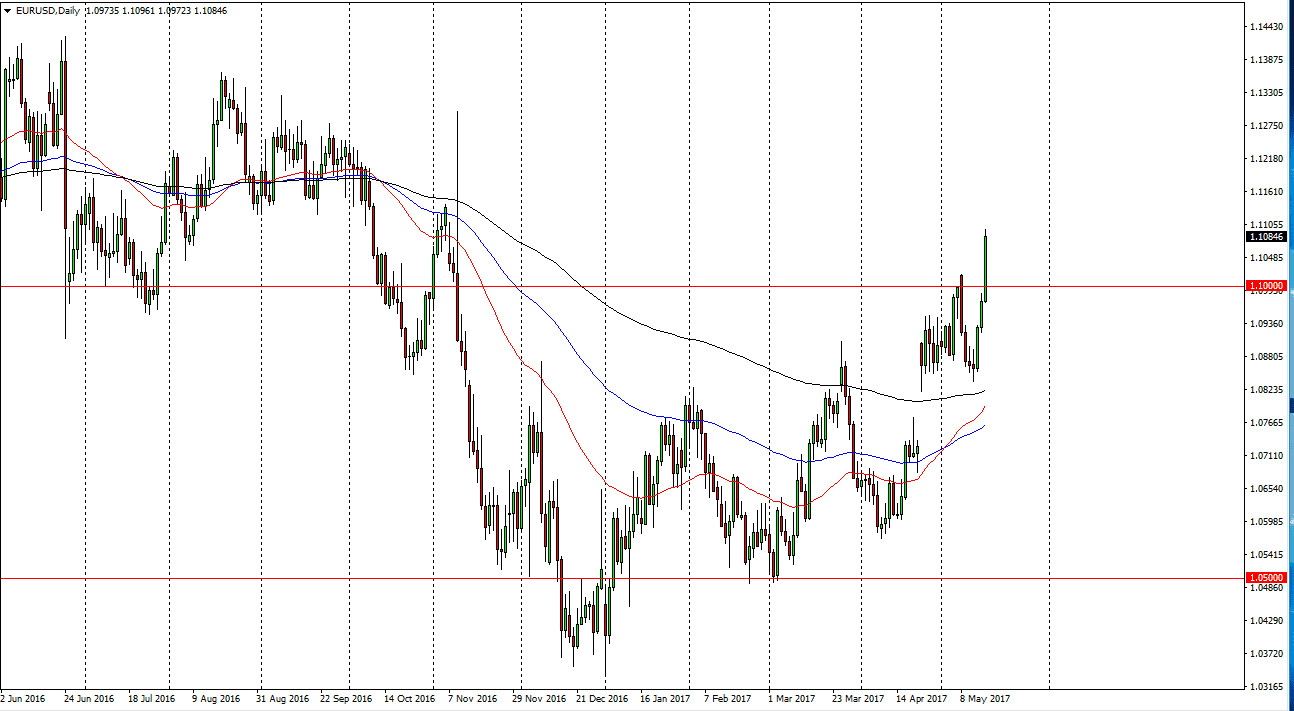

EUR/USD

The EUR/USD pair rallied on Tuesday, breaking above the significant 1.10 level. Now that we have broken above there, the market looks as if it is ready to continue going higher and I think that the longer-term target is going to be the 1.12 level above. Short-term pullback should be supported at the 1.10 level, as it was previously resistive, and should now be supportive. I have no interest in shorting this market, even though the gap below has not been filled. That may have to wait until we get a shift in overall sentiment at this point. I think there is a lot of noise between here and the 1.12 level, so it will be a “buy on the dips” type of market on short-term charts.

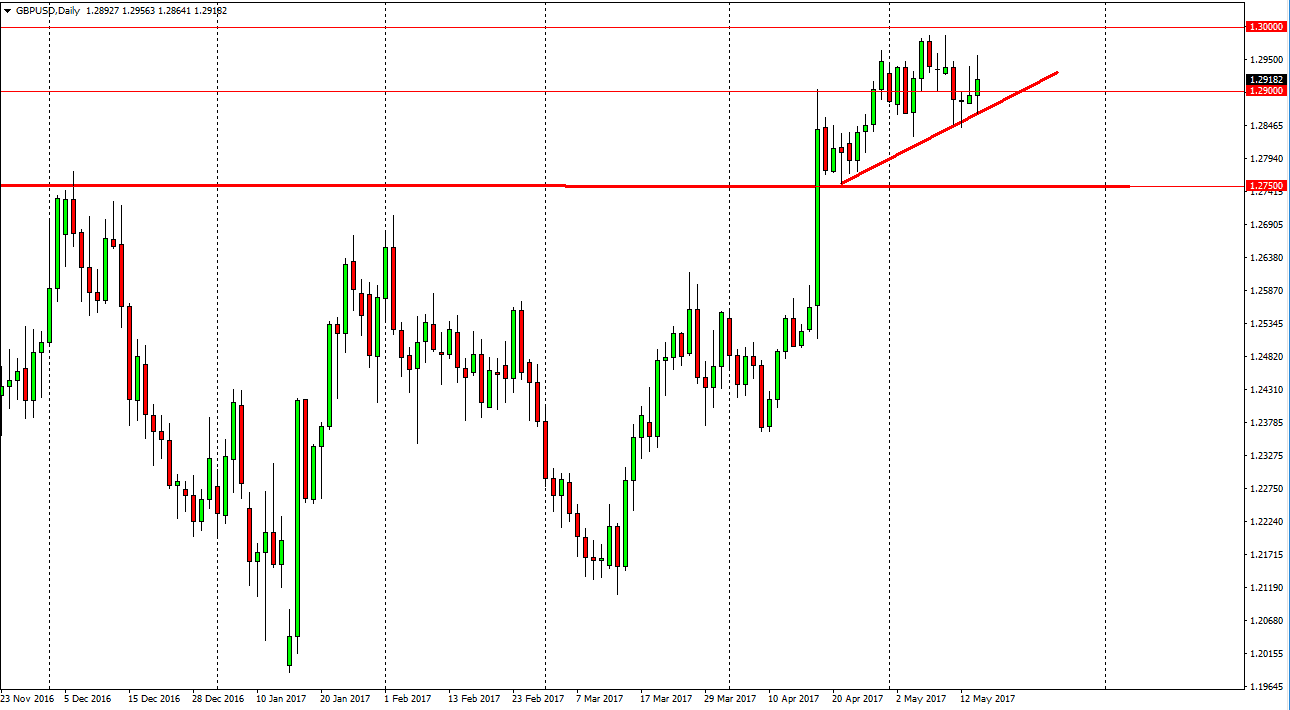

GBP/USD

The British pound had a volatile session during the day on Tuesday, breaking above the 1.29 handle. The market fell back, showing signs of exhaustion. The 1.30 level above should be resistive, but I think it’s the short-term target. If we can break above there, the market then should go to the 1.3450 level, which was the top of the previous consolidated area that the market had been trading in. If we can break down below the uptrend line on the daily chart, I think that the market then goes down to the 1.2750 level underneath. That should be a massively supportive level that the market could bounce off. If we break down below there, then the market should start selling off but I don’t think that’s going to happen. Given enough time, I believe that the market goes higher over the longer term, and with this being the case I’m looking for buying opportunities to take advantage of the bullish move that we have made in the British pound.