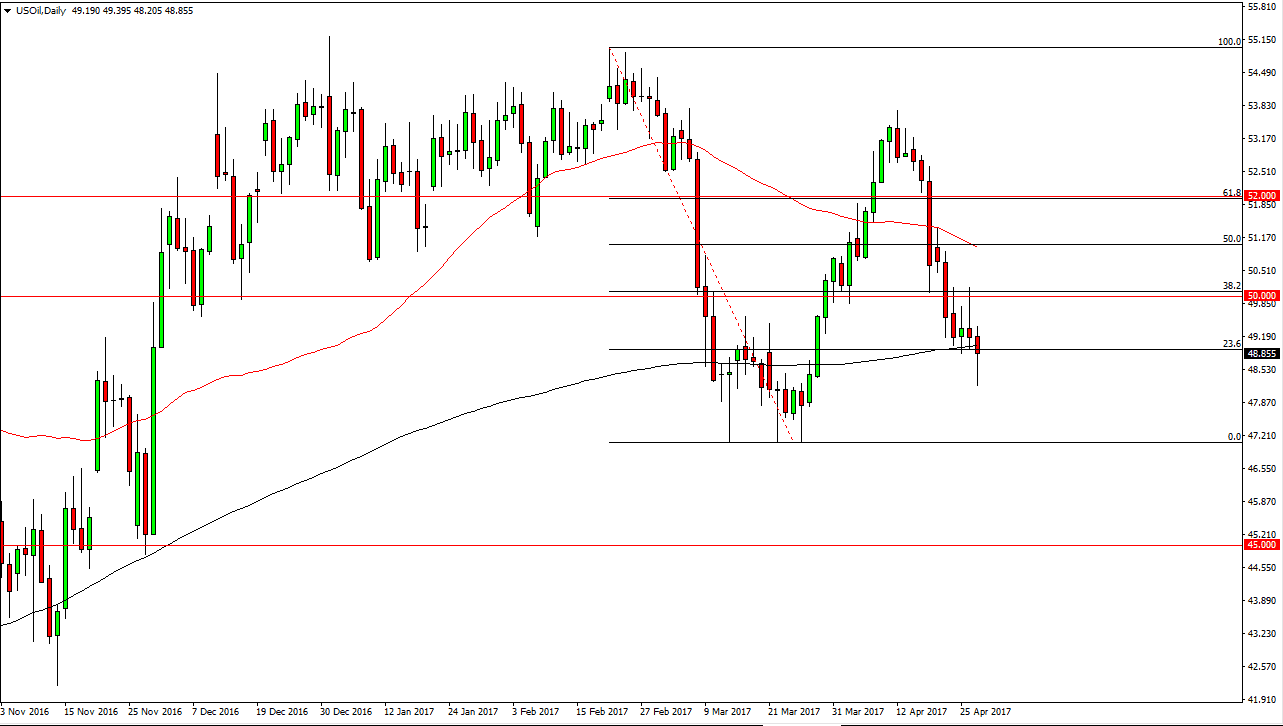

WTI Crude Oil

The WTI Crude Oil market broke down significantly during the Thursday session, but we bounced significantly as well, and the daily candle ended up forming a hammer. There are a couple of shooting stars just above though, so I think that any rally at this point in time should be a selling opportunity off short-term charts. If we break down below the bottom of a hammer, that’s a very negative sign and should send this market down to the lows again at the $47.20 level. I don’t have any interest in buying, I believe that selling rallies will be the most viable trading strategy on short-term charts going forward. I believe that the market will be choppy and volatile, as there are a lot of moving pieces when it comes to this market.

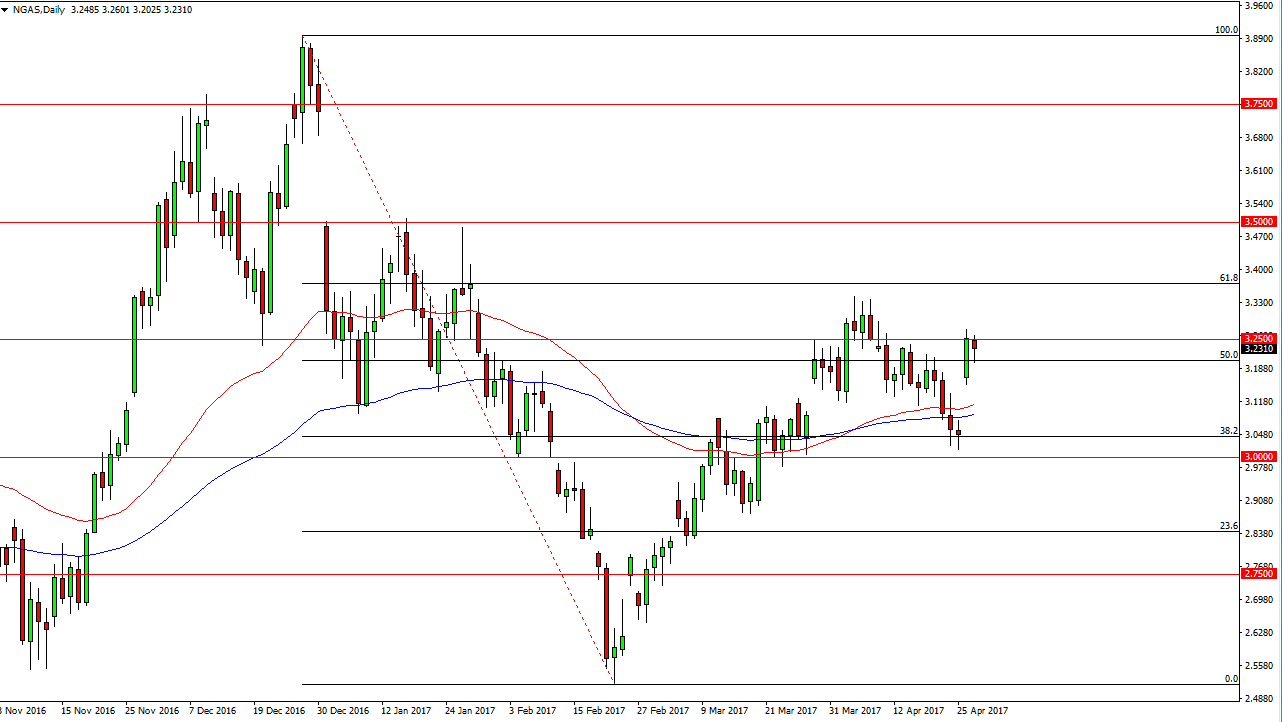

Natural Gas

Natural gas markets initially fell on Thursday, but found enough support at the $3.20 level to turn around and form a hammer like candle. If we can break above the $3.25 level, the market should then go to the $3.33 level. Even if we fall from here, there’s plenty of support below based upon the gap that form the other day and of course the moving averages that are sitting just below as well. In fact, I think that the buyers will come back into this market when we pull back, because of all the bullish and impulsive moves that we have seen recently. I have no interest in shorting this market, least not until we break down below the $3 level, something that isn’t going to happen today. With this in mind, I believe that the buyers get involved, and to continue to push higher as the natural gas markets are showing signs of life yet again in what has been very violent upswings.