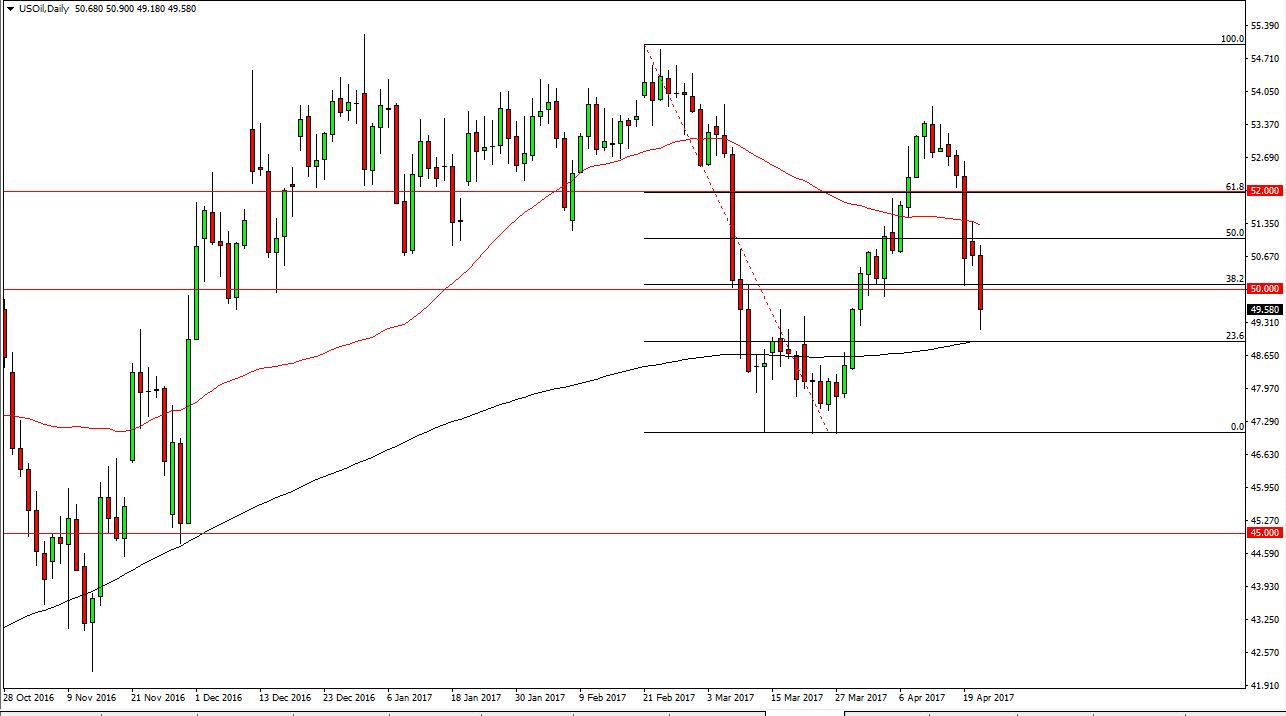

WTI Crude Oil

The WTI Crude Oil market broke down during the session on Friday, as we continue to see quite a bit of bearish pressure. In fact, we even tested the 200-day exponential moving average but it did hold as support. We are below the $50 level now, and I think that signals that this market could go much lower. The short-term bounce might be an opportunity to start selling from higher levels on signs of exhaustion if you can pay attention to shorter-term charts. I have no interest in buying, I think that the tide has turned again as traders are finally beginning to appreciate the fact that there is a massive oversupply of crude oil in the world right now.

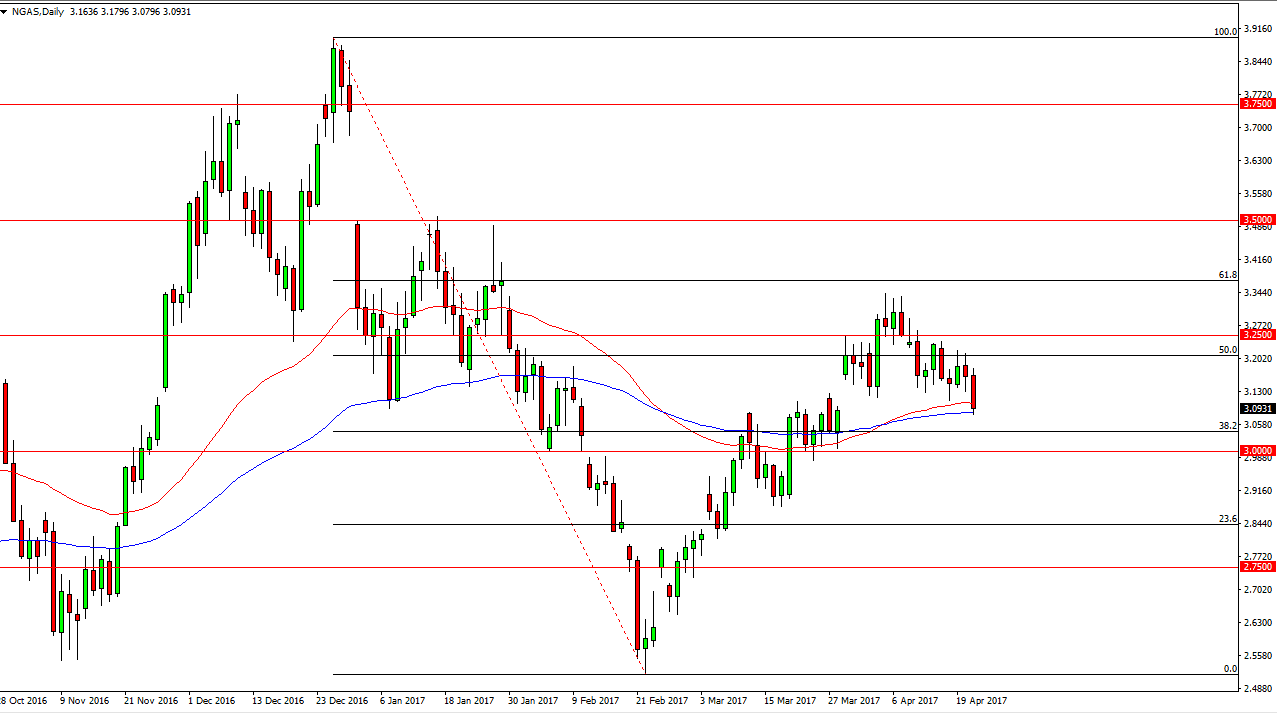

Natural Gas

The natural gas markets broke down during the day as well, filling the gap from before. We tested the 100-day exponential moving average, and I believe that there is support just below and extending all the way down to the $3 level. It’s not until we break down below the $3 level that I would consider selling, but right now it looks as if we are going to make a serious attempt to do just that. We get a supportive candle; the market could bounce towards the $3.25 level. Alternately though, I do think that longer-term the sellers will return as natural gas inventories are huge, even if there is a significant export market coming out of the United States. Right now, I believe that the market is a bit of a crossroads, and we will have to see how it reacts over the next several sessions to get a better feel of where we may be in the next few months.

I could make an argument for a slight bullish flag, but I think it’s a little early to suggest that, so at this point I’m going to sit on the sidelines and wait to see what happens over the next 24 hours.