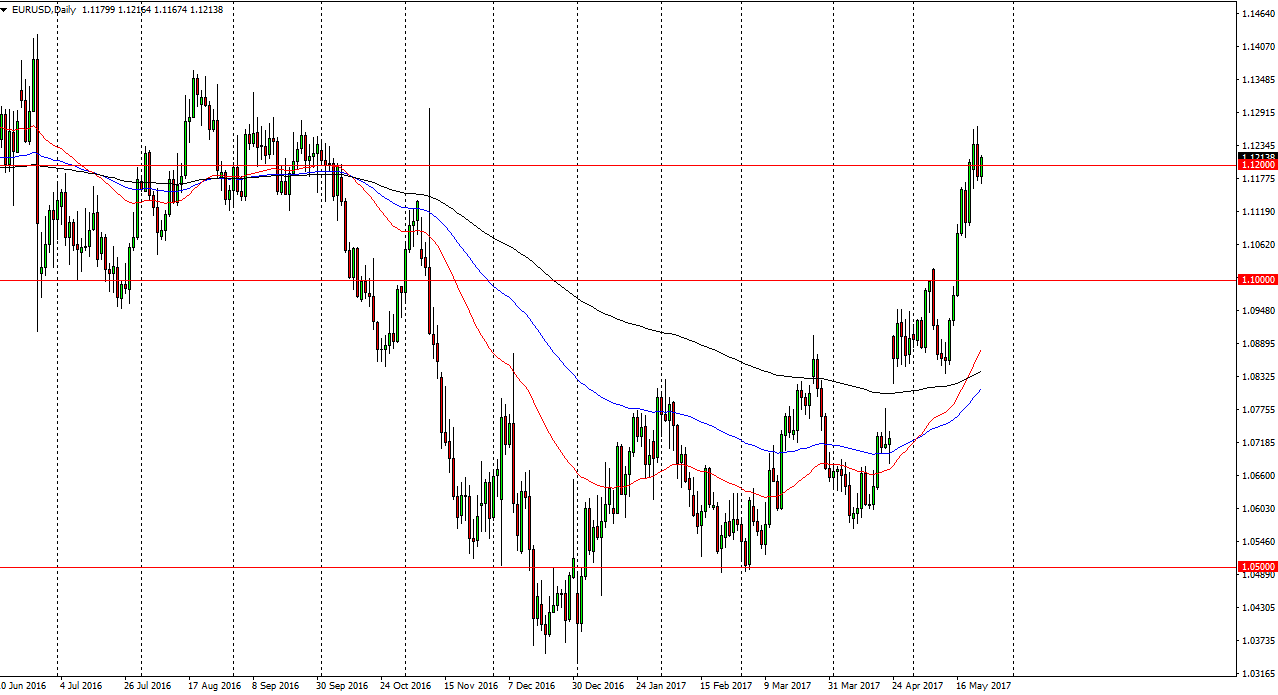

EUR/USD

The EUR/USD pair rallied slightly during the day on Wednesday, as we continue to bounce around in the neighborhood of the 1.12 level. This is an area that has been important on longer-term charts, but we are still consolidating between the 1.05 level on the bottom, and the 1.15 level on the top. That has been the consolidation area over the last almost 3 years, and I believe because of this it will be a tempting target to aim for the 1.15 level above. If we pull back from here, I think that the 1.11 level and the 1.10 level after that will offer buying opportunities. I have no interest in shorting the market, it’s very likely to continue to find buyers on dips, as we have seen over the last several weeks.

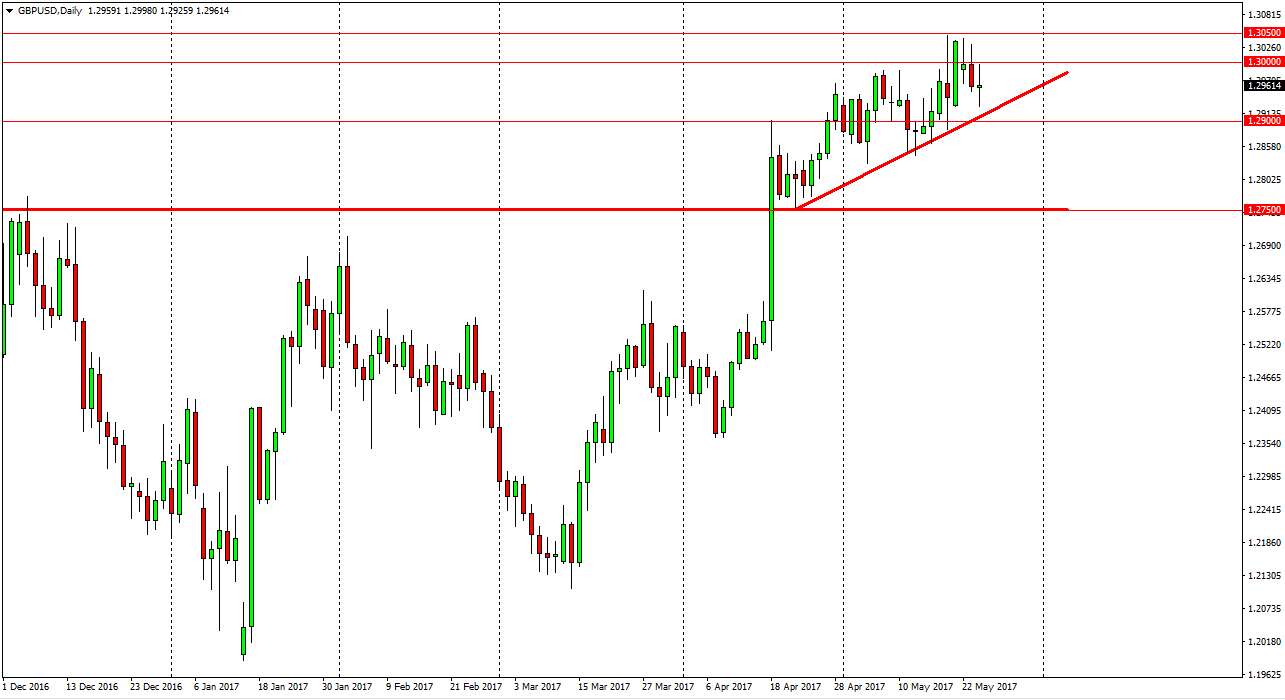

GBP/USD

The British pound went back and forth during the day on Wednesday, showing signs of volatility and choppiness. We continue to see significant support underneath based upon the uptrend line that has been involved in the market for the last couple of weeks, and that being the case it’s likely that support or bounces from that level should be buying opportunities. If we can break down below that uptrend line, I think the 1.29 level below opens up the market to the possibility of retesting the 1.2750 level beyond that. That level was previously resistive, and it should now be supportive. Alternately, we could rally from here.

I think we will more than likely rally from here over the longer term, and if we can break above the 1.3050 level, the market should then go to the 1.3450 level above, which was the top of the largest consolidation area that this market has seen for several years. Because of this, I believe that although it may be choppy, longer-term traders are eyeing that level.