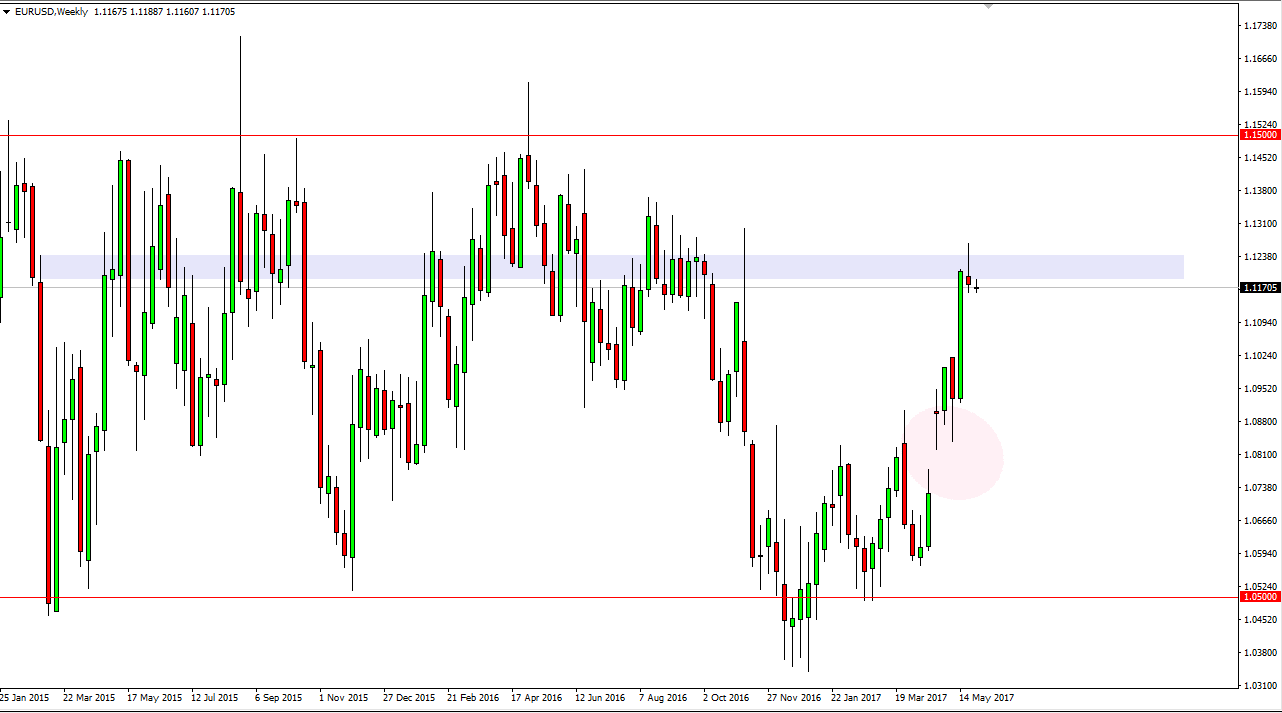

The EUR/USD pair has had a very strong month of May, reaching above the 1.12 handle. However, the last week of the month showed bits of exhaustion at the 1.12 handle. If we can break down below there, I think the market may very well fall, perhaps reaching towards the 1.10 level, and then down to the 1.08 level which would fill the gap that is shown by the pink circle on the weekly chart accompanying this article. With that being the case, I think that the market will find plenty of buyers in that area though, because of the technical analysis aspect of gaps. I believe that if we can break above the top of the candle for the last week of May, the market should then reach towards the 1.15 level which of course is the top of the overall consolidation area.

3 years of consolidation

The last 3 years have been consolidation, between the 1.05 level on the bottom, and the 1.15 level above. The market should continue to be volatile, but if we can break down I believe that the first week or 2 of the month could be negative for the EUR. Longer-term, I do believe that the buyers come back in and continue to push to the upside. This market has been very choppy overall, and I don’t think this month is going to be a whole lot different than the previous ones. , we are bit overbought as I record this but it’s only a matter of time before we continue the bullish push higher. If we did break above the 1.15 handle, the market should continue to go much higher but I do not expect that, there is simply nothing out there that will break us out of this range that I can see currently. We already know that the Federal Reserve is going to raise interest rates, so that is off the table.