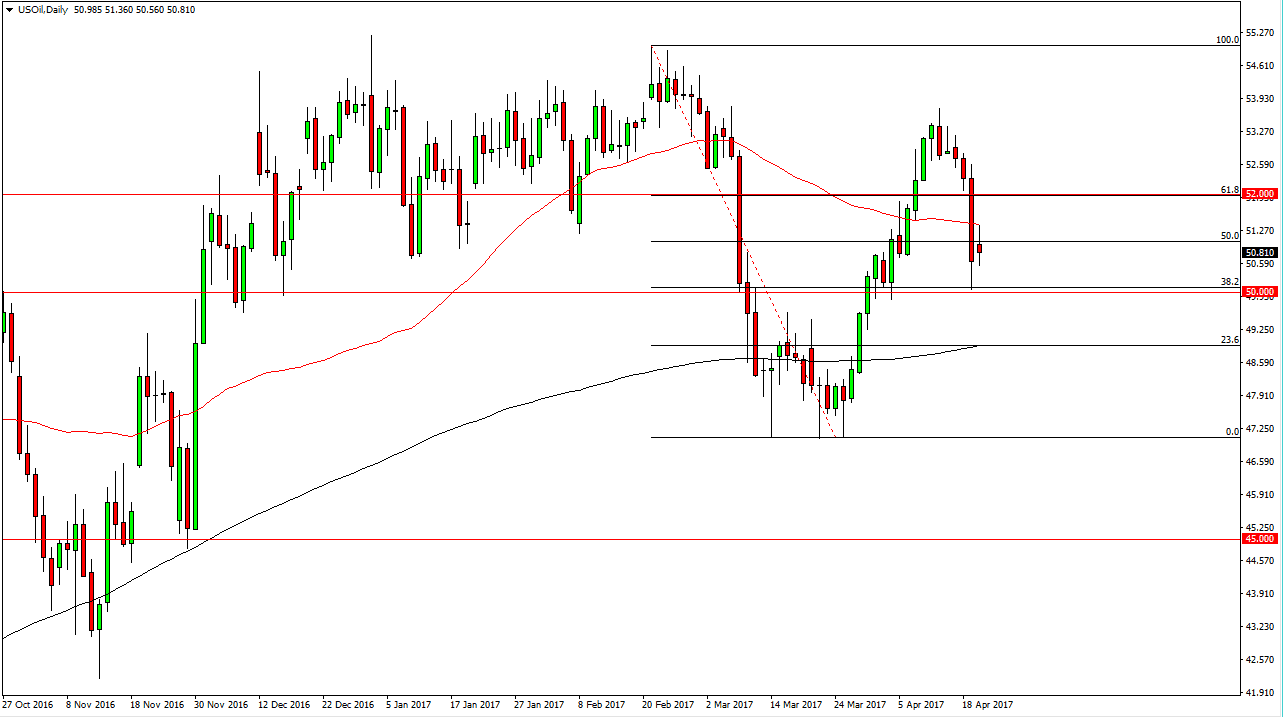

WTI Crude Oil

The WTI Crude Oil market fell again during the session after initially trying to rally on Thursday. By forming a shooting star like candle at the 50-day exponential moving average, the market looks as if we could continue the bearish pressure, and that of course could send this market down to the psychologically important $50 level. A breakdown below there would be rather negative. Alternately, if we can break above the top of the range for the session on Thursday, then I believe the market will test the $52 level. There are a lot of moving pieces when it comes to the crude oil market currently, so this does not surprise me at all, as we continue to see an increase of volatility.

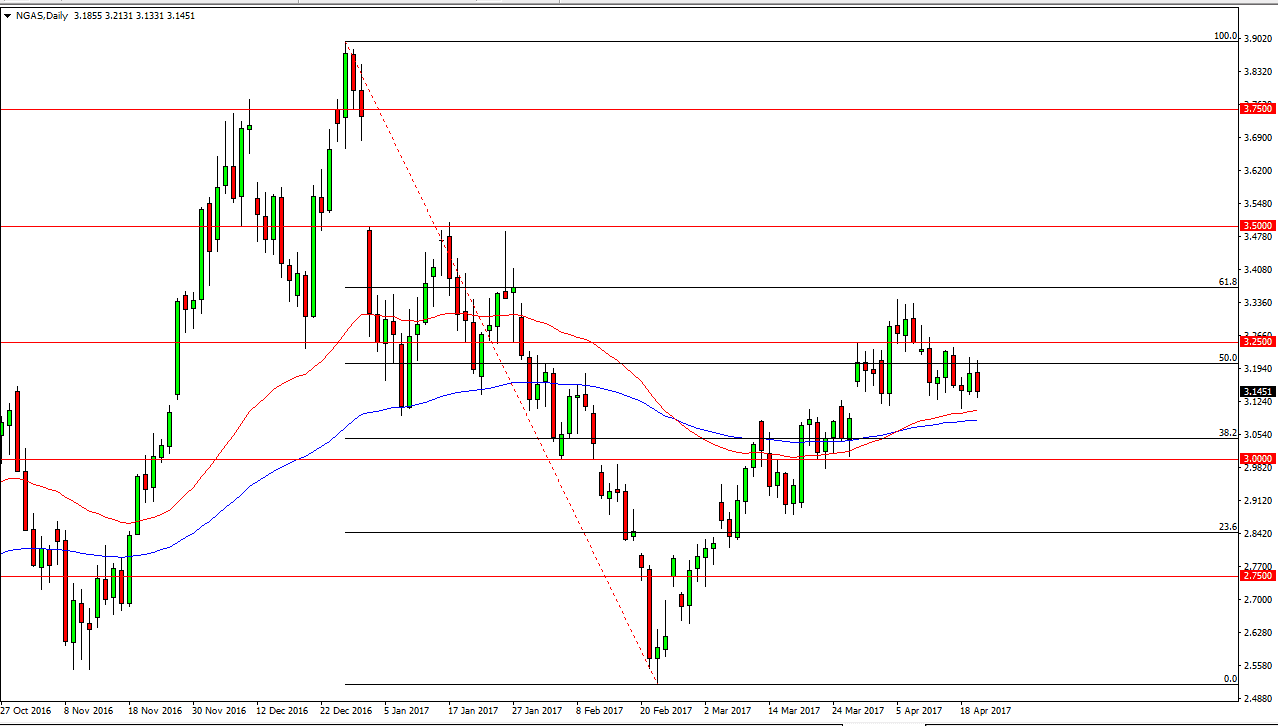

Natural Gas

Natural gas markets continue to grind sideways in general, forming a negative candle for Thursday. I still see the $3.10 level below as significant support based upon the gap and of course the 50 day exponential moving average. Because of this, I believe that in the short term at least, we will have buying in this market. If we can break above the $3.25 level, the market then is free to go to the $3.33 level above. A break above there could send this market looking to fill the gap that extends all the way to the 3.50 region.

Natural gas markets tend to be choppy and current trading conditions have been no different. Because of this, I believe that the market should continue to offer a lot of back and forth type of trading but I would stick to an upward bias as longer-term that should continue to pay more dividends than trying to short a market that has been this strong and resilient. A breakdown below the $3.10 level would have me starting to look for selling opportunities though.