but quite frankly this pullback is something that’s been needed to. I think the real question now is going to be whether the 2350 handle can hold. If it does, then a bullish candle or a bounce might be a nice buying opportunity. On the other hand, if we can break down below the 2350 handle, I think the market will go looking towards the 2325 level, and then the 2300 level underneath there. Longer-term, I still believe that the buyers are getting into the market, and pushing higher. However, in the short term this pullback is long overdue.

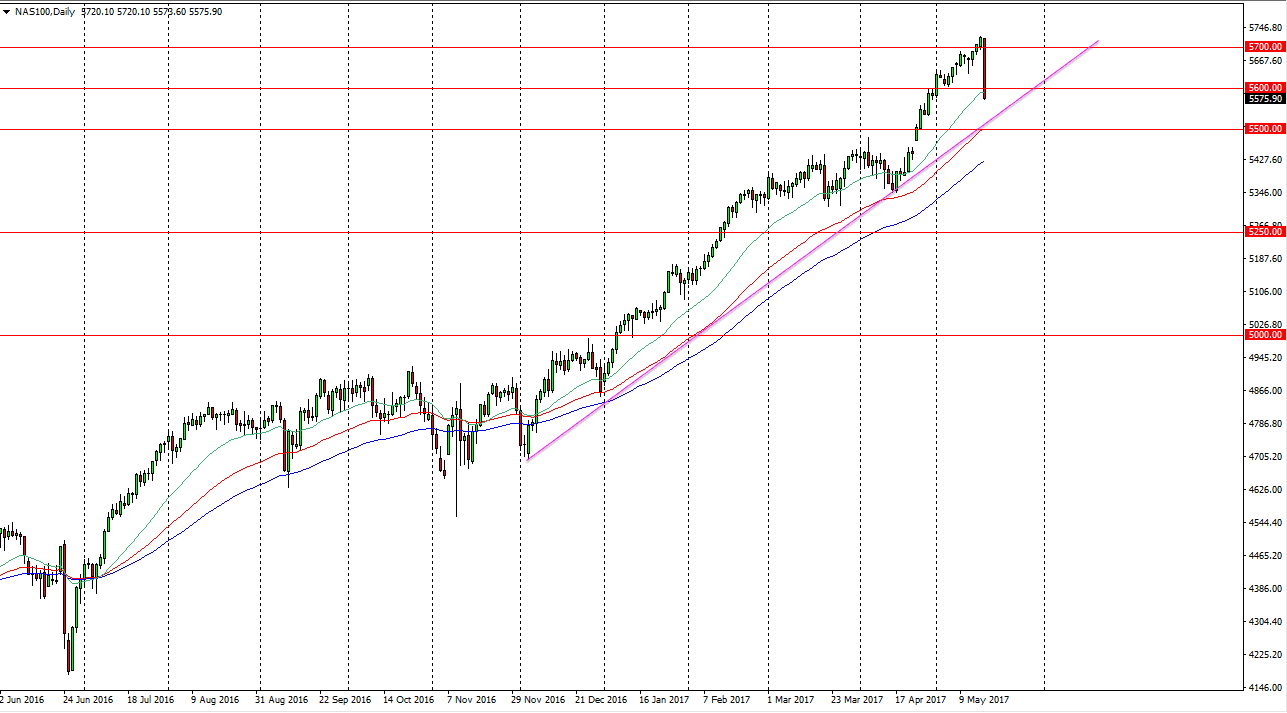

NASDAQ 100

The NASDAQ 100 fell apart during the day, but that’s not overly surprising considering that it has lead the charge higher. Because of this, it quite frankly had more to lose. We broke below the 5600 level, and I think that we will go looking for the 5500 level after that. There is a gap below that could be filled, meaning that we could drive down to the 5425 handle. Because of this, I believe that we will see a bit of continuation today, but eventually you should have an opportunity to take advantage of value and start buying. I believe that short-term traders will look to the short side of the straight, but longer-term traders will continue to look to the NASDAQ 100 to lead the way as tech companies have done so well. I still have a target of 6000, but obviously, we are going to pull back a little bit too perhaps try and build up enough momentum to make that move in the future. The next couple of days could be very difficult.