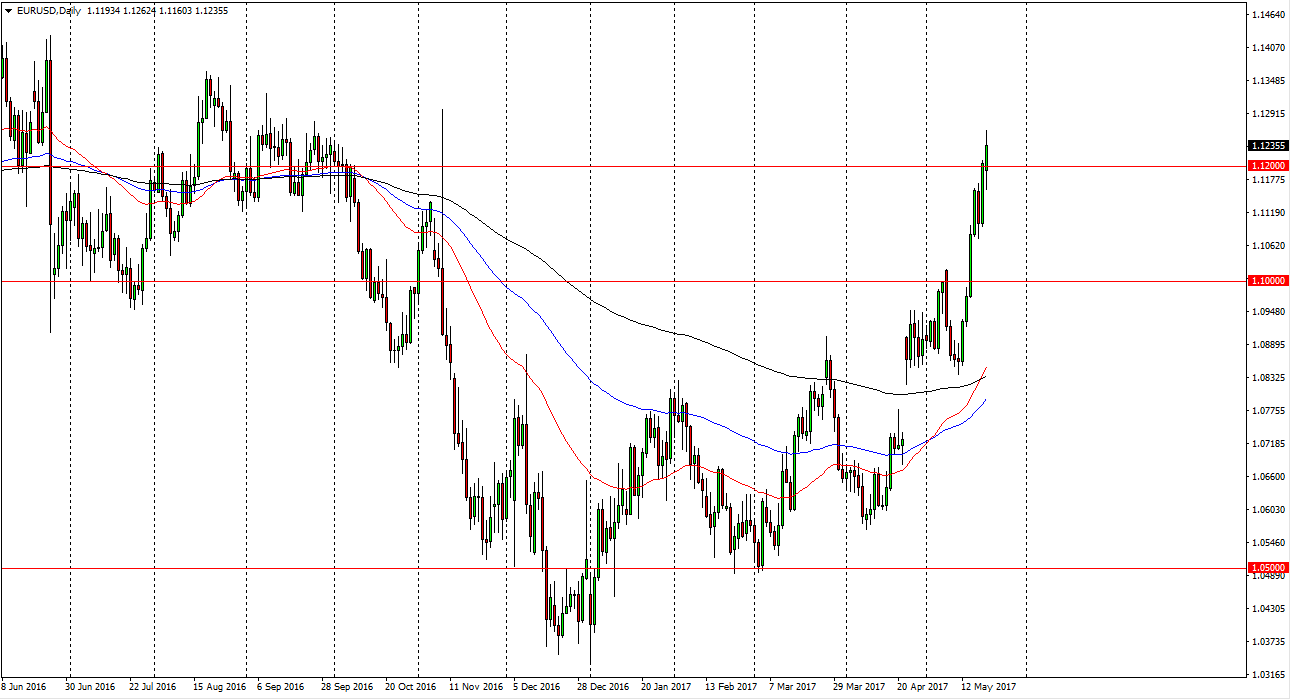

EUR/USD

The EUR/USD pair initially fell during the session on Monday, but found support at the 1.1150 reason to turn around and bounce above the 1.12 handle. Ultimately, the market has reacted to the comments by Angela Merkel suggesting that the pair is too low, and the EUR in general is undervalued. She blamed the value of the currency on the reactions of the European Central Bank, and this suggests that perhaps the Germans will press for higher value. Ultimately, the US dollar has been on the back foot anyway, so I think that the market will continue to reach towards the top of the consolidation area that we have been stuck in over the last 3 years. Because of this, it looks very likely that the market will go looking for the 1.15 level above, although it will probably be very choppy and more of a “buying on the dips” type of situation.

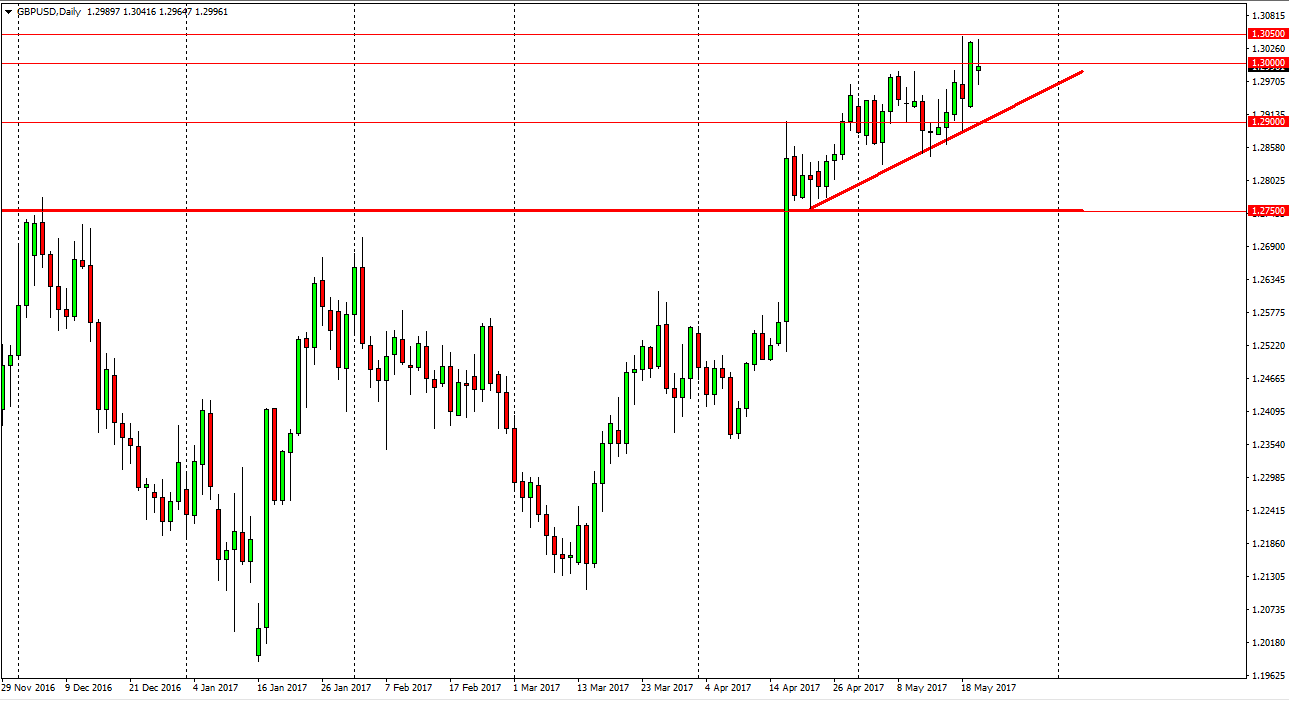

GBP/USD

The British pound went back and forth during the day on Monday, forming a relatively neutral candle. The market seems to be hovering around the 1.30 level, but I think that given enough time we will continue to go higher. I don’t have any interest in shorting, and a fresh, new high should send this market looking towards the 1.3450 level above. Pullbacks will more than likely find support below, at the uptrend line that I have marked on the chart. The 1.29 level under there will be supportive as well. Either way, the market should continue to find buyers on dips, and that longer-term traders will continue to have an interest in going long, and because of this I do not have any interest in selling. If we break down below the 1.2750 level, the market should continue to go much lower. However, that seems very unlikely, and therefore I remain positive.