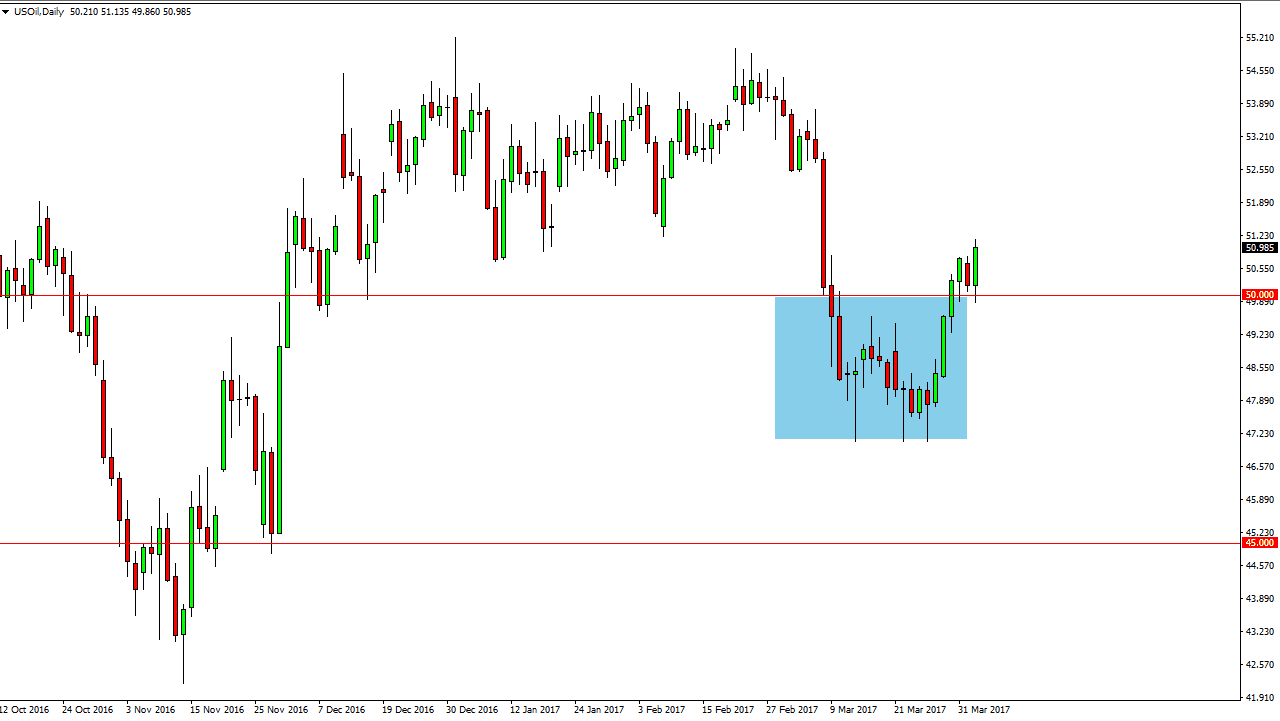

WTI Crude Oil

The WTI Crude Oil market initially fell during the day on Tuesday, but tested the $50 level only to find buyers. We broke out and towards the $51 level. If we can break above there, I believe that the market continues to go even higher. Pullbacks will more than likely be buying opportunities as it looks like the market is ready to go higher. It will be choppy, because are so many different things going on and of course we have the Crude Oil Inventories number coming out during the day which can cause quite a bit of volatility. Currently, I think the market is biased to the upside, as we continue to see bullish pressure every time we draw.

Natural Gas

The natural gas markets broke higher and cleared the $3.25 level. A break above the top of the range should send this market higher, and thus this is a massive green candle that suggests that we are going to continue to see bullish pressure and reach towards the $3.50 level. The markets continue to be volatile, but it appears that the markets are going to continue to find buyers as the 50 and the 100-day exponential moving averages are getting ready to cross. This is a longer-term bullish sign, but ultimately, I think that we will continue to have whippy conditions.

Ultimately, it’s all but impossible to short this market currently as it has seen so much in the way massive bullish pressure. I think that the $3.25 level will start to act as a support level now, but the natural gas markets tend to be very choppy and difficult over the longer term, so keep in mind that you must deal with quite a bit of volatility and may have to take small positions.