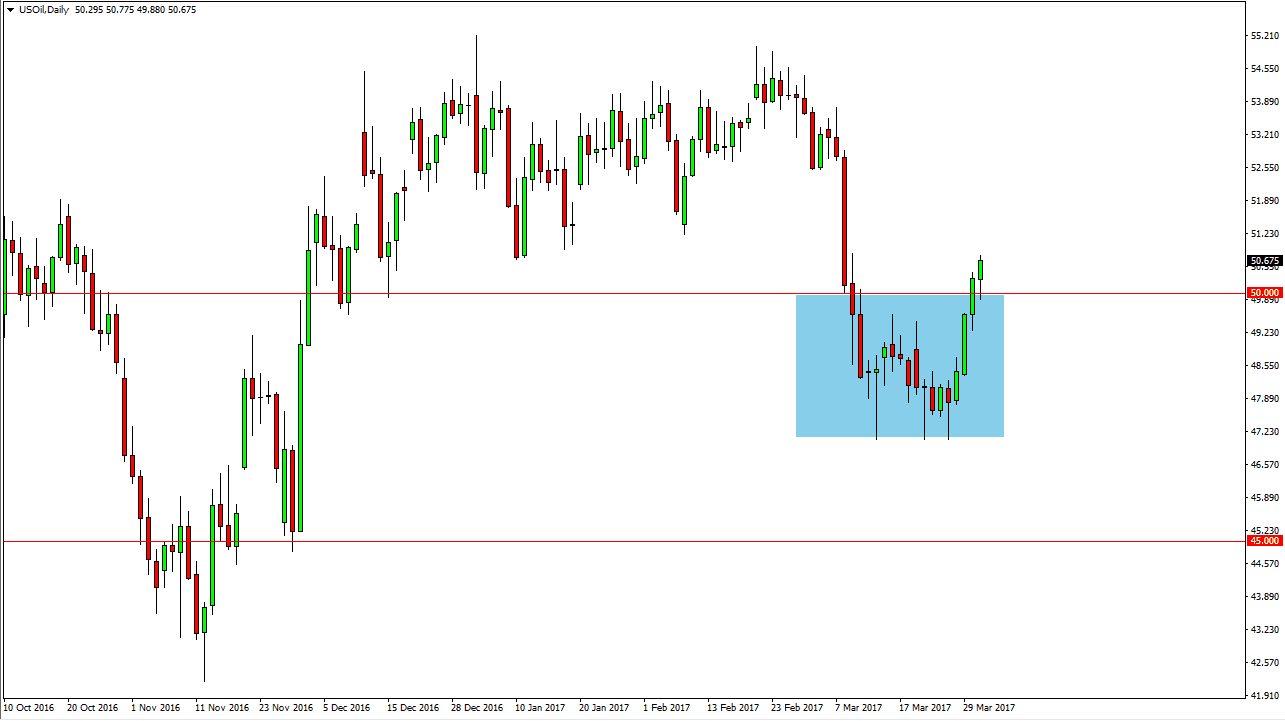

WTI Crude Oil

The WTI Crude Oil market initially fell during the session on Friday, but found enough support at the $50 level to turn things around and form a hammer. The fact that we closed higher suggests that there are still plenty of buyers underneath, and that we should continue to go higher over the next several sessions. I believe the pullbacks offer value, as the $50 level now should offer support. I think the target will be the $52 level and the short-term, but expect a lot of volatility. With this, I’m not interested in selling until we get below the $49.50 level, which would be a significant breakdown in support and become a very interesting trade.

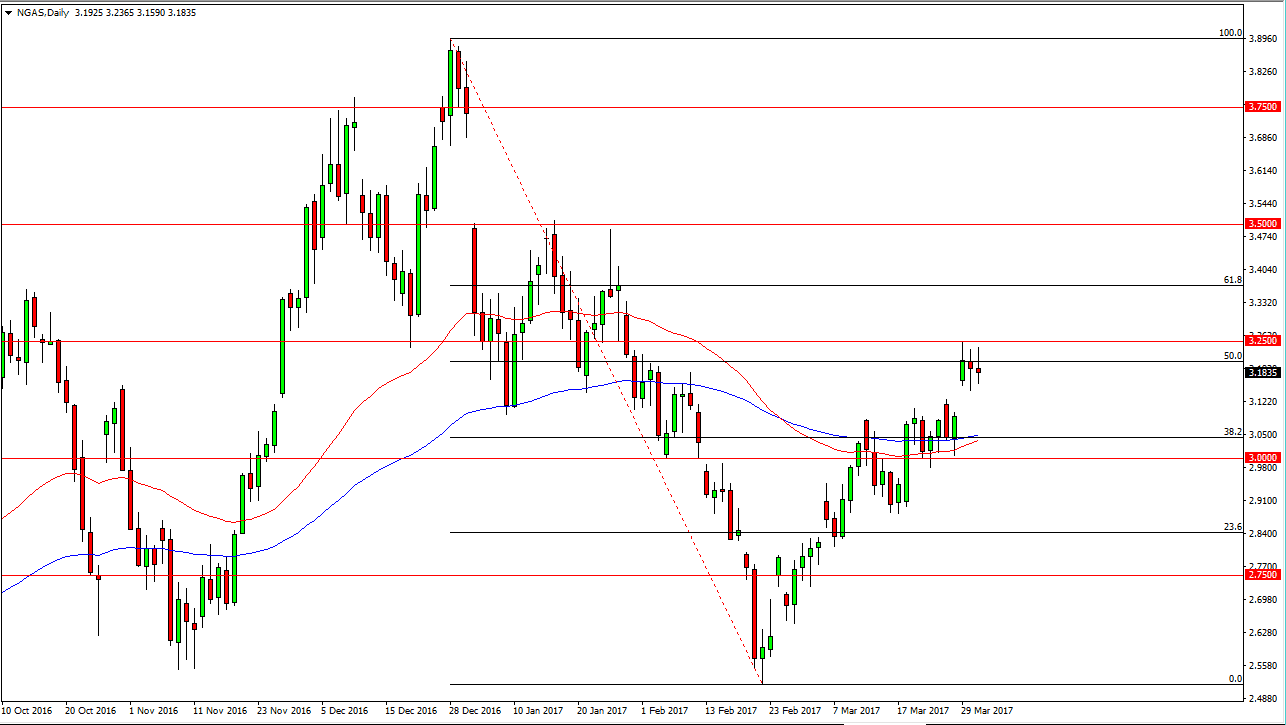

Natural Gas

The natural gas markets went back and forth during the Friday session, as we continue to see a significant amount of resistance at the $3.25 level. We did gap higher on Wednesday, and that should offer support as well. Because of this, I believe that we are going to continue to see a lot of chop in this market, but if we can break above the $3.25 level, that would be a very bullish sign. I also believe that a pullback isn’t necessarily a negative sign, I least not until we can break down below the gap, and more importantly the $3 handle.

The market is starting to focus more on exports of natural gas than demand in the United States, and that has changed the overall attitude. It appears that exports from the United States are starting to pick up, and that of course helps. Ultimately, I still believe that there is far too much natural gas to start a longer-term “buy-and-hold” type of situation, but obviously, the buyers are running a significant amount of control in this market.